Trade setup for Saturday: 15 things to know before opening bell

Nifty likely to consolidate within 21,500-21,800 range

The market has rebounded after three days of correction, but is overall expected to consolidate unless and until it gives decisive close above 21,800 area on the higher side and 21,300 on the lower side in the near term. In the coming session, 21,700 is expected to be an immediate resistance for the Nifty 50, with a key support at 21,550-21,500 levels given the volatility and unstable Bank Nifty due to HDFC Bank.

On January 19, the BSE Sensex jumped 496 points to 71,683, while the Nifty 50 climbed 160 points to 21,622 and formed Doji kind of candlestick pattern on the daily charts.

BSE and NSE will hold normal trading session on January 20 while January 22 has been declared as a trading holiday.

“The Nifty 50 is likely to consolidate within the bands of 21,500 and 21700. A decisive breakout on either side would confirm a directional move,” Rupak De, senior technical analyst at LKP Securities said.

The index negated the formation of higher lows of the last two sessions. “Now it has to hold above 21,550 area for an up move towards 21,750 and 21,850 zones, while on the downside support exists at 21,500 and 21,400 zones,” Chandan Taparia, senior vice president | analyst-derivatives at Motilal Oswal Financial Services said.

The broader markets reported strong performance with healthy breadth. The Nifty Midcap 100 and Smallcap 100 indices rallied 1.5 percent and 1.1 percent respectively, while more than two shares advanced against one declining share on the NSE.

We have collated 15 data points to help you spot profitable trades:

Story continues below Advertisement

Key support and resistance levels on the Nifty and Bank Nifty

The pivot point calculator indicates that the Nifty is likely to take immediate support at 21,586, followed by 21,564, and 21,527 levels, while on the higher side, it may see an immediate resistance at 21,631 followed by 21,682 and 21,718 levels.

Meanwhile, on January 19, the Bank Nifty also bounced back and climbed above 46,000 mark, but could not sustain due to selling pressure in HDFC Bank. The banking index fell 12 points to 45,701 and formed bearish candlestick pattern on the daily charts.

Overall, the Bank Nifty was comparatively weak on Friday. Overall, “we believe that the index can consolidate in the range 46,500 – 45,500 from short term perspective. A breach of 45,500 can lead to a further decline till 45,200 – 45,000,” Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas said.

As per the pivot point calculator, the Bank Nifty is expected to take support at 45,572, followed by 45,409 and 45,145 levels, while on the higher side, the index may see resistance at 45,765, followed by 46,264 and 46,528 levels.

