Fed’s favorite inflation gauge shows prices rose at 3.2% annual rate in November, less than expected

A gauge the Federal Reserve uses for inflation rose slightly in November and edged closer to the central bank’s goal.

The core personal consumption expenditures price index, which excludes volatile food and energy prices, increased 0.1% for the month, and was up 3.2% from a year ago, the Commerce Department reported Friday.

Economists surveyed by Dow Jones had been expecting respective increases of 0.1% and 3.3% respectively.

On a six-month basis, core PCE increased 1.9%, indicating that if current trends continue the Fed essentially has reached its goal.

“Adding in the further sharp slowdown in rent inflation still in the pipeline, it’s hard to see any credible reason why the annual inflation rate won’t also return to the 2% target over the coming months,” wrote Andrew Hunter, deputy chief U.S. economist at Capital Economics.

Markets reacted little to the report, with Wall Street set for a mixed open Friday in its last session before the Christmas.

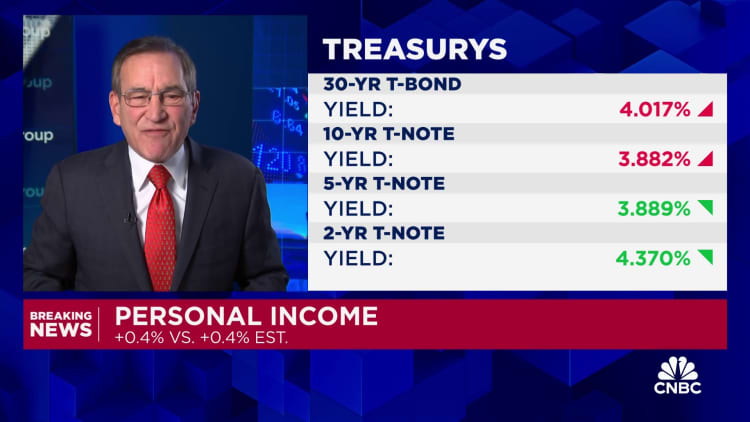

Elsewhere in the report, consumer expenditures in November increased 0.3% while income rose 0.4%, numbers that were in line with expectations and indicative that spending was continuing apace despite ongoing inflation pressures.

Including food and energy costs, so-called headline PCE actually fell 0.1% on the month and was up just 2.6% from a year ago, after peaking above 7% in mid-2022. That was the first monthly decline since April 2020, according to Fed data.

The 12-month numbers are significant in that both show inflation making continued progress toward the Fed’s 2% target.

“The Federal Open Market Committee is not yet ready to declare victory on inflation, but the outlook is much better than it was just a few months ago,” wrote Gus Faucher, chief economist at PNC Financial Services. “The slowing in core inflation opens the door for fed funds rate cuts in 2024; the timing will depend on core PCE numbers over the next few months.

The Fed prefers PCE as an inflation measure over the more widely followed CPI as the former focuses more on what consumers actually spend rather than the latter’s measure of what goods and services cost. Though policymakers watch both measures, they are more concerned with core prices as a longer-run inflation gauge.

November’s report reflected a shift in consumer appetite, as prices for services increased 0.2% while goods slumped 0.7%. A 2.7% slide in energy prices and a 0.1% decrease in food helped hold back inflation for the month.

Much of the market’s focus lately has been on the Fed’s inflation view and what that will mean for interest rates.

For each of its last three meetings, the Federal Open Market Committee has heled the line, keeping its benchmark overnight borrowing rate targeted between 5.25%-5.5%. At its meeting last week, the committee indicated it is done raising rates and expects to implement cuts totaling 0.75 percentage point in 2024. Markets expect the first rate cut to happen in March.