The Data That Found NVIDIA Early Could Find the Next Market Giant

Editor’s note: Some market moments redefine what’s possible; and this week heralded one of them. Nvidia became the world’s first $5 trillion company: a milestone that cements its role as the backbone of the global AI economy.

Louis Navellier, one of America’s top quantitative investors, saw this coming long before Wall Street did. His Stock Grader system flagged Nvidia years ago, when most analysts still thought of it as a gaming-chip maker. Now he’s showing how that same data-driven approach can find the next Nvidia even earlier.

That’s why Navellier has teamed up with Andy and Landon Swan, two pioneers in real-time consumer analytics, to launch The Ultimate Stock Strategy – a new system that merges hard fundamentals with social-sentiment data.

Their goal: to spot market leaders before they make headlines.

In today’s piece, Louis explains how Nvidia reached this historic milestone – and how his new collaboration could uncover the next generation of AI-driven winners. Read on to see what pushed Nvidia past $5 trillion and how to position yourself for what comes next…

NVIDIA Corporation (NVDA) just made history. Again.

This week, NVIDIA became the world’s first $5 trillion company.

The rally wasn’t just driven by hype, either. After unveiling a new wave of partnerships and projects that signal how deeply it has embedded itself in the global AI economy, the stock went on a tear – up 16% in five days as of yesterday.

If you’re a regular reader, you know that I predicted this last summer.

The stock has soared more than 60% since I made that call.

So, in today’s Market 360, we’ll talk more about what pushed NVIDIA over the top this week. I’ll also cover how my Stock Grader system found it years before Wall Street caught on – and how my new partnership with Andy and Landon Swan is designed to find the next big winner even earlier.

Let’s dive in.

What Pushed NVIDIA Past $5 Trillion

NVIDIA’s stock surged after a slew of announcements at its GTC event, where CEO Jensen Huang gave the keynote address. Here’s just a sampling of what we learned:

- Roughly $500 billion in AI-chip orders now committed through 2026.

- A new U.S. Department of Energy partnership to build seven national supercomputers powered by NVIDIA architecture.

- A collaboration with Eli Lilly and Company (LLY) to create a dedicated AI supercomputer for drug discovery and pharmaceutical design.

- Fresh autonomous-vehicle partnerships, including Lucid Group Inc.’s (LCID) upcoming Level 4 self-driving EV and a new robotaxi program between Stellantis N.V. (STLA), Uber Technologies Inc. (UBER) and Foxconn using NVIDIA hardware and software.

- A $1 billion strategic investment/partnership with telecom provider Nokia Oyj (NOK) to rollout 6G network infrastructure, with the goal of enabling a move from 5G to 6G via software upgrades alone.

- New investments in AI factories, quantum-computing centers, and more.

These aren’t incremental product launches. They’re not short-term contracts. They’re proof that NVIDIA has become the backbone of the next generation of computing.

Now, while I may have made my big prediction last summer, I’ve been pounding the table on NVIDIA for years – and it’s all because of my Stock Grader system. Here’s why…

How I Found NVIDIA Early

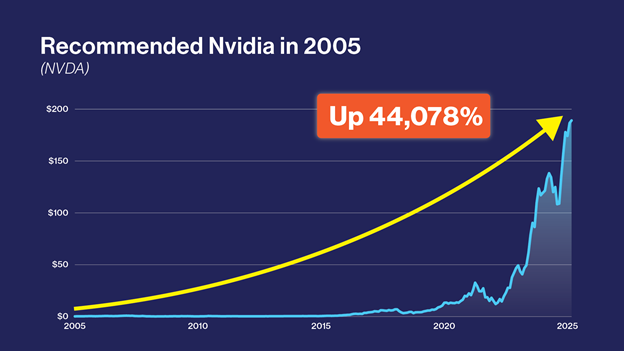

When my system first flagged NVIDIA in 2005, most investors still thought of it as a gaming-chip company. But Stock Grader doesn’t chase headlines. It ranks thousands of stocks using eight key fundamental metrics – earnings growth, sales acceleration, profit margins and institutional buying pressure among them.