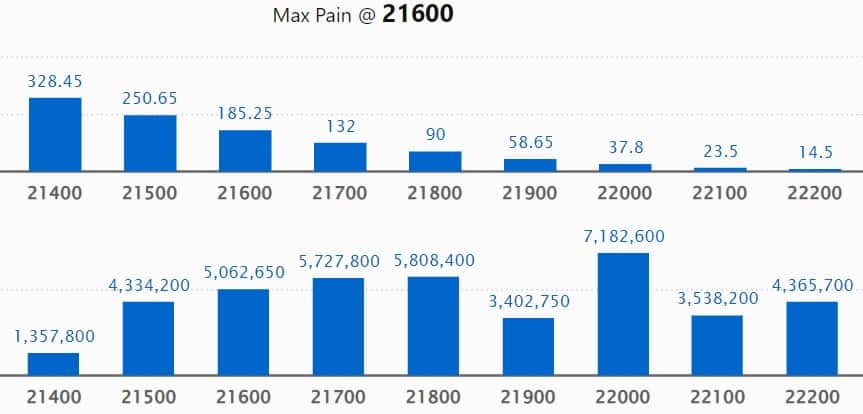

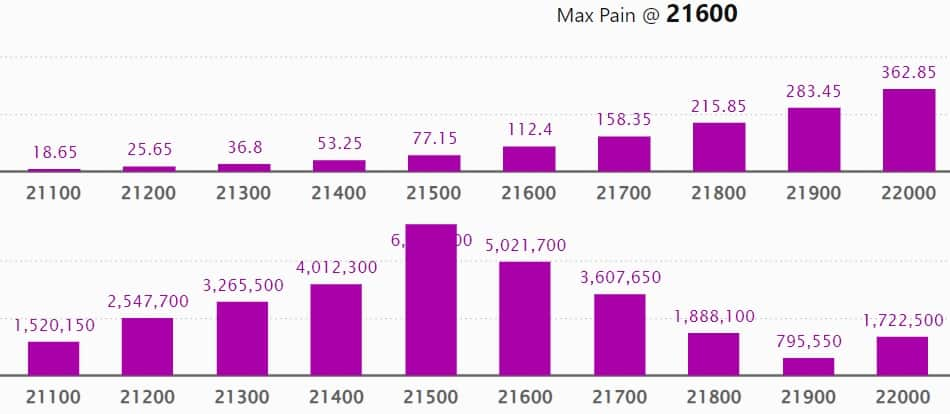

As per the weekly options data, the maximum Call open interest was seen at 22,500 strike, with 90.12 lakh contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 22,000 strike, which had 71.82 lakh contracts, while the 21,800 strike had 58.08 lakh contracts.

Meaningful Call writing was seen at the 22,500 strike, which added 24.81 lakh contracts followed by 21,600 and 21,700 strikes adding 12.65 lakh and 12.27 lakh contracts, respectively.

The maximum Call unwinding was at the 21,400 strike, that shed 7.07 lakh contracts followed by 21,300 and 21,500 strikes which shed 1.03 lakh and 70,050 contracts.

On the Put front, the 20,500 strike owned the maximum open interest, which can act as a key support area for Nifty with 75.35 lakh contracts. It was followed by 21,500 strike comprising 66.37 lakh contracts and then 21,000 strike with 59.25 lakh contracts.

Meaningful Put writing was at 21,600 strike, which added 33.51 lakh contracts followed by 21,500 strike and 20,500 strike adding 27.33 lakh contracts and 23.25 lakh contracts, respectively.

Put unwinding was seen at 21,100 strike, which shed 8.37 lakh contracts, followed by 21,200 strike which shed 4.13 lakh contracts, and 21,400 strike, which shed 1.26 lakh contracts.

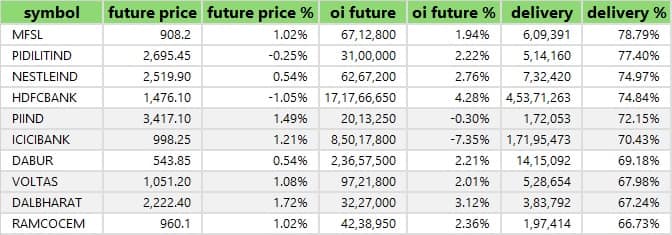

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Max Financial Services, Pidilite Industries, Nestle India, HDFC Bank, and PI Industries saw the highest delivery among the F&O stocks.

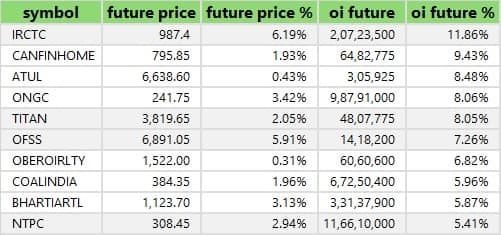

A long build-up was seen in 78 stocks, which included IRCTC, Can Fin Homes, Atul, ONGC, and Titan Company. An increase in open interest (OI) and price indicates a build-up of long positions.

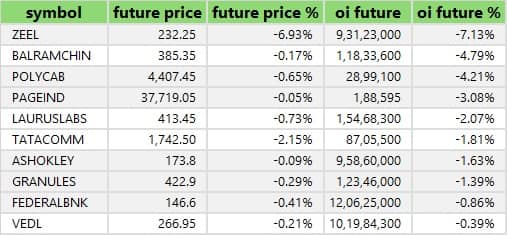

Based on the OI percentage, 14 stocks saw long unwinding, including Zee Entertainment Enterprises, Balrampur Chini Mills, Polycab India, Page Industries, and Laurus Labs. A decline in OI and price indicates long unwinding.

28 stocks see a short build-up

A short build-up was seen in 28 stocks including IndusInd Bank, RBL Bank, Gujarat Gas, AU Small Finance Bank, and Bata India. An increase in OI along with a fall in price points to a build-up of short positions.

