F&O Manual | Nifty surpasses 22,000, experts say next stop 22,222

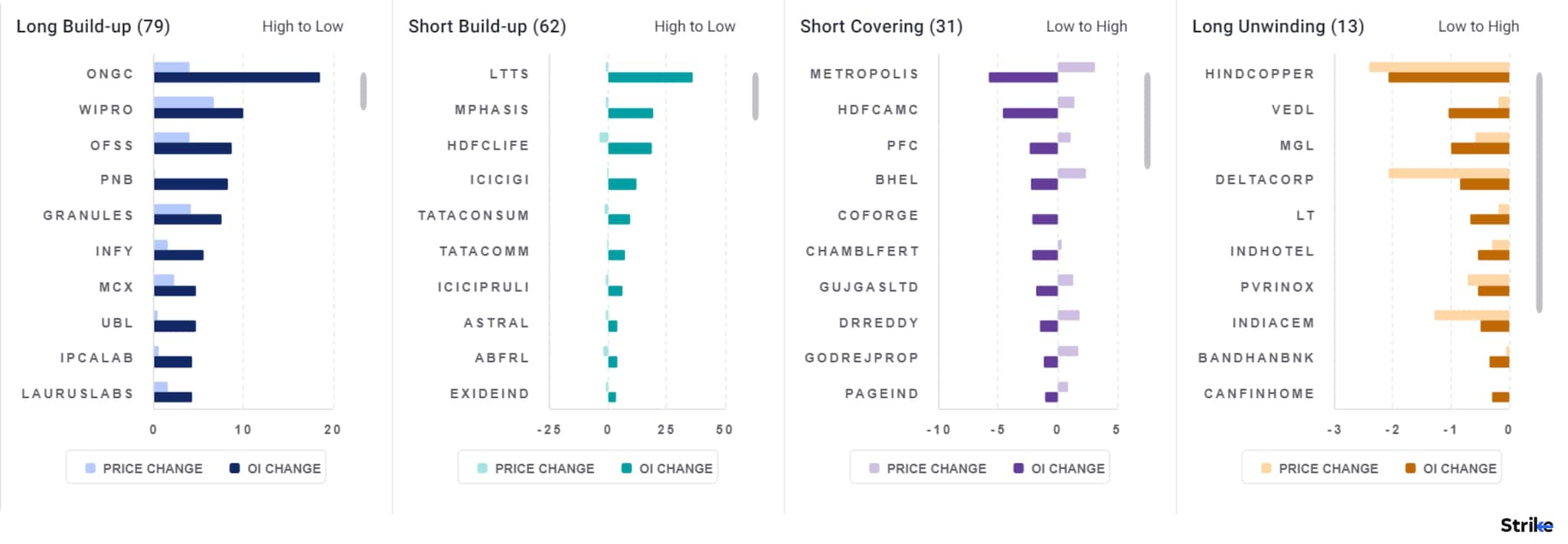

Among individual stocks, long build up can be seen in ONGC, Wipro, OFSS and PNB is observed. While short build up is seen at LTTS, Mphasis, HDFCLife and ICICIGI.

The equity benchmark Nifty continued its record run to surpass the psychological milestone of 22,000 on January 15, propelled by the positive impact of the IT sector earnings results.

The Nifty closed the week gone by above the critical threshold of 21,800. Experts expect the rally to continue, setting a higher target of 22,222. The support for the index lies at 21,800-850 and 21,700, with immediate resistance at 22,000 and the subsequent hurdle at 22,222.

All sectoral indices, excluding metal and power, were trading in the green. Information Technology, banking, pharmaceuticals, oil & gas, and realty sectors’ gains ranged from 0.5 to 1.5 percent.

At of 11 am, the Sensex has surged by 585.36 points, or 0.81 percent, to touch 73,153.81, while the Nifty gained 152.20 points, or 0.70 percent, reaching 22,046.70.

As many as 1,758 shares advanced, 1,509 declined and 93 remained unchanged.

