China markets rebound after softer-then-expected deflation, Japan extends record-breaking rally

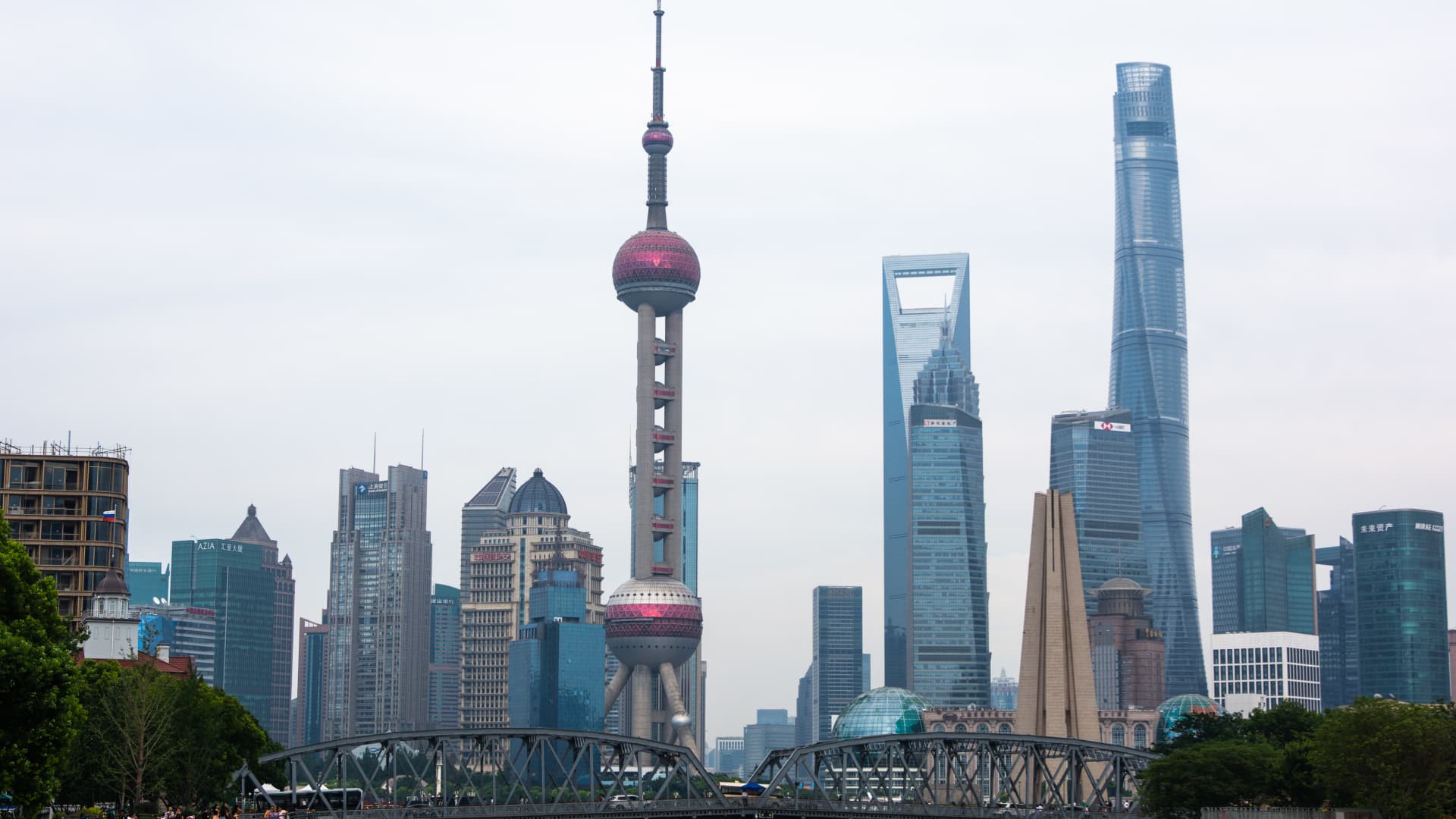

A view of high-rise buildings is seen along the Suzhou Creek in Shanghai, China on July 5, 2023.

Ying Tang | NurPhoto | Getty Images

Chinese markets reversed losses on Friday after the country posted softer-then-expected deflation data for December, while Japan’s markets continued their record breaking rally.

Hong Kong’s Hang Seng index was up 0.16%, while the mainland Chinese CSI 300 rose 0.35%. The country’s consumer price index fell 0.3%, softer than a 0.4% expected by a Reuters poll of economists, and also lower than the 0.5% fall seen in November.

Separately, both the benchmark Nikkei 225 and Topix are at their highest levels since 1990, having surged in the past week.

The Nikkei advanced 1.06%, paring some gains after surging 2.1% at open, while the broader Topix was up 0.18%.

In Australia, the S&P/ASX 200 slipped marginally lower, while South Korea’s Kospi inched down 0.14% and the small-cap Kosdaq was down 0.95%.

Overnight in the U.S., all three major indexes ended Thursday close to the flat line even as U.S. inflation for December came in higher than expected.

December’s consumer price index report came out slightly higher-than-expected, reflecting a 0.3% increase in consumer prices for the month, pushing the annual rate to 3.4%, compared to the 3.2% expected by economists polled by Dow Jones.

The Nasdaq Composite closed at the flat line, while the Dow Jones Industrial Average eked out a gain of 0.04%.

The S&P 500 edged lower by 0.07%, although earlier in the session, the broad market index briefly traded above its record closing high of 4,796.56.

— CNBC’s Pia Singh and Brian Evans contributed to this report