The Day Wall Street Lost Control of the AI Boom

There are moments in market history when everything quietly changes – when the old rules stop working and a new force takes over.

Most investors don’t see it happening in real time.

They only spot it years later, staring at a long-term chart and saying:

Oh… that was the moment everything shifted.

I’m here to tell you – not in hindsight, but right now – that one of those moments just happened.

And almost nobody is talking about it.

The mainstream media is all about the noise: Nvidia Corp.’s (NVDA) earnings reports, Michael Burry’s short positions, circular financing deals, and whether an AI bubble is popping or not.

For a moment, I want you to forget all of that.

Because what I’m about to show you is much bigger…

Not long ago, if you wanted to spot the next transformative tech stock, you’d follow the venture capital money in Silicon Valley or the innovation coming out of places like Caltech (my alma mater).

Today, I’ll argue that you should follow the money flowing out of Washington, D.C.

The U.S. government has effectively launched a modern Manhattan Project for AI – a massive, multitrillion-dollar effort to secure America’s dominance in artificial intelligence and other critical technologies.

This initiative spans investments in advanced microchips, quantum computing, critical minerals, clean energy, and more. The White House is actively picking and funding the companies it deems crucial to winning the 21st-century tech race.

And if you don’t understand what that means for your portfolio, you’re going to miss the most explosive wealth-creation window since the early days of the internet.

So, let’s walk through why the government is suddenly acting like Silicon Valley’s new mega VC fund… and why early investors in these White House-blessed companies are seeing gains most hedge funds can only dream of.

I explain exactly how to profit – including my #1 stock pick I believe the government will target next – in a brand-new briefing I just finished recording.

But let’s start at the beginning…

The Federal AI Boom Is Rewriting How Market Winners Are Chosen

We’ve seen the proof in recent months.

You’ve probably heard about all of the administration’s pro-AI initiatives, like Project Stargate.

But what you haven’t heard is how they are being used today.

We aren’t talking just subsidy bills. Or stimulus packages. Or even industrial policy plans.

This is the federal government taking direct equity stakes in the companies it believes will determine America’s technological dominance.

And when Washington picks a winner?

The stock reacts like a powder keg.

For example, the government acquired stakes of 15% in MP Materials Corp. (MP) and 9.9% in Intel Corp. (INTC) earlier this year, among others.

It’s a radical departure from business as usual.

But whether one likes it or not, this bold federal intervention is now a reality. And as investors, we need to understand the implications.

Washington’s Equity Stakes Are Creating a New Class of AI Champions

What are those implications?

Huge stock moves – to the upside – in the companies that get tapped by Uncle Sam. It turns out that betting alongside Washington can be extremely profitable.

So far, “Uncle Sam’s portfolio” of chosen companies is trouncing the broader market. Consider that:

- Intel’s shares are up about 77% this year,

- MP has rocketed 276%,

- Lithium Americas Corp. (LAC) is up 50%,

- and Trilogy Metals (TMQ) is up 204%.

All far outperforming the S&P 500’s ~13% gain.

These stocks surged as news hit that the government was backing them with major investments or contracts.

In effect, Washington has become the world’s most powerful venture capitalist, and it’s fast-tracking a new generation of tech winners.

And if you understand it, you can profit from it… just like we did.

How Federal Backing Sends AI Stocks Parabolic

To illustrate this pattern in action, let me share an example from our portfolio – one that we got right by being a step ahead of Washington’s move.

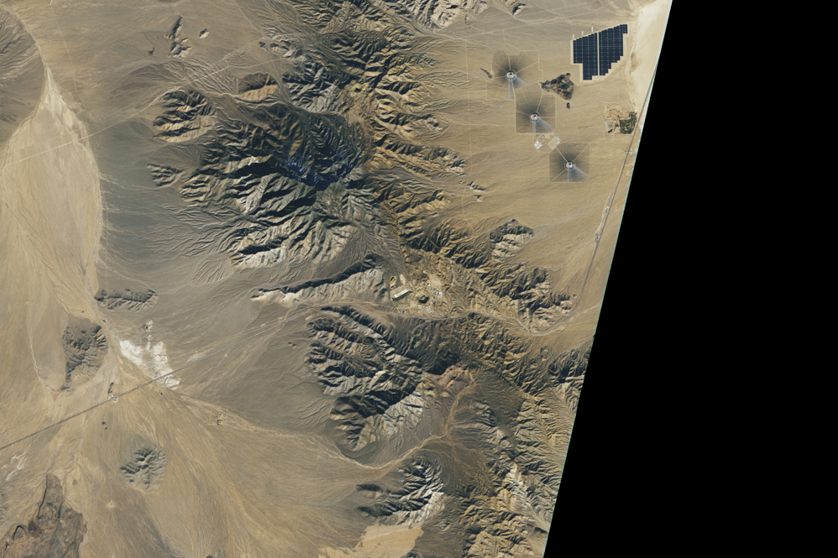

Mountain Pass rare-earth mine in California. Source: NASA.gov

A while back, I recommended my paid members buy shares of MP Materials at around $30. That was based on a thesis that rare earth elements (used in everything from fighter jets to electric vehicles) were a strategic priority for the U.S.

