F&O Manual | Benchmark indices gain, Nifty may resume uptrend if closes above 21,550

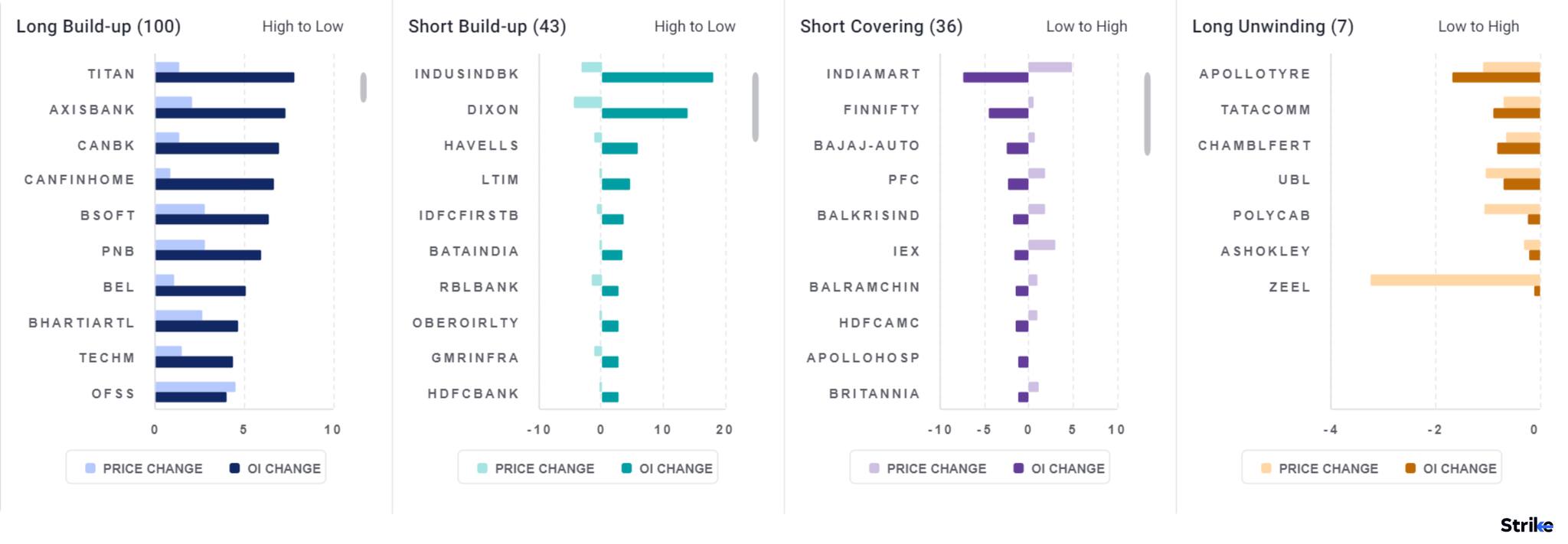

Among individual stocks Titan, Axisbank, Canarabank and Birlasoft are witnessing long build up. While Indusindbank, Dixon and Havells are seeing short build up.

The benchmark NSE Nifty 50 and the BSE Sensex advanced on January 19 after three straight sessions in the red. In the previous session, prices convincingly broke key supports for the first time since November 2023, and closed below them.