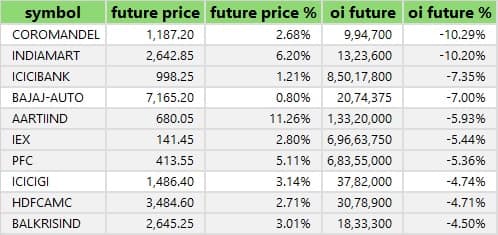

Based on the OI percentage, 66 stocks were on the short-covering list. This included Coromandel International, IndiaMART InterMESH, ICICI Bank, Bajaj Auto, and Aarti Industries. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, rose to 0.96 on January 19, from 0.94 levels in the previous session. The below 1 PCR indicates that the traders are buying more Calls options than Puts, which generally indicates an increase in bullish sentiment.

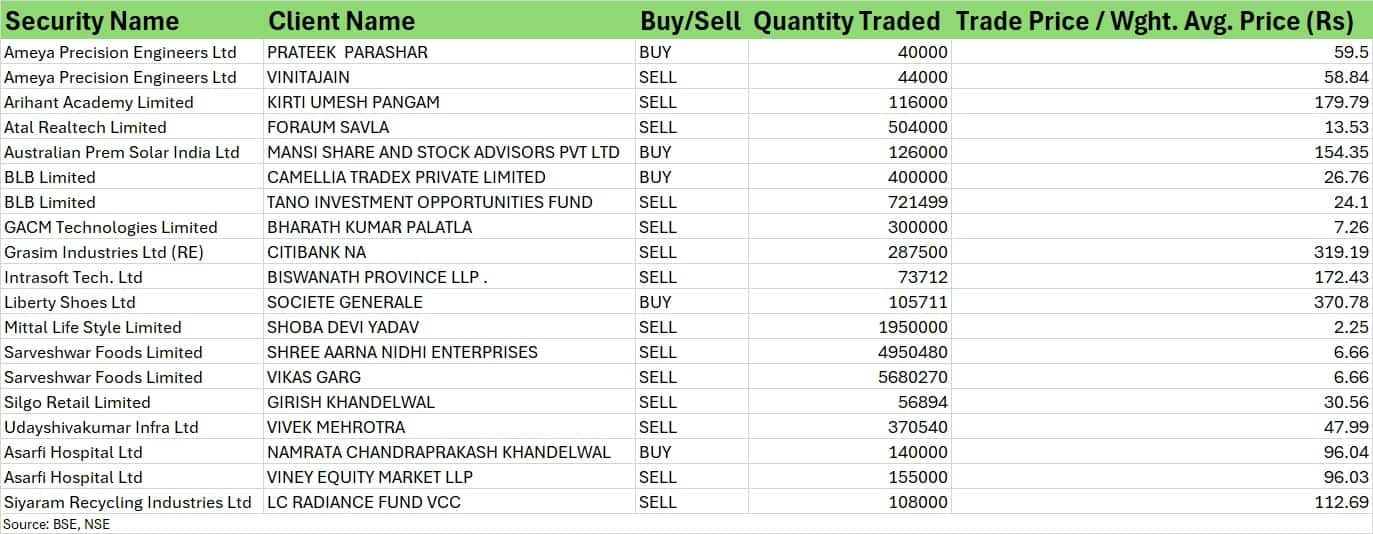

For more bulk deals, click here

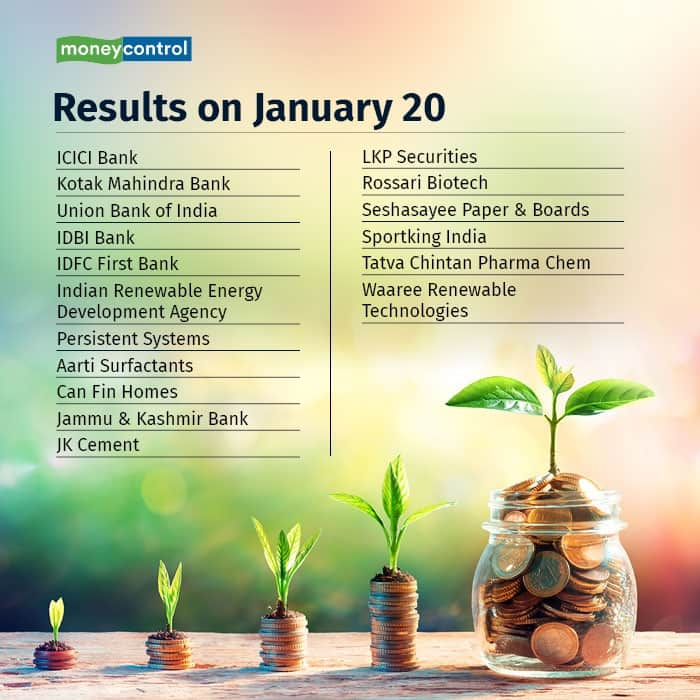

ICICI Bank, Kotak Mahindra Bank, Union Bank of India, IDBI Bank, IDFC First Bank, Indian Renewable Energy Development Agency, Persistent Systems, Aarti Surfactants, Can Fin Homes, Jammu & Kashmir Bank, JK Cement, LKP Securities, Rossari Biotech, Seshasayee Paper & Boards, Sportking India, Tatva Chintan Pharma Chem, and Waaree Renewable Technologies will be in focus ahead of quarterly earnings on January 20.

Stocks in the news

Reliance Industries: The billionaire Mukesh Dhirubhai Ambani-headed company reported healthy numbers for the quarter ended December FY24 with consolidated net profit growing by 10.9 percent on-year to Rs 19,641 crore and EBITDA increasing sharply by 16.7 percent on-year to Rs 44,678 crore, boosted by retail, digital (Jio) and oil & gas businesses. Consolidated revenue at Rs 2,48,160 crore for the quarter grew by 3.2 percent YoY.

Hindustan Unilever: The FMCG major has recorded a 0.6 percent on-year increase in standalone net profit at Rs 2,519 crore for October-December quarter of FY24, due to weak topline and muted margin growth (of 10 bps YoY). Revenue from operations fell by 0.3 percent to Rs 15,188 crore compared to year-ago period due to decline in growth of home care and beauty & personal care segments.

