As Nifty tops 21,900, what should 22,000 call writers do – square off, adjust or hold?

At 14:23 hrs IST on January 12, the Sensex was up 834.34 points or 1.16 percent at 72,555.52, and the Nifty was up 237.60 points or 1.10 percent at 21,884.80

The Nifty surged to new all-time high to trade above 21,900 on January 12, after IT heavyweights TCS and Infosys earnings results boost sentiment.

Traders, especially call writers who were betting the market to fall in January, find themselves in a quandary — to square off positions or to continue with their directional view?

The dilemma is around what to do with these short calls — to unwind, adjust, or hold?

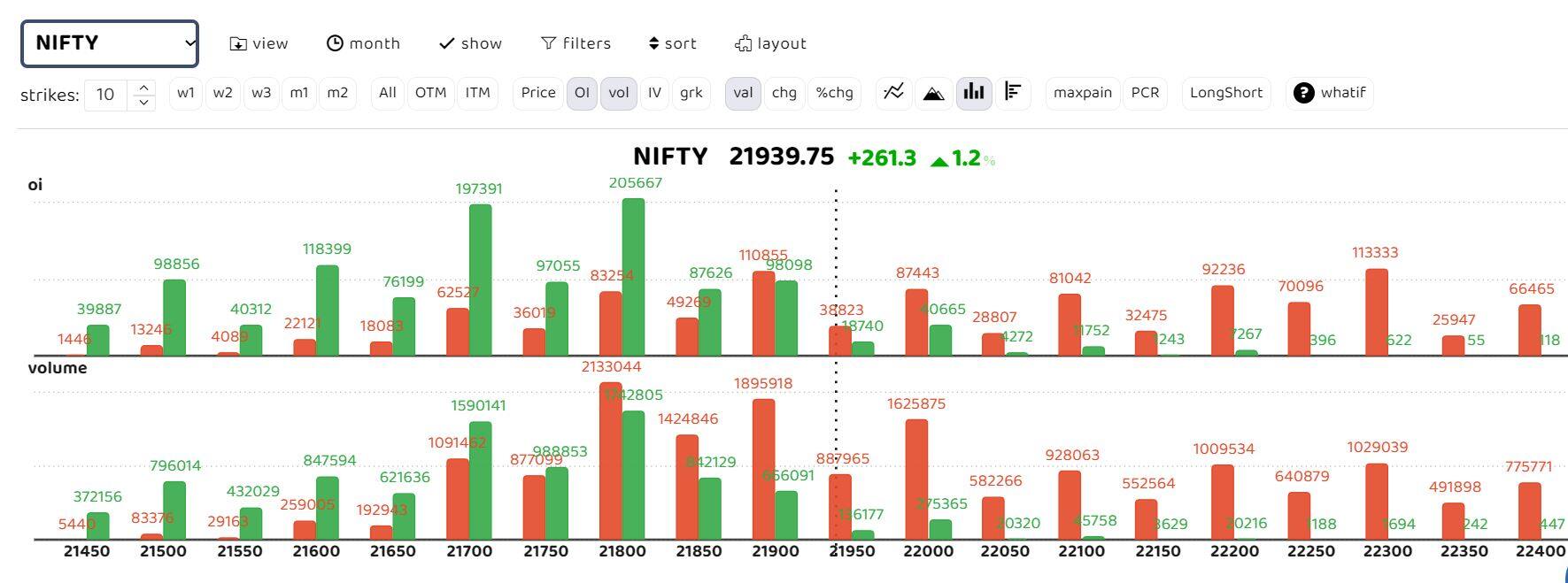

Derivative monthly data chart of Nifty showing the open interest and volume | Highest OI of call writers in terms of value seen at 22000 and 22300 levels

Derivative monthly data chart of Nifty showing the open interest and volume | Highest OI of call writers in terms of value seen at 22000 and 22300 levels

According to Avdhut Bagkar, Derivatives and Technical Analyst at StoxBox, “With a new historic peak in Nifty 50 on Friday, the breakout implies a next leg of upside towards 22,000 and 22,250 levels. Any short calls in option strikes within the range of 21,800-22,000 may witness short-covering, potentially pushing Nifty into further uncharted territories.”

“It is prudent to avoid writing in the range of 21,600 CE–22,000 CE strike prices to mitigate unworthy premiums. The underlying trend has resumed its upward journey and should see quick upside rallies,” added Bagkar.

Tejas Shah, Vice President–Technical Research at JM Financial, said if the Nifty closes above 21,800, then the index is likely to test 22,000 on an immediate basis. “Traders who are short should square off the position at the current market price or on a minor pullback,” he said.

“Current weekly option series has the highest open interest of around 61 lakh shares, and the current price premium is around 14 rupees; the next highest OI stands at 21,900 CE with 59 lakh shares. Traders who have short positions in the 22,300 CE should maintain strict SL of 21,900 spot level on closing basis and go long on the 22,000 CE of the current weekly series,” said Arun Kumar Mantri, Founder of Mantri Finmart.

Story continues below Advertisement

He said that huge short-covering may be expected once the index crosses 21,900 in the near term.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.