NVIDIA earned one of my highest grades that year. It was growing revenue faster than almost any other semiconductor firm, and big institutions were quietly piling in.

Over the years, the company transformed from a small graphics-card maker into the dominant force behind AI computing. That early A-grade call led to a 44,000% climb, one of the most remarkable runs I’ve ever seen.

Over at my Growth Investor premium service, I recommended NVIDIA in May 2019 – and we’re currently up about 4,600%.

The point is that Stock Grader identified multiple opportunities to get in on this generation-defining company. And as I’ve told my readers before, this is a company that should do well through the end of the decade, and possibly beyond.

That’s the value of letting the data guide you instead of emotion.

A Different Kind of Data

Around the time I was relying on fundamentals to find stocks like NVIDIA, brothers Andy and Landon Swan were building a system to find winners by listening to the crowd.

I introduced you to the Swans earlier this week.

Their technology tracks millions of social-media posts, search trends and web traffic to measure real-time excitement around brands and products. It’s a way to see what consumers love – and what they’re walking away from – before that activity shows up in quarterly results.

It’s like having a finger on the pulse of the consumer – and by extension, the market.

To put it simply, this is next-gen stuff, folks. It’s one of the most impressive systems I’ve ever seen.

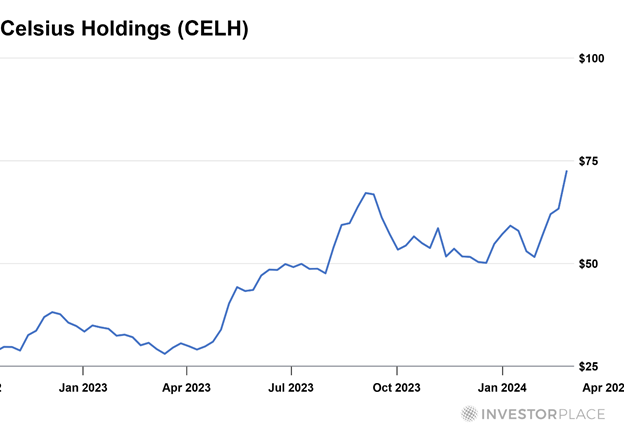

One of their biggest successes was Celsius Holdings, Inc. (CELH), the fast-growing energy-drink company in the U.S. Their data showed consumer mentions exploding in early 2022, long before Wall Street noticed. They bought in under $10 a share. By the time analysts caught on, Celsius had climbed nearly 400%.

They saw similar results in Hims & Hers Health, Inc. (HIMS), up roughly 550% since their system flashed, and Robinhood Markets, Inc. (HOOD) before a 600% run.

Different methods, same goal. Their system captures what people are doing with their money. Mine captures what companies are earning with it.

But here’s where things start to get interesting…

What Happens When You Combine the Two

On October 28, the Swans and I unveiled a new collaboration called The Ultimate Stock Strategy.

It merges my Stock Grader fundamentals with their real-time consumer analytics to identify “Ultimate Stocks” – companies that are financially strong, gaining institutional support and already trending among consumers.

Our five-year backtest showed more than 240 potential doubles, 12 ten-baggers, and an average gain of 244 percent – across every kind of market: up, down, and flat.

And during our live event, we revealed that this new system is now detecting a divergence in the market. Some popular names could struggle in November, while a handful of new leaders are emerging fast.

If you missed our broadcast, the replay is still available for a short time.

Why You Should Watch

In the replay, you’ll see exactly how this new system works and the kinds of signals that spotted NVIDIA and Celsius early. You’ll also get three free stock recommendations – two buys and one sell – that we shared during the event.

NVIDIA’s rise proves what can happen when you recognize a major shift before everyone else. The same goes for the Swans with Celsius.

With this new strategy, you could find the next generation opportunities like this – possibly weeks, months or even years before the crowd catches on.

Click here to watch the replay here while it’s still online.