F&O Manual| Nifty consolidates towards 22,000, technical charts indicate

Except FMCG and pharma, all other sectoral indices are trading in the green with auto, capital goods, realty, IT, up 0.5-1 percent each.

The benchmark Indian indices traded positive to range-bound amid mixed global cues on January 5. Except pharma, all sectoral indices were in the green with realty, power, IT, metal and realty up 1 percent each intraday.

At 10am, the Sensex was up 241.42 points or 0.34 percent at 72,088.99, and the Nifty was up 77.40 points or 0.36 percent at 21,736. About 2269 shares advanced, 799 shares declined, and 90 shares unchanged.

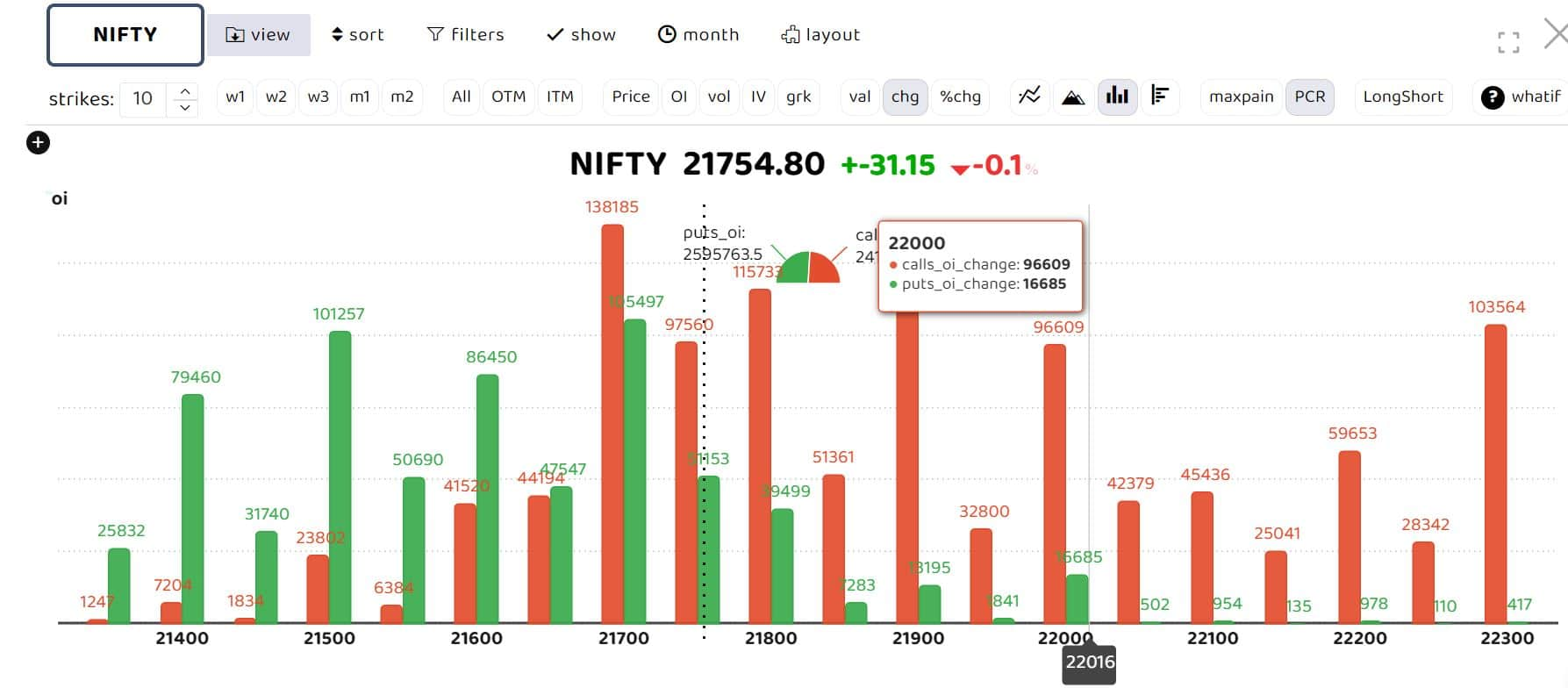

Bars in red indicate the change in open interest (OI) of call writers, while green bars show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while green bars show the change in OI of put writers

Open interest data suggests heavy call writing at 21,900 and 22,000 strikes forming stiff resistance for the day. “In the near term, in the Nifty, any corrections towards 21,200-20,800 levels should be seen as buying opportunities. The index has the potential to extend its rally and reach levels towards the 22,000-22,500 levels,” Axis Securities said.

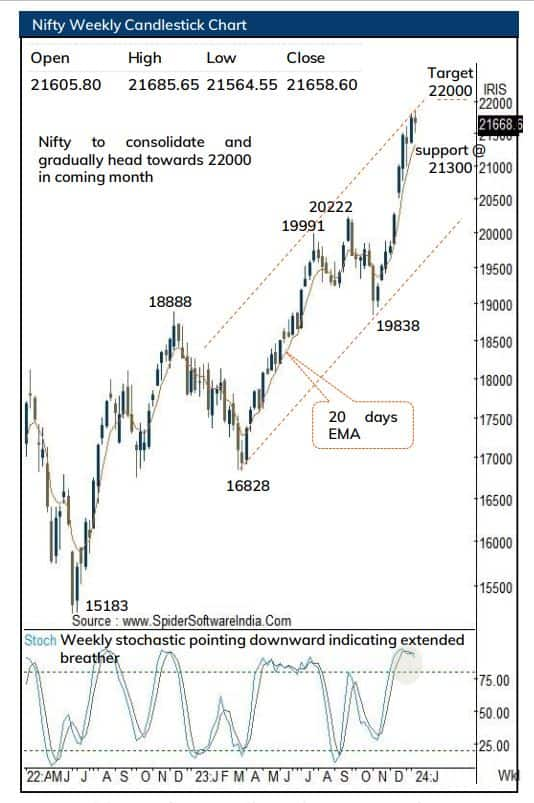

Brokerage house, ICICI Securities stated that, “The shallow retracement followed by elongation of rallies signifies robust price structure that makes us confident to reiterate our positive stance of Nifty heading towards psychological mark of 22000 in the coming weeks.”

Nifty weekly candlestick chart indicating that the index is consolidating towards 22000 | Source: ICICI Securities

Nifty weekly candlestick chart indicating that the index is consolidating towards 22000 | Source: ICICI Securities

“Key point to highlight since end of October 23 is that the intermediate corrections have been limited to the tune of 3 percent while time wise correction has not exceeded for more than 2-3 sessions, highlighting inherent strength. Thus, any breather should be capitalized to accumulate quality stocks ahead of Q3 earning season as we expect Nifty to hold the key support threshold of 21300,” added ICICI Securities.

Story continues below Advertisement

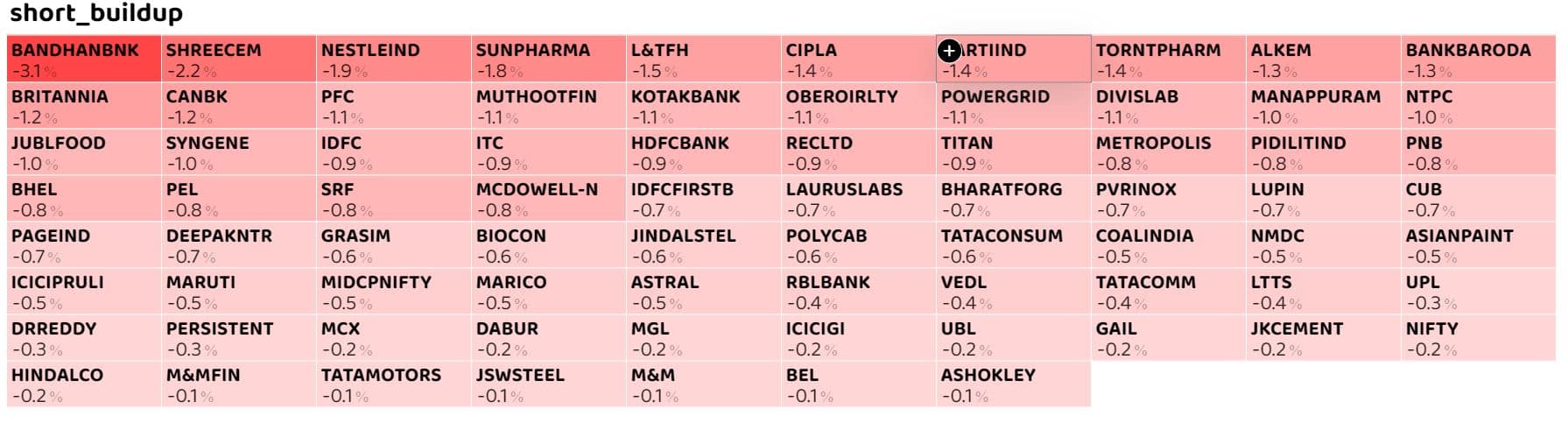

Among individual stocks, long build up is witnessed in Industower, OFSS and HAL. While short build up is observed in Bandhan Bank, Shreecement and SunPharma.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.