Opendoor’s Rebirth: Can the Army Turn Meme Momentum Into Millions?

Opendoor (OPEN) is suddenly the comeback story no one saw coming.

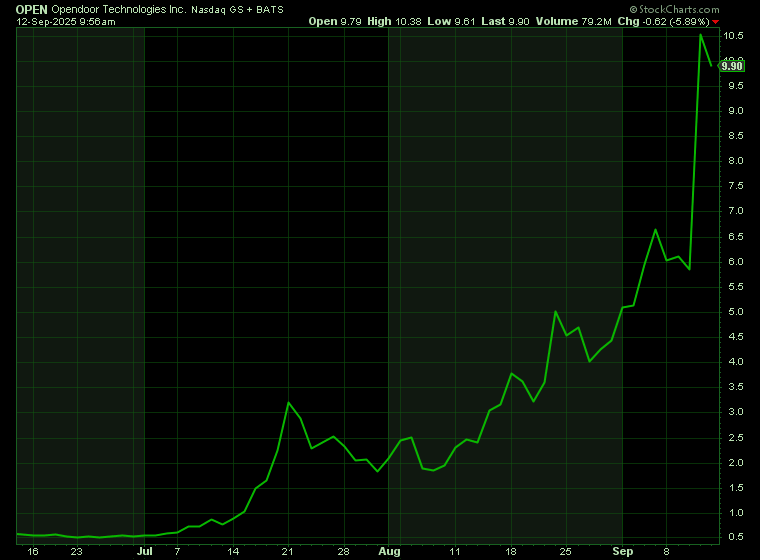

Once left for dead as a failed SPAC trading at just $0.50, Opendoor stock has skyrocketed more than 20X in just two months.

The turnaround has been fueled by retail investors, bold leadership changes, and a complete reimagining of the business around AI.

Now Wall Street is asking: is this just another fleeting meme-stock spike – or the start of one of the most remarkable corporate transformations in modern history?

We think the latter…

The Rise of the Opendoor Army: Retail Investors Take Charge

Rewind to early July 2025, when Opendoor was basically a punchline.

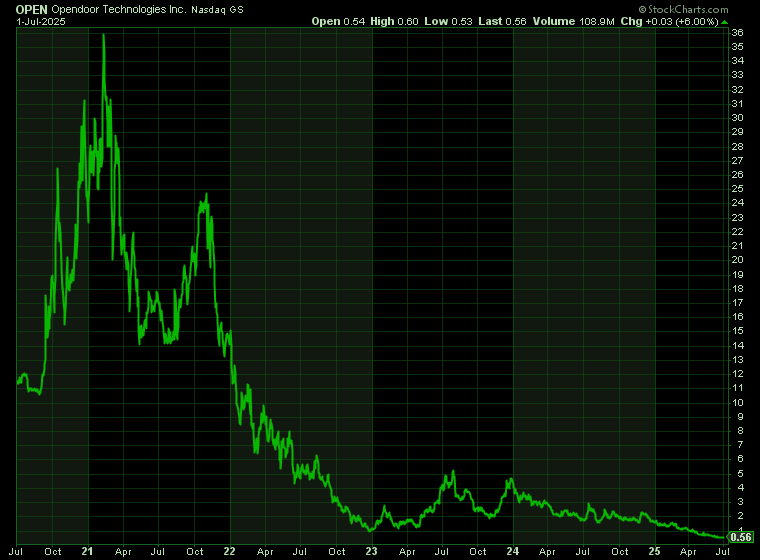

The onetime iBuying pioneer had been reduced to a penny stock, trading for less than a buck after years of brutal losses, collapsing home volumes, and a balance sheet weighed down by money-losing inventory. Its market cap had gone from $20 billion at its SPAC peak to less than $500 million.

Then came Eric Jackson.

If you don’t know him, he’s a founding hedge fund manager at EMJ Capital. He got wrecked in 2022 after an anchor investor withdrew substantial funds during a tech downturn. But he redeemed himself with his legendary call on Carvana (CVNA), which went from $4 to $400 in just two years.

