F&O Manual | Indices in red as FIIs reduce future longs, raise shorts by 2%

FIIs decreased their future index long position holdings by 0.71 percent, increased future index shorts by 2.55 percent

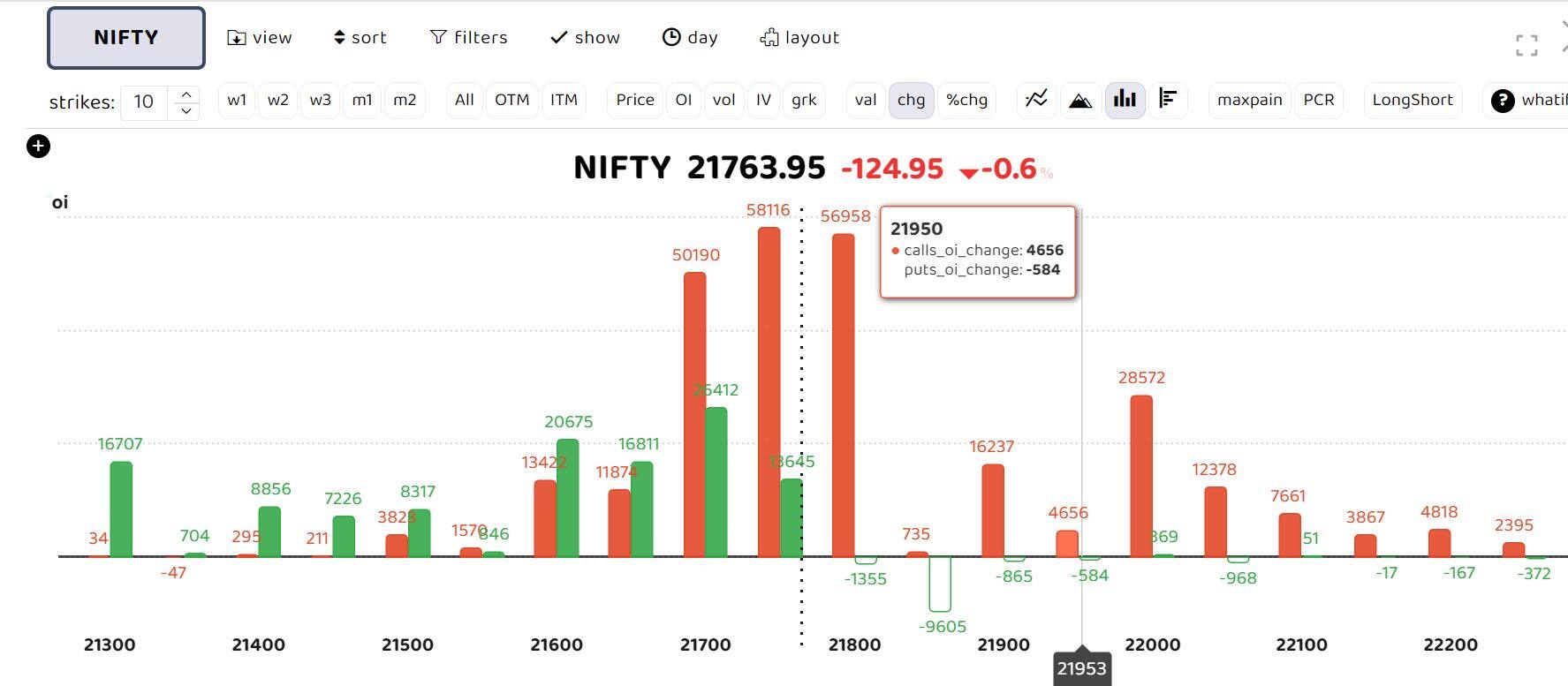

The benchmark Indian indices are trading on a negative note, with the Nifty holding the key straddle positions at 21,700. Support for the day is pegged at the 21,500 level. On the higher side, immediate resistance is seen at 21,750, followed by 21,800 and 21,900.

At 10:40am, the Sensex was down 616.72 points or 0.85 percent to 71,655.22, and the Nifty was down 169.60 points or 0.78 percent to 21,572.30.

Nifty Levels

Bars in red indicate the change in open interest (OI) of call writers, while green bars show the change in OI of put writers

“Significant call-writing buildup is witnessed in 21,750 and 21,800 strikes, while on the puts front, 21,700-21,600 witnessed considerable Open Interest additions. Overall, the range for the index could be 21,570 on the downside and 21,850 on the upside. Going forward, the 21,610-21,630 zone would act as an important support, and until it holds, the upside could continue up to 21,830-21,860. Below 21,610, the index could test the 21,550-21,500 zone,” Sudeep Shah, head of derivative and technical research at SBI Securities, said.

FII positioning

The FII Long-Short Ratio for the Index Futures decreased marginally to 68.84 as they sold 2,732 index future longs. On the stock futures front, FIIs have sold 17,479 contracts, while on the options front, FIIs bought 210,365 call option contracts and 228,239 put option contracts.

Story continues below Advertisement

“FIIs decreased their future index long position holdings by 0.71 percent, increased future index shorts by 2.55 percent, and in index options, there was a significant increase of 36.11 percent in Call longs, 49.21 percent in Call shorts, 20.05 percent in Put longs, and 36.85 percent in Put shorts,” Geojit Financial Services said.

Stocks and sectors in focus

Among individual stocks, long build-up is observed in pharma sector scrips like Lupin, Glenmark, and Divislab. Meanwhile, short build-up can be seen in Gail, Eicher Motors, and Dixon Technologies.

From the broader market, bullish setups were observed in Coalindia, Tatamotors, Apollohospitals, Powergrid, Lichsgfin, Gujarat Gas, Fortis, Zeel, Ofss, Recltd, Ashokley, Pnb, Petronet, Nmdc, prestige, Bharatforge, Igl, Ipcalab, Gnfc, Route, Birlacorpn, Cesc, Nationalum, Hudco and Kalyanjkil.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.