Kings of consistency: Nifty stocks which have regularly outdone the benchmark

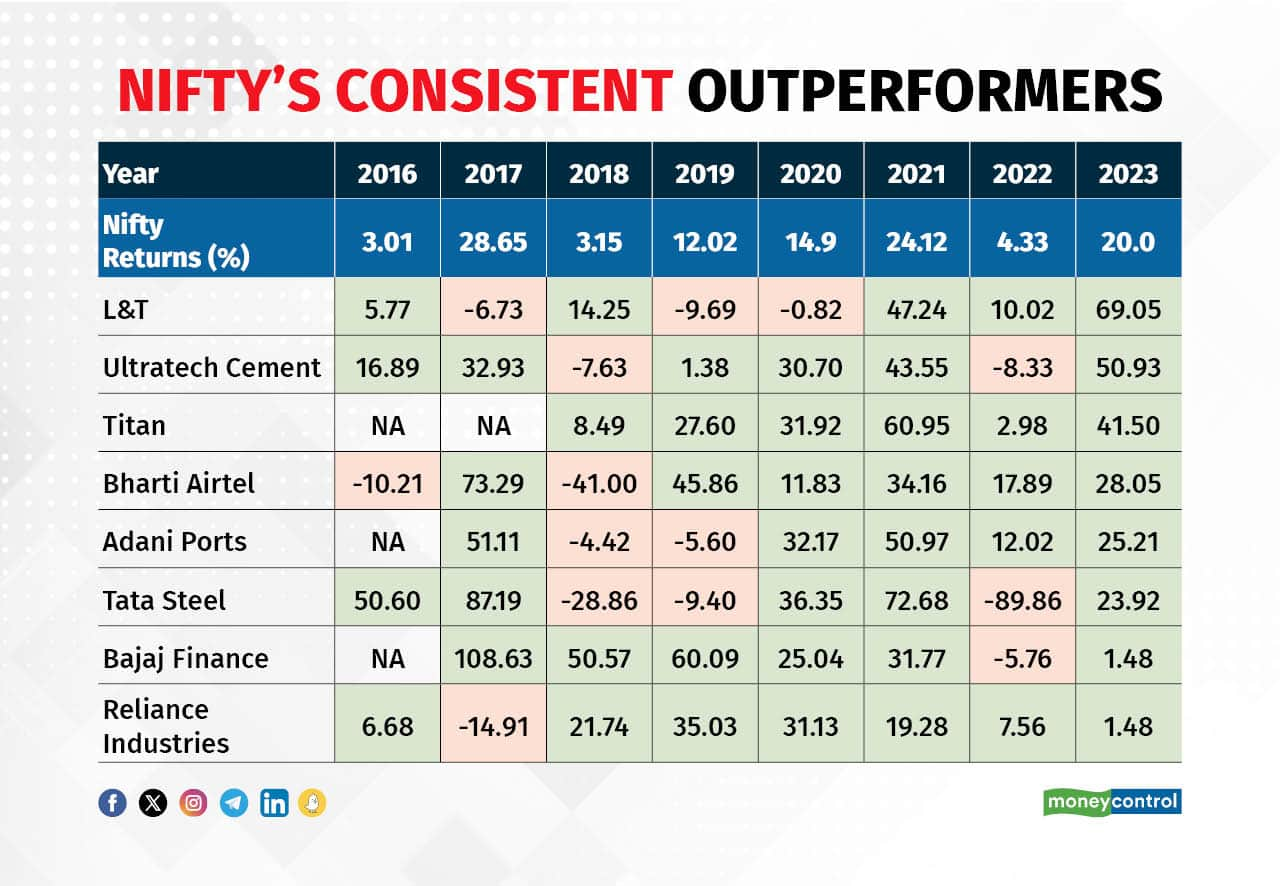

A Moneycontrol analysis shows that eight Nifty stocks have outperformed the index five times, the highest, since 2016. These are L&T, Ultratech Cement, Titan, Bharti Airtel, Adani Ports, Tata Steel, Bajaj Finance and RIL

Equity benchmark Nifty ended 2023 with robust gains of 20%, marking its eight straight year of positive returns

‘);

$(‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]);

//if(resData[stkKey][‘percentchange’] > 0){

// $(‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”);