When he says he sees a ‘100-bagger,’ people listen.

In July, Jackson tweeted that he had taken a stake in Opendoor and believed it could be his next 100-bagger. The internet took that and ran. Within days, thousands of retail traders piled in, and the ‘Opendoor Army’ was born.

At first, it looked like a classic meme-stock spike. OPEN sprinted from $0.50 to $3. Then $5. But as quickly as it came, the rally faded. By early August, Opendoor had slipped back below $2 after posting another ugly earnings report.

Everyone figured the meme trade was over.

Boy, were they wrong.

Opendoor’s Meme Stock Rally Becomes a Real Turnaround

The second act of this saga began when Anthony Pompliano – better known as ‘Pomp,’ the crypto influencer with millions of followers – disclosed that he had also taken a stake in Opendoor.

Suddenly, this wasn’t just Jackson. It was Jackson and Pomp, two widely followed internet investors both planting their flags on this struggling company.

The retail crowd doubled down. They didn’t just want the stock to go higher. They wanted to change the company itself, demanding:

- A new CEO with AI bona fides.

- A reimagined business model centered on AI-driven services, not risky housing inventory.

- The return of original co-founders like Keith Rabois and Eric Wu.

And Opendoor actually listened.

In mid-August, then-CEO Carrie Wheeler abruptly resigned – the first domino to fall. Within weeks, the board was reshuffled. Rabois and Wu were invited back, with Rabois becoming Chairman. Former Shopify (SHOP) COO Kax Nejatian – a product visionary with a strong AI track record – was named CEO.

To top it off, Khosla Ventures cut a $40 million check to support the turnaround.

What started as a meme rally became a grassroots shareholder revolt that literally reinvented the company.

And the rocketed again, blasting past $10 for a 20X gain from its July lows.

The Original Vision: Reinventing Housing With iBuying

To appreciate what’s happening now, you need to remember what Opendoor was always meant to be.

Founded in 2014 by Keith Rabois, Eric Wu, and JD Ross, Opendoor’s mission was simple: make buying and selling homes as easy as buying and selling products on Amazon (AMZN).

The company pioneered ‘iBuying’ – offering instant cash offers on homes through its digital platform, then reselling those homes for profit.

The model worked… for a while. By 2019, Opendoor was moving nearly 19,000 homes annually and generating close to $5 billion in revenue. In its established metros like Phoenix, it was hitting 2% market share.

Bigtime VC Chamath Palihapitiya took it public via SPAC in 2020. The stock ripped to $40, and the valuation topped $20 billion.

Then came inflation, high interest rates, a frozen housing market – and the iBuying model broke.

Buying real estate in bulk works when home prices rise; but it’s a bloodbath when prices fall or stagnate. By 2022, Opendoor was fire-selling inventory, burning cash, and laying off staff. The stock cratered.

And by July of this year, OPEN looked dead in the water… until it was rescued by the Opendoor Army.

Opendoor’s New AI-Powered Business Model

These retail vigilantes aren’t just cheerleading. They’re re-architecting the business, giving it the foundation to endure and dominate.

The iBuying model made Opendoor a ‘hedge fund for homes’: buy inventory, hold, hope prices rise. That’s capital-intensive and risky.

The new vision? Make Opendoor the Citadel of homes.

Think about how Citadel works in equities. When you sell a stock, you’re often selling it to Citadel, who instantly flips it to another buyer. It doesn’t ‘hold’ the stock; it provides liquidity and earns a spread.

Opendoor can do the same in real estate – use AI algorithms to price homes in real time, provide instant liquidity to sellers, and match them with buyers. Only occasionally would it need to actually hold inventory.

That model:

- Leans on the company’s AI pricing expertise.

- Scales more efficiently.

- Operates with fatter margins.

- Dramatically reduces balance sheet risk.