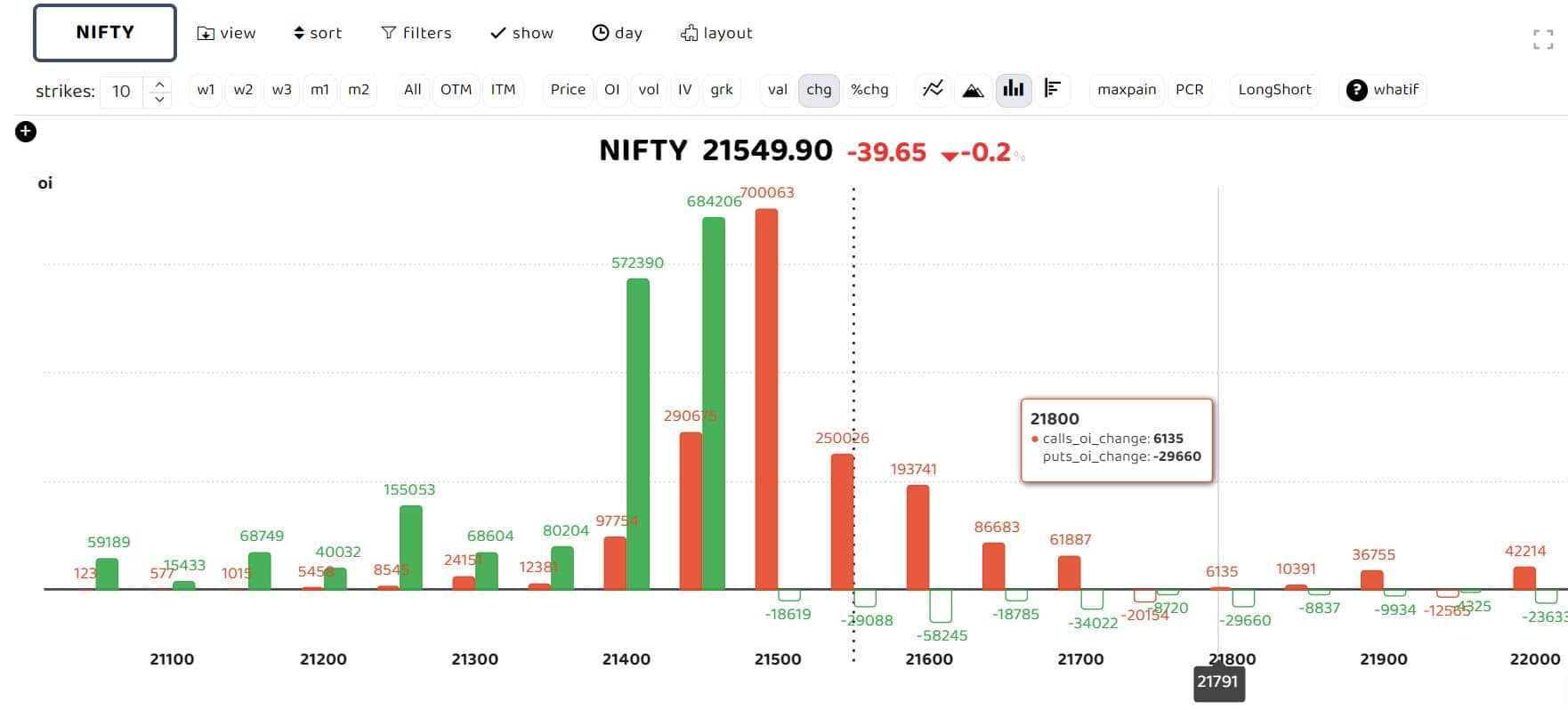

According to experts, traders and investors must refrain from rushing to ‘buy this dip’. The correction might not be over until the Nifty closes above the support zone of 21,500-21,550, which now serves as a resistance.

At 11:33am, the Sensex was up 434 points or 0.61 percent to 71,621, and the Nifty was up 132 points or 0.62 percent to 21,594. About 2,281 shares advanced, 861 declined, and 65 stayed unchanged

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

“For the first time since November 2023, prices have broken key supports convincingly and have also closed below them. Until we witness a price closure above the earlier mentioned support zone 21500-21550, now likely to be resistance, one should not believe that this was just a two-day correction,” brokerage house Angel One said.

“Prices have retraced 100 percent of the prior upward move from 21,500. It is advisable to avoid venturing into long positions and utilise rallies to sell for the time being. Much of the market activity is being driven by the ongoing results season, and it’s crucial to keep a watchful eye on this development,” said the brokerage.

Support and resistance zones

Story continues below Advertisement

“The crucial zone of 21,450-21,500 has been broken. It will be interesting to see which levels on the downside provide the cushioning effect. As of now, 21,300 – 21,000 seems to be in jeopardy unless some overnight miracle happens in the coming days. Going forward, the 21,550-21,700 zone is likely to act as a crucial hurdle,” Angel One said.

Bank Nifty

“Bank Nifty witnessed long unwinding to the tune of 8.5 percent, and its PCR OI is at 0.67, indicating an indecisive outlook. The highest OI on the PE side is at 44,000 PE with 0.99 lakh contracts, and on the CE side, it is at 47,000 CE with two lakh contracts. The 46,000 straddle has high open interest (OI) too, with CE having 1.15 lakh contracts and PE having 1.11 lakh contracts,” Soni Patnaik, derivatives research analyst at JM Financial, said.

“Weekly closing today is important. If it is above 46,500, then some respite can be seen in the next week. However, if it closes below 45500 today, it will open gates for more downside, and simultaneously, Bank Nifty can drag down markets. Maintain caution in Bank Nifty,” Patnaik said.

Among individual stocks, Titan, Axisbank, Canarabank and Birlasoft are witnessing long build up. While Indusindbank, Dixon and Havells are seeing short build-up.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.