RBL Bank: The private sector lender has recorded standalone profit at Rs 233 crore for the quarter ended December FY24, rising 12 percent YoY but missed analysts estimates. Net interest income increased by 21 percent YoY to Rs 1,546 crore for the quarter.

One 97 Communications: The Paytm operator posted net loss at Rs 219.8 crore for October-December FY24 quarter, narrowing from loss of Rs 392 crore in same period last year. Revenue from operations surged 38.2 percent year-on-year to Rs 2,850.5 crore for the quarter.

HFCL: The company has received a purchase order worth Rs 623 crore for supply of indigenously manufactured telecom networking equipment for 5G network of one of the domestic telecom service providers.

Funds Flow (Rs crore)

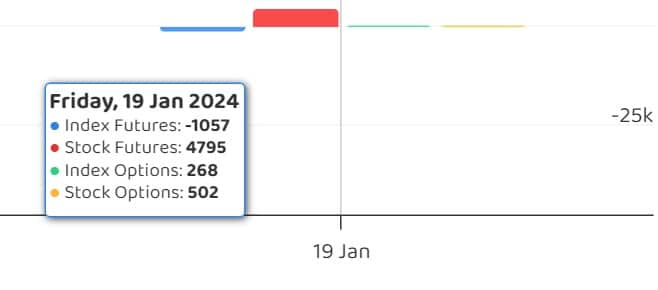

Foreign institutional investors (FIIs) sold shares worth Rs 3,689.68 crore, while domestic institutional investors (DIIs) bought Rs 2,638.46 crore worth of stocks on January 19, provisional data from the NSE showed.

Stock under F&O ban on NSE

A total of 11 stocks are in the F&O ban list for January 20. The NSE has added Oracle Financial Services Software, and RBL Bank to the said list while retaining Aditya Birla Fashion & Retail, Balrampur Chini Mills, Delta Corp, Hindustan Copper, Indian Energy Exchange, National Aluminium Company, Polycab India, SAIL and Zee Entertainment Enterprises to the said list. Ashok Leyland, Bandhan Bank, Metropolis Healthcare, and PVR INOX were removed from the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.