Dalal Street Week Ahead | Q3 earnings, ECB interest rate decision, US GDP to keep traders busy in holiday-shortened week

Dalal Street Week Ahead: Consolidation is likely to continue in the coming week

Indian equity markets saw a sharp fall in the week gone by with Nifty and Sensex falling close to 1.5 percent each. The frontline indices were dragged by HDFC Bank, when the heaviest-weight constituent failed to impress the Street with Q3 numbers.

In the week ended January 20, the Nifty 50 and Sensex fell 1.5 percent to end at 21,572 and 71,424 respectively. In broader markets, midcaps shone with the Nifty Midcap 100 gained 1.16 percent. Nifty Smallcap 100 fell 0.17 percent.

Among sectoral indices, Nifty Bank fell close to 3.5 percent as the Street was not happy with HDFC Bank’s net interest margins (NIM) numbers.

“CASA deposits are going down, term deposits are going up, all that is affecting margins. I think margin improvement is most likely to happen from Q2 FY25 onwards,” said Suresh Ganapathy of Macquarie Capital in a conversation with Moneycontrol.

In the coming holiday-shortened week, the interest rate decisions of the BoJ and ECB, along with US GDP data, more quarterly numbers announcements, and pre-Budget sentiment are anticipated to drive the market dynamics.

Also Read: Sebi probing mule accounts, faulty IPO applications, 3 cases under scanner, says Buch

Let’s take a look at the factors

Story continues below Advertisement

There would be over 200 companies announcing their Q3 FY24 results. The major ones among them are Axis Bank (Jan 23), Tata Steel (Jan 24), Cipla (Jan 25) and Bajaj Auto (Jan 24). Other companies in the list are Karntaka Bank, Blue Dart, Oberoi Realty, Railtel, VST Industries, Tata Chemical, Indian Bank, UCO Bank, SBI Cards, and others.

BoJ and ECB rate decisions

The Bank of Japan is likely to maintain its ultra-loose monetary settings when it announces its rate decision on January 23. Markets now expect a rate hike in March or April at the earliest, reported Reuters.

Further, the European Central Bank is also expected to hold rates steady on January 25. A Bloomberg consensus pointed to four 25 basis points (bps) cuts starting June.

US GDP

On January 25, the US Bureau of Economic Analysis is expected to report GDP growth of around 2 percent (seasonally adjusted annual rate) for Q4 (This would be the advance estimates). That’s a sharp slowdown from Q3’s strong 4.9 percent increase.

The GDP growth numbers will give a picture of whether recession risk in the US is around the corner and what will the Federal Reserve do next.

