Bank Nifty plunges 1,500 points down on HDFC Q3 results; traders watching 46,500 support

Bank Nifty 47,500 CE saw aggressive open interest additions of 1.7 lakh contracts today in 10 minutes, with a total OI of 2.14 lakh contracts.

The benchmark indices had a rough start to January 17, with the Nifty dropping 300 points from the previous session and the Bank Nifty index diving 1,500 points due to disappointing December quarter results from index heavyweight HDFC Bank.

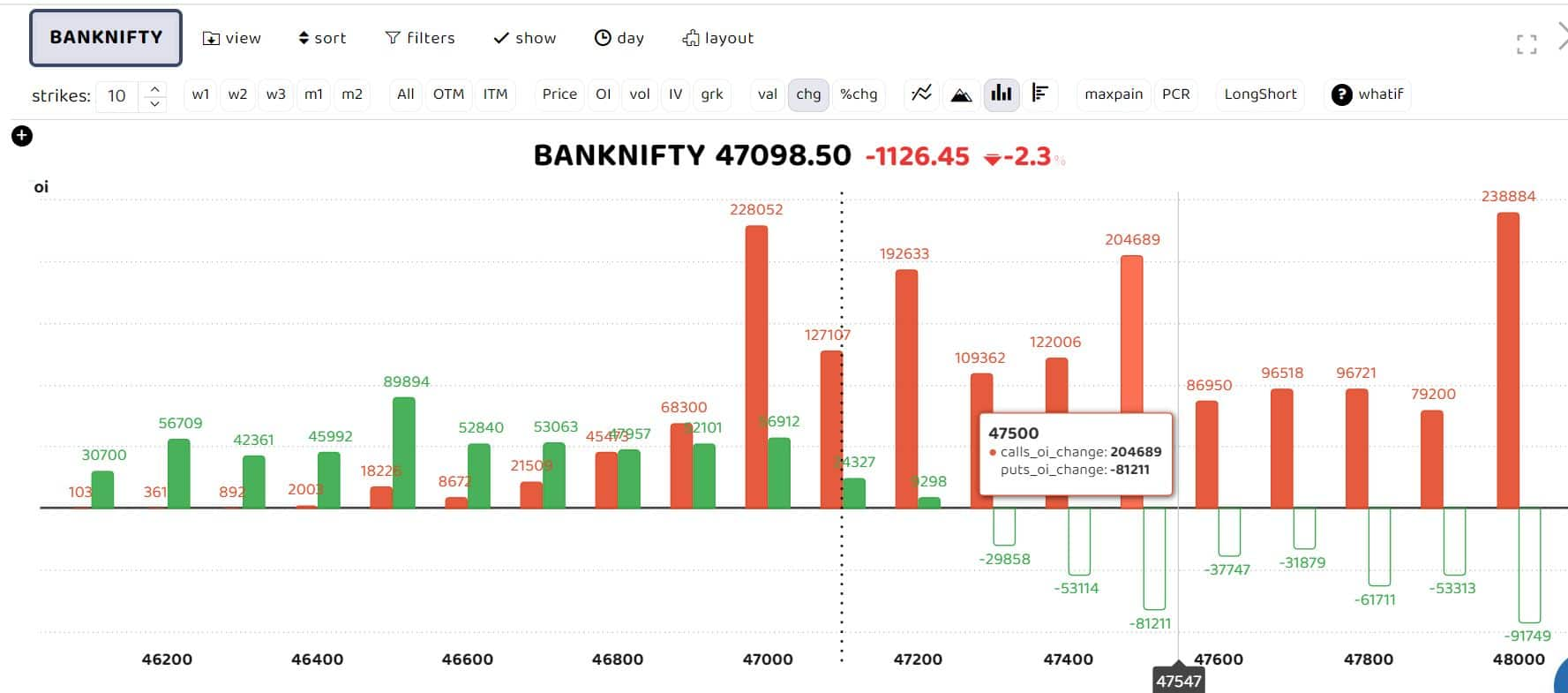

On derivatives front, call writers were dominant for the day. Bank Nifty 47,500 CE saw aggressive open interest (OI) additions to the tune of 1.7 lakh contracts within first 10 minutes, taking the total open interest to 2.14 lakh contracts. The options data also showed a substantial short position buildup at 47400, 47,800 and 48,000 levels.

Bars in red indicate the change in open interest (OI) of call writers, while the green show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while the green show the change in OI of put writers

Soni Patnaik, Assistant Vice President-Derivatives Research, JM Financial, said, “OI added in the morning within 5 minutes to the tune of 5.4 percent but it is a mixed bag of positions. Bank Nifty 47,500 CE saw aggressive open interest additions of 1.7 lakh contracts today in 10 minutes, with a total OI of 2.14 lakh contracts. On the PE side, the highest OI remains at 47,000 PE with 2.79 lakh contracts.”

The 12-pack Bank Nifty broke the crucial support of 46,800 following the gap-down opening before climbing back above 46,900. “It is crucial to observe if it closes above 47,500. Unable to cross above these levels, Bank Nifty can slide down towards 46,000. Today’s low of 46,500 is expected to act as support going forward,” Patnaik said.

The gap-down opening weakened the positive bias that had prevailed since the start of this year. As long as the support of 46,282 ,the 50-simple moving average (SMA), is held firm, the index may recoup the losing sentiment, said Avdhut Bagkar, Derivatives & Technical Analyst at StoxBox .

On the upside, the index must go past 48,000 for an uptrend. “A breakdown beneath the 50-SMA may result in the build-up of a bearish bias, potentially reaching levels of 45,000,” he said.

Trader’s view

Story continues below Advertisement

“Today, we will see a full recovery in Nifty and a 50 percent recovery in Bank Nifty and HDFC Bank. PSU banks and HDFC Bank are also expected to witness some recovery going forward,” derivatives trader Rajesh Sriwastava said.

Shijumon Antony, another derivatives trader, has a different view. After the heavy gap down, Bank Nifty is trying for a recovery, which is unlikely to continue. “We may not see a large selloff from this point too. Bank Nifty is trying to find an equilibrium around 47,000, range of 100 points,” he said. Immediate strong support is around 46,370, which is likely to hold for the day.

Antony expects rangebound day but the range can be wider than usual, “considering the magnitude of the gap down we had”.

“Even for HDFC Bank today’s move is exaggerated and we’ll have to wait for at least two–three days to see how it is reacting after today’s move. (For) Bank Nifty 46,800-47,200 is the most probable range for the day as it looks now,” he said.

The HDFC Bank share fell over 5 percent in the morning trade after its December quarter results while meeting expectations on headline numbers disappointed investors.

India’s largest private sector bank’s net profit rose 33 percent year-on-year (YoY) to Rs 16,372 crore, which was near expectations but it included a one-time tax rate gain. Its net interest income grew 24 percent to Rs 28,470 crore, falling below street estimates. On the other hand, provisions rose 50 percent to Rs 4,216 crore.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.