F&O Manual | Nifty trades in a range, strong support placed at 22,000 levels

At 11:20 hrs IST, the Sensex was up 46.07 points or 0.06 percent at 73,374.01, and the Nifty was up 11.90 points or 0.05 percent at 22,109.40.

The benchmark indices traded range-bound in the first few hours of January 16 after a euphoric rally on the back of strong earnings from IT heavyweights.

According to experts, the Nifty’s options data indicates a potential continuation of the rally, testing higher levels at 22,300 and 22,500. Immediate trading support is seen at 22,000-21,900, with a positive view negating only below 21,700.

At 11:20am, the Sensex was up 46.07 points or 0.06 percent at 73,374.01, and the Nifty was up 11.90 points or 0.05 percent at 22,109.40.

About 1,642 shares advanced, 1,527 declined, and 64 traded unchanged.

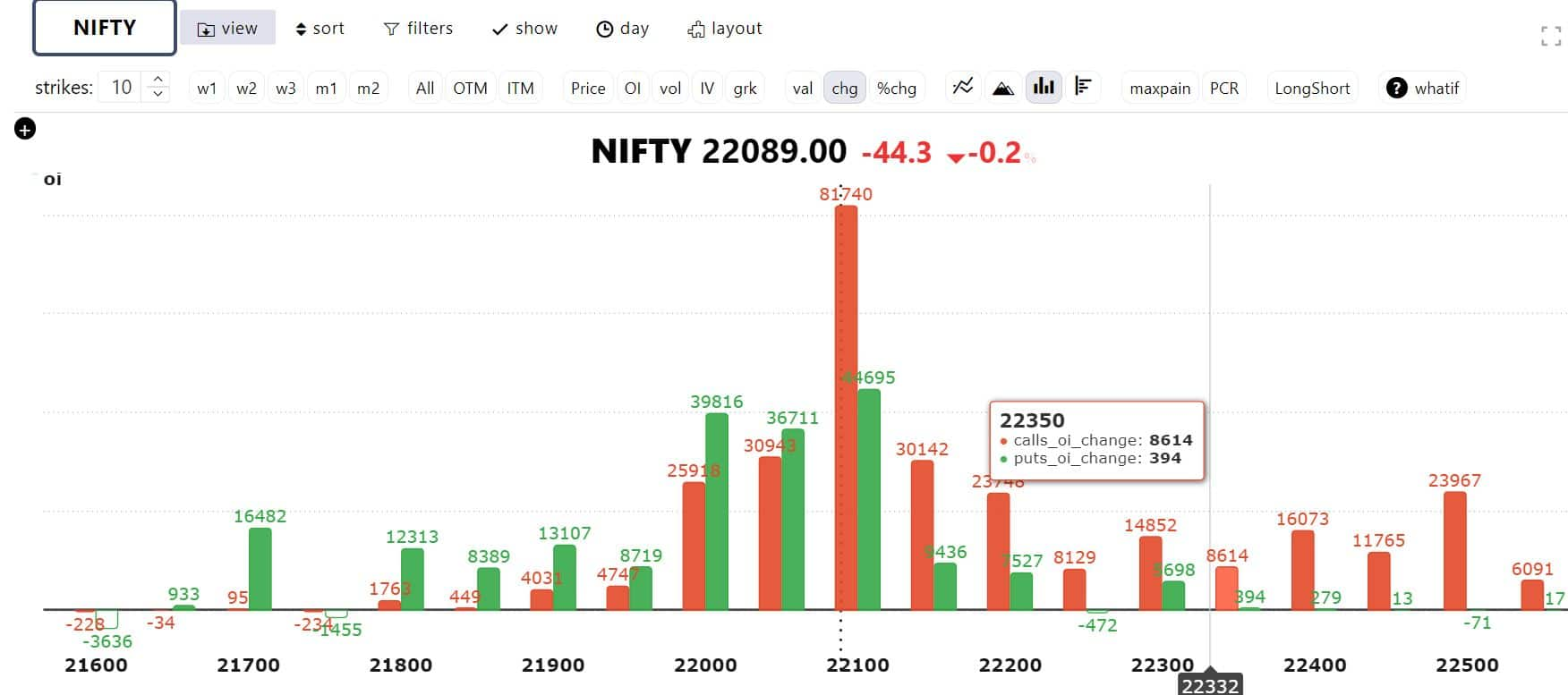

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Options data suggests a conflict between put and call writers at 22,000, 22,100, and 22,200 strikes. “The Nifty Futures witnessed a 4 percent addition in long positions, with OIPCR for January 18 weekly expiry rising to 1.51, indicating a resurgence of put writers. The increase in OIPCR is primarily attributed to widespread unwinding, mainly in In The Money calls from 21,800 to 22,000, and aggressive put writing positions added at 22,000 PE. The highest OI stands at 22500 CE with 1.34 lakh contracts, followed by 22,300 CE with 1.27 lakh contracts,” Avani Bhatt, senior vice-president of derivative research at JM Financial, said.

“On the puts side, the highest OI is now at 22,000 PE with 1.56 lakh contracts, followed by 21,700 and 21,800 puts, each holding an average OI of 1.36 lakh contracts. Options data points towards a continuation of the rally to test higher levels of 22,300 and 22,500. Immediate trading support stands at 22,000/21,900. A positive view negates only below 21,700, ” Bhatt said.

She advises a buy-on-dips strategy up to 21,900-21,950 should be used for a target of 22,300/22,500, keeping a strict stop-loss of 21,700 for all long positions.

“Nifty PCR_OI is currently stronger at 1.53 but is very close to the overbought zone with aggressive Put writing seen in 22,000 and 21,900 strikes, while 22,200 as well as 22,300/22,500 calls have seen aggressive writing. Overall, the range for the coming few sessions could be 21,930 on the downside and 22400 on the upside,” Sudeep Shah, head of derivative and technical research at SBI Securities, said.

Story continues below Advertisement

Finnifty Expiry Day View:

Finnifty is currently marginally positive at Rs 21,491.85, up 30.50 points or 0.14 percent.

“The Fin Nifty index is trading in a tight range between spot 21400 – 21500 levels. While the underlying bias remains optimistic, only a breakout over 21500 could confirm the upward tilt on its weekly expiry day. On the option side, writing is observed in 21500 CE, implying weakness around the same mark,” Avdhut Bagkar, derivatives and technical analyst at StoxBox, said.

“On the downside, 21400 follows a similar structure, with writers aggressively dominating the said area. OI concentration can be seen in both 21450 CE and PE, suggesting a tussle for the day. The following support for the index is located at spot 21320 – 21300 range, which the index may attempt if it breaks 21400,” added Bagkar.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.