This would transform Opendoor from a capital-hungry business into a capital-light platform.

Growth Potential: Market Share and Valuation Scenarios

Let’s run some scenarios.

- Baseline U.S. housing market: ~5.5 million homes sold annually. Average price ~$400,000; ~$2.2 trillion in transaction value every year.

- If Opendoor captures 5% market share: ~275,000 homes per year – roughly $4 billion in revenues, ~$500 million in earnings before interest, taxes, depreciation, and amortization (EBITDA) (assuming a 50-50 split between iBuying at 5% margins and AI market-making at 30% margins).

- 10% share: ~$8 billion revenues, ~$1 billion EBITDA.

- 20% share: ~$16 billion revenues, ~$2 billion EBITDA.

Now apply multiples. If Opendoor evolves into a software-style business with predictable margins, it could fetch 35X EBITDA – the going rate for premium software-as-a-service (SaaS) names.

That implies valuations from:

- $17.5 billion at 5% share. (~$25/share).

- $35 billion at 10% share. (~$50/share).

- $70 billion at 20% share. (~$100/share).

From today’s stock price, that’s anywhere from a 2.5X to 10X upside.

Why This Turnaround Has Real Momentum

Of course, we understand these are all hypotheticals. But three things make us confident this could evolve from fantasy into reality.

First, the energy driving this shift: The Opendoor Army isn’t just noise. It’s already forced a CEO change, reinstalled founders, and attracted VC backing. These investors are aligned, motivated, and loud. Retail energy has real power when channeled constructively.

Second, the talent: Kax Nejatian is not a meme CEO. He’s the real deal – a product and AI operator with Shopify and Facebook experience. With Rabois back as chairman, the leadership table is stacked with proven talent.

Third, the capital: With shares back above $10, Opendoor can easily raise hundreds of millions through a secondary. Combine that with Khosla’s $40 million and Wu’s reinvestment, and the runway is there to build.

Altogether, that’s the recipe for a real and lasting turnaround.

Though, clearly, the risks remain.

- The housing market is cyclical. If volumes stay frozen, even a better model struggles.

- AI pricing works at scale, but scaling trust in AI home valuations is tricky.

- Execution risk is massive. Transforming a company culture from balance-sheet heavy to software-light is not an overnight job.

And we can’t ignore history: most meme-stock-turned-fundamentals stories end badly. GameStop (GME) never became Amazon. AMC (AMC) never became Netflix.

But the difference here? Opendoor already has the infrastructure, the technology, and the data. It isn’t about building from scratch – it’s pivoting an existing platform.

The Future of Opendoor: Meme Hype or Lasting Transformation?

This is what makes Opendoor fascinating.

Most meme rallies are castles in the air: stock prices with no foundation. But Opendoor’s rally has created its own foundation. The Army forced out a CEO, installed a visionary operator, brought founders back, and attracted real VC money.

That’s a corporate rebirth. But now the hard part begins.

Changing management is one thing. Rebuilding a business model is another. Execution will take years, and patience will be tested. But for the first time in years, Opendoor has a real shot.

Maybe the Opendoor Army is right about this being a 100-bagger in the making. Or maybe it’s just another meme stock headed for the graveyard.

Either way, the next chapter of Opendoor is going to be one hell of a ride. And if the company does pull it off, the story we’ll tell in a few years won’t just be about a stock that went parabolic… it’ll be about the biggest business turnaround of all time.

Opendoor’s rebirth shows how fast fortunes can change when technology and capital collide. But as big as the housing market is, a different sector is boasting a trillion-dollar opportunity right now… humanoid robotics.

Tesla’s (TSLA) Optimus project is accelerating the race to put robots in every warehouse, factory, and household – and the suppliers making the critical components behind these bots could see monster profits.

Early investors who spot these companies before ubiquity hits could be sitting on the kind of windfalls we haven’t seen since the dawn of the internet.

Discover the opportunity that could mint the next generation of 100-baggers.