Finnifty volatile, sell-off in underlying spot triggers spike in 21,200 put options

At 12:41 pm on January 2, Finnifty trades at 21353, down 103 points or 0.48 percent.

Finnifty is threw up a bearish trend in afternoon trade on January 2 amid volatility because of weekly expiry. The index finds support at 21,200 and 21,100, where maximum puts have been written, and key resistance is seen at 21,450 and 21,500 where there has been a huge call writing.

At 12:41pm on January 2, Finnifty was trading at 21,353, down 103 points or 0.48 percent.

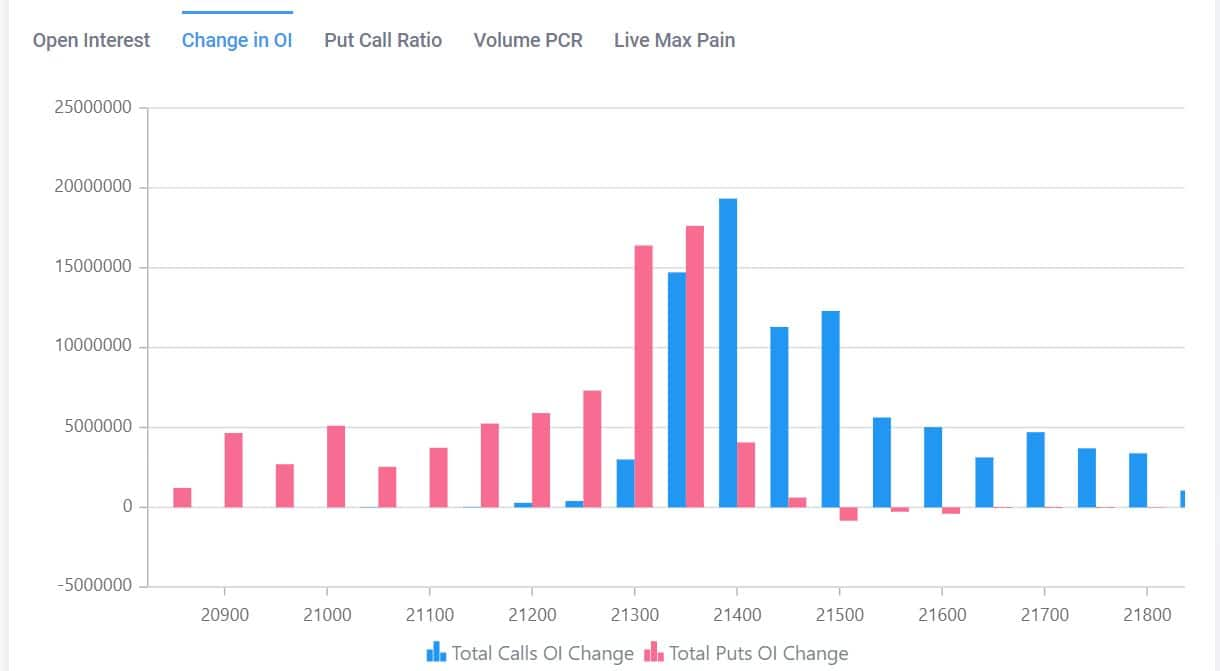

Finnifty Open Interest data

The open interest data reinforces the strong support levels at 21,200 and 21,100, with call writers holding sway at 21,450 and 21,500, acting as a key resistance.

Around 10am, the Finnifty 21,200 Put Option witnessed a significant spike, with premiums surging from Rs 1.85 to Rs 24.85. Although this initially caused unease in the trading community, the spike gradually subsided across the day.

Candlestick chart of FinNifty 21200 put option showing spike in premium at 10 am

Story continues below Advertisement

“Bears took control of Finnifty in the morning session, with the spot falling more than 0.5 percent within 15 minutes (9:45am – 10am). This resulted from selling in the underlying spot of Finnifty. Non-directional option sellers faced Stop Loss triggers during this sudden move, while momentum-based option buyers emerged victorious,” said Chitan Singh Jaggi from Algotest.in.

Expiry trading view

“The Finnifty index is trading in a tight range of 21,400 to 21,300 in the last few hours, and a breakout on either side could trigger the next move. Option data reveals a mixed trend, with 21,400 CE and 21,300 PE witnessing writing. Despite concerns from the steep drop at 10 am, the underlying momentum appears secure over the key support level of 21,000,” Avdhut Bagkar, derivatives and technical analyst at StoxBox, said.

“We advocate taking a long position in 21,400 CE once the spot surpasses the hurdle and stays over for 5-10 minutes. Similarly, if the index breaks 21,300, we would advise taking a long position in 21,300 PE,” he said.

“Finnifty is showing bearish momentum, and it shall continue until 21,590 levels are broken,” said Rajesh Srivastava, a derivatives trader.

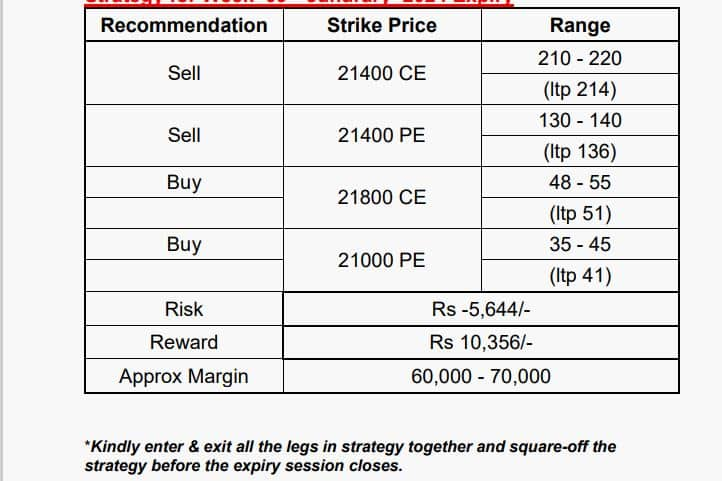

Derivative Strategy Recommendation for January 9, 2024 Expiry by Axis Securities: Range Bound

Axis Securities recommends a range-bound strategy for traders, suggesting initiating a spread strategy to yield modest returns with limited risk and reward. The recommended spread involves buying one lot of the 21,000 strike put option, buying one lot of the 21,800 call option, and selling one lot each of the 21,400 call and 21,400 put options.”

Finnifty Strategy for week: 09 the January 2024 expiry | Source: Axis Securities

Finnifty Strategy for week: 09 the January 2024 expiry | Source: Axis Securities

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.