We were right.

In July, MP Materials announced that the Pentagon would purchase $400 million of its stock, taking a 15% ownership stake through structured agreements. In essence, MP was anointed as a national champion for rare-earth supply.

The stock’s reaction? It surged, ultimately climbing as high as $90 at one point – a triple from our entry price.

We managed to be there before the White House money arrived, but truth be told, we had a hunch that Washington was about to step in.

A Simple Framework for Spotting the Next Federal AI Champion

How did we know MP was likely to get federal support?

We spotted a clear pattern in how the White House and Pentagon were picking national champions and refined that into a simple three-part screen for predicting future winners:

- Right Industry: Is it in a sector Washington deems essential (AI, semiconductors, critical minerals, drones, nuclear, cybersecurity, etc.)?

- Right Company: Is it the clear leader with the best shot at solving the national-security problem?

- Right People/Relationships: Do they have U.S. operations, D.C. ties, or credible strategic backers?

If a company checks these three boxes, it’s a strong candidate for federal support… and often just one announcement away from a major stock move.

Indeed, MP checked every box:

- Right Industry: Rare earths are officially classified as vital to U.S. national security, and China controls the supply chain. Washington had already signaled it wanted a domestic producer. MP runs America’s only major rare-earth mine – an obvious match.

- Right Company: In rare earths, MP is the strongest U.S. operator, with its Mountain Pass mine in California, proven output, and big expansion goals. If the U.S. wanted a rare-earth champion, MP was it.

- Right People/Relationships: MP CEO James Litinsky’s brother Andrew Dean Litinsky (Andy Dean) was a candidate on the 2004 season of The Apprentice… where he got “fired” by Donald Trump. Andy Dean later landed a role within the Trump Organization and helped get Truth Social started. While this doesn’t prove causation, it underscores how visibility, networks, and strategic alignment can accelerate federal attention.

Using this blueprint, we’re now scanning publicly held AI, semiconductor, advanced manufacturing, energy, and critical material companies. The rules of capitalism are changing… and Washington is now a copilot steering capital into specific sectors.

And that brings us to the most important part…

Most Investors Still Don’t See What’s Coming

You’d think Wall Street would be all over this. But incredibly, most analysts still treat these moves as “one-offs.”

They look at MP Materials and think: “Huh, cool. The Pentagon invested in a miner.”

They look at Intel and say: “Interesting, a government-backed chip expansion.”

They think these are isolated events.

They’re not.

They’re Act 1.

The Office of Strategic Capital has already published its roadmap – listing every chokepoint in America’s AI supply chain.

The White House has already declared rare earths, semiconductors, small nuclear reactors, robotics, advanced software, and drone technologies as mission-critical

And the Pentagon, the Department of Energy, and others have begun allocating capital to secure each of these links.

This means there are dozens of companies that haven’t yet received federal backing… but almost certainly will.

And investors who buy those companies before Washington strikes will capture the biggest gains of the entire AI Boom.

I’m talking about potential 500%… 1,000%… even 2,000% returns.

The U.S. Government’s AI Shortlist – and Why It Matters

This is Act 2.

And over the past six months, I’ve worked hard to build what I call: The U.S. Government AI Shortlist.

This is the list of companies I believe are next in line to receive federal investment, partnerships, or guaranteed contracts.

And one company stands out on that list above all others.

It sits at the very center of the AI supply chain. It’s U.S.-based. It’s critical to national security. Government agencies have already signaled strong interest.

And I don’t see anyone talking about this company right now.

It may be the most under-the-radar investment in the market today.

That’s why I put together a new presentation on this very topic.

Inside my new urgent briefing, I reveal:

- The company’s name…

- Its ticker symbol…

- Why I believe it could soar 10X or more…

- And the exact signals I’m watching for a government-confirmed deal…

You don’t need to buy anything to watch this briefing.

Just click the link here and get this info for free.

I believe we’re witnessing the moment Wall Street lost sight of the AI Boom…

Not because of Nvidia’s earnings. Or Michael Burry’s warnings. Or any of the nonsense that the mainstream media just keeps spouting.

But rather, because of Washington.

And the investors who recognize that shift now will be the ones who get rich from it.

Click here to watch my latest presentation now.