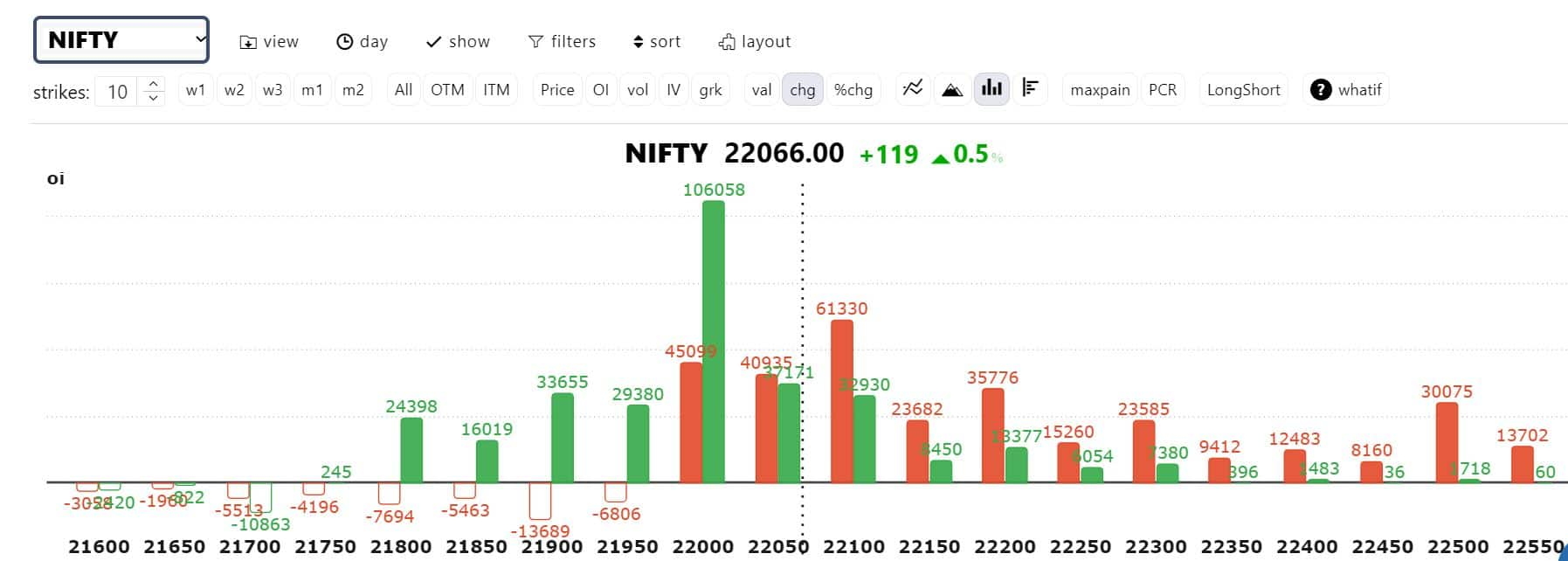

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

The options data suggests substantial call writing at 22,350 and 22,500 strikes, establishing crucial resistance levels. Key straddle positions are observed at 22,050, 22100 and 22,150, showcasing a contest between call and put writers.

Tejas Shah, Vice President of Technical Research at JM Financial, said, “The Nifty witnessed a breakout above 21,800 last Friday and the first target of 22,000 was achieved today morning post breakout by way of gap up opening. We believe Nifty’s rally is likely to persist and will eventually test the significant resistance level of 22,222. Nifty’s support is now identified at 21,800-850 and 21,700 levels. On the upside, the immediate psychological resistance for Nifty is at the 22,000 mark, followed by the next hurdle at 22,222 levels.”

Story continues below Advertisement

ICICI Direct said the Nifty may attempt to move towards 22,200 levels. A move below 21,750 could extend the consolidation in the Nifty.

Bank Nifty

The Bank Nifty underperformed the Nifty last week. The immediate resistance is in the 47,800-48,000 range. “If this range is successfully surpassed on a closing basis, it is anticipated to rekindle fresh bullish momentum, potentially propelling the index back toward the 48,600 – 49,000 levels within a short span. On the downside, the support zone is situated at 47,400-47500 and 47,000, while resistance is identified at 47,800-48,000 followed by 48,400 levels, ” added Shah.

Among individual stocks, a long buildup was seen in ONGC, Wipro, OFSS and PNB . While short build up is seen at LTTS, Mphasis, HDFCLife and ICICIGI.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.