// $(‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”);

//}else if(resData[stkKey][‘percentchange’] < 0){

// $(‘#greentxt_’+articleId).removeClass(“greentxt”).addClass(“redtxt”);

// $(‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”);

//}

if(resData[stkKey][‘percentchange’] >= 0){

$(‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”);

//$(‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”);

$(‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”);

}else if(resData[stkKey][‘percentchange’] < 0){

$(‘#greentxt_’+articleId).removeClass(“greentxt”).addClass(“redtxt”);

//$(‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”);

$(‘#gainlosstxt_’+articleId).find(‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”);

}

$(‘#volumetxt_’+articleId).show();

$(‘#vlmtxt_’+articleId).show();

$(‘#stkvol_’+articleId).text(resData[stkKey][‘volume’]);

$(‘#td-low_’+articleId).text(resData[stkKey][‘daylow’]);

$(‘#td-high_’+articleId).text(resData[stkKey][‘dayhigh’]);

$(‘#rightcol_’+articleId).show();

}else{

$(‘#volumetxt_’+articleId).hide();

$(‘#vlmtxt_’+articleId).hide();

$(‘#stkvol_’+articleId).text(”);

$(‘#td-low_’+articleId).text(”);

$(‘#td-high_’+articleId).text(”);

$(‘#rightcol_’+articleId).hide();

}

$(‘#stk-graph_’+articleId).attr(‘src’,’//appfeeds.moneycontrol.com/jsonapi/stocks/graph&format=json&watch_app=true&range=1d&type=area&ex=’+stockType+’&sc_id=’+stockId+’&width=157&height=100&source=web’);

}

}

}

});

}

$(‘.bseliveselectbox’).click(function(){

$(‘.bselivelist’).show();

});

function bindClicksForDropdown(articleId){

$(‘ul#stockwidgettabs_’+articleId+’ li’).click(function(){

stkId = jQuery.trim($(this).find(‘a’).attr(‘stkid’));

$(‘ul#stockwidgettabs_’+articleId+’ li’).find(‘a’).removeClass(‘active’);

$(this).find(‘a’).addClass(‘active’);

stockWidget(‘N’,stkId,articleId);

});

$(‘#stk-b-‘+articleId).click(function(){

stkId = jQuery.trim($(this).attr(‘stkId’));

stockWidget(‘B’,stkId,articleId);

$(‘.bselivelist’).hide();

});

$(‘#stk-n-‘+articleId).click(function(){

stkId = jQuery.trim($(this).attr(‘stkId’));

stockWidget(‘N’,stkId,articleId);

$(‘.bselivelist’).hide();

});

}

$(“.bselivelist”).focusout(function(){

$(“.bselivelist”).hide(); //hide the results

});

function bindMenuClicks(articleId){

$(‘#watchlist-‘+articleId).click(function(){

var stkId = $(this).attr(‘stkId’);

overlayPopupWatchlist(0,2,1,stkId);

});

$(‘#portfolio-‘+articleId).click(function(){

var dispId = $(this).attr(‘dispId’);

pcSavePort(0,1,dispId);

});

}

$(‘.mc-modal-close’).on(‘click’,function(){

$(‘.mc-modal-wrap’).css(‘display’,’none’);

$(‘.mc-modal’).removeClass(‘success’);

$(‘.mc-modal’).removeClass(‘error’);

});

function overlayPopupWatchlist(e, t, n,stkId) {

$(‘.srch_bx’).css(‘z-index’,’999′);

typparam1 = n;

if(readCookie(‘nnmc’))

{

var lastRsrs =new Array();

lastRsrs[e]= stkId;

if(lastRsrs.length > 0)

{

var resStr=”;

let secglbVar = 1;

var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’;

$.get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) {

$(‘#backInner1_rhsPop’).html(data);

$.ajax({url:url,

type:”POST”,

dataType:”json”,

data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs},

success:function(d)

{

if(typparam1==’1′) // rhs

{

var appndStr=”;

//var newappndStr = makeMiddleRDivNew(d);

//appndStr = newappndStr[0];

var titStr=”;var editw=”;

var typevar=”;

var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’);

var phead =’Why add to Portfolio?’;

if(secglbVar ==1)

{

var stkdtxt=’this stock’;

var fltxt=’ it ‘;

typevar =’Stock ‘;

if(lastRsrs.length>1){

stkdtxt=’these stocks’;

typevar =’Stocks ‘;fltxt=’ them ‘;

}

}

//var popretStr =lvPOPRHS(phead,pparr);

//$(‘#poprhsAdd’).html(popretStr);

//$(‘.btmbgnwr’).show();

var tickTxt =’‘;

if(typparam1==1)

{

var modalContent = ‘Watchlist has been updated successfully.’;

var modalStatus = ‘success’; //if error, use ‘error’

$(‘.mc-modal-content’).text(modalContent);

$(‘.mc-modal-wrap’).css(‘display’,’flex’);

$(‘.mc-modal’).addClass(modalStatus);

//var existsFlag=$.inArray(‘added’,newappndStr[1]);

//$(‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’);

//if(existsFlag == -1)

//{

// if(lastRsrs.length > 1)

// $(‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’);

// else

// $(‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’);

//

//}

}

//$(‘.accdiv’).html(”);

//$(‘.accdiv’).html(appndStr);

}

},

//complete:function(d){

// if(typparam1==1)

// {

// watchlist_popup(‘open’);

// }

//}

});

});

}

else

{

var disNam =’stock’;

if($(‘#impact_option’).html()==’STOCKS’)

disNam =’stock’;

if($(‘#impact_option’).html()==’MUTUAL FUNDS’)

disNam =’mutual fund’;

if($(‘#impact_option’).html()==’COMMODITIES’)

disNam =’commodity’;

alert(‘Please select at least one ‘+disNam);

}

}

else

{

AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’;

commonPopRHS();

/*work_div = 1;

typparam = t;

typparam1 = n;

check_login_pop(1)*/

}

}

function pcSavePort(param,call_pg,dispId)

{

var adtxt=”;

if(readCookie(‘nnmc’)){

if(call_pg == “2”)

{

pass_sec = 2;

}

else

{

pass_sec = 1;

}

var postfolio_url = ‘https://www.moneycontrol.com/portfolio_new/add_stocks_multi.php?id=’+dispId;

window.open(postfolio_url, ‘_blank’);

} else

{

AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’;

commonPopRHS();

/*work_div = 1;

typparam = t;

typparam1 = n;

check_login_pop(1)*/

}

}

function commonPopRHS(e) {

/*var t = ($(window).height() – $(“#” + e).height()) / 2 + $(window).scrollTop();

var n = ($(window).width() – $(“#” + e).width()) / 2 + $(window).scrollLeft();

$(“#” + e).css({

position: “absolute”,

top: t,

left: n

});

$(“#lightbox_cb,#” + e).fadeIn(300);

$(“#lightbox_cb”).remove();

$(“body”).append(”);

$(“#lightbox_cb”).css({

filter: “alpha(opacity=80)”

}).fadeIn()*/

$(“.linkSignUp”).click();

}

function overlay(n)

{

document.getElementById(‘back’).style.width = document.body.clientWidth + “px”;

document.getElementById(‘back’).style.height = document.body.clientHeight +”px”;

document.getElementById(‘back’).style.display = ‘block’;

jQuery.fn.center = function () {

this.css(“position”,”absolute”);

var topPos = ($(window).height() – this.height() ) / 2;

this.css(“top”, -topPos).show().animate({‘top’:topPos},300);

this.css(“left”, ( $(window).width() – this.width() ) / 2);

return this;

}

setTimeout(function(){$(‘#backInner’+n).center()},100);

}

function closeoverlay(n){

document.getElementById(‘back’).style.display = ‘none’;

document.getElementById(‘backInner’+n).style.display = ‘none’;

}

stk_str=”;

stk.forEach(function (stkData,index){

if(index==0){

stk_str+=stkData.stockId.trim();

}else{

stk_str+=’,’+stkData.stockId.trim();

}

});

$.get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?classic=true&sc_id=’+stk_str, function(data) {

stk.forEach(function (stkData,index){

$(‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]);

});

});

function redirectToTradeOpenDematAccountOnline(){

if (stock_isinid && stock_tradeType) {

window.open(`https://www.moneycontrol.com/open-demat-account-online?classic=true&script_id=${stock_isinid}&ex=${stock_tradeType}&site=web&asset_class=stock&utm_source=moneycontrol&utm_medium=articlepage&utm_campaign=tradenow&utm_content=webbutton`, ‘_blank’);

}

}

Here is a thought experiment for cricket aficionados. Compare these two statistics and pick the better Test player:

Batsman A – 52 Matches, 80 innings, 6,996 runs.

Batsman B – 200 matches, 329 innings, 15,921 runs.

Before you make this seemingly straightforward choice, here’s another input. These two are not hypothetical cases but real players. The prolific Batsman B with an avalanche of runs is Sachin Tendulkar. And Batsman A is a gentleman named Sir Donald Bradman.

So why is that the overwhelming majority of the cricketing world, including the Little Master himself, picks Batsman A over Batsman B?

The answer lies in another piece of statistic — average runs per innings.

Bradman’s batting average of 99.94 remains the stuff of legends, a feat no other batsman has come close to achieving. Sachin has a test batting average of 53.78, Sunil Gavaskar 51.12 and Brian Lara 52.88.

There have been batsmen who have scored more runs than Bradman, at a faster clip, with the highest top score and with more centuries and half-centuries. But no one has managed to score runs with the dependable regularity of “The Don”.

Story continues below Advertisement

In other words, the secret sauce of greatness is not one-off outperformance but consistency.

Which brings us to Dalal Street.

The equity benchmark Nifty ended 2023 with robust gains of 20 percent, marking its eight straight year of positive returns.

While 2023 belonged to auto, infrastructure and PSU stocks, which counters consistently outperformed the Nifty during the eight-year period? And which ones were turned out to be duds? Here’s what we found:

Bull Run Scorecard

As per a Moneycontrol analysis, eight Nifty stocks have outperformed the index the highest number of times (five) since 2016 – L&T, Ultratech Cement, Titan, Bharti Airtel, Adani Ports & SEZ, Tata Steel, Bajaj Finance and Reliance Industries.

While banks hog the limelight, not one features in this list, which is dominated by capex-related names.

Analysts say this could be the major theme for the Indian market, at least in the medium term.

“The broad-basing of India’s rising investment cycle is well evident but there is significant headroom here. The capex as a percent of nominal GDP would rise to a nearly decade high of 30% in FY24. We believe though, there is a long way to go in the capex cycle,” global brokerage firm Jefferies said in a note.

The recent upturn in corporate spending and housing cycle have around five years to go, it said, adding that L&T, Ultratech, and Coal India are among its preferred capex cycle plays.

Also Read: India rises to 2nd spot in MSCI EM index, firms up stand as investment destination

A finer look at the data offers some more insights.

Bajaj Finance, which was included in the 50-pack Nifty in 2017, topped the index gainers’ list that year with returns of 108 percent. It went on to top the winners’ chart for the next two years as well — a hat-trick no other Nifty constituent scored during the period under review.

Another high-flying stock emerged as a cautionary tale for momentum investors.

Yes Bank was the second biggest Nifty gainer in 2016 with a rise of 59 percent but did a 180-degree turnabout to emerge as the biggest loser in the Nifty pack the next year and in 2019 as well before being removed from the index in March 2020.

Another mercurial member has been Adani Enterprises – the top Nifty gainer in 2022 (126 percent returns) followed by the biggest loser in 2023 (down 26 percent).

Tata Motors, the only Nifty constituent to have jumped over 100 percent in 2023, has another feather in its cap – the biggest single-year gain by a Nifty stock in the eight-year period at 162 percent, which it achieved in 2021.

There has also been a heartening reversal in fortunes, this time by a PSU stock, demonstrating perhaps the change in narrative around the sector as a whole.

Coal India finished in the red for five straight years starting 2016. It managed to gained a paltry 8 percent in 2021, while the Nifty vaulted over 24 percent. However, it zoomed to the second position in 2022 with 54 percent returns, followed by a top-five finish the next year at 67 percent gains.

While a number of stocks have underperformed during the period in question, two stick out – BPCL and UPL, which have ended five of the eight years in losses.

As it turns out, not every consistency is worth aspiring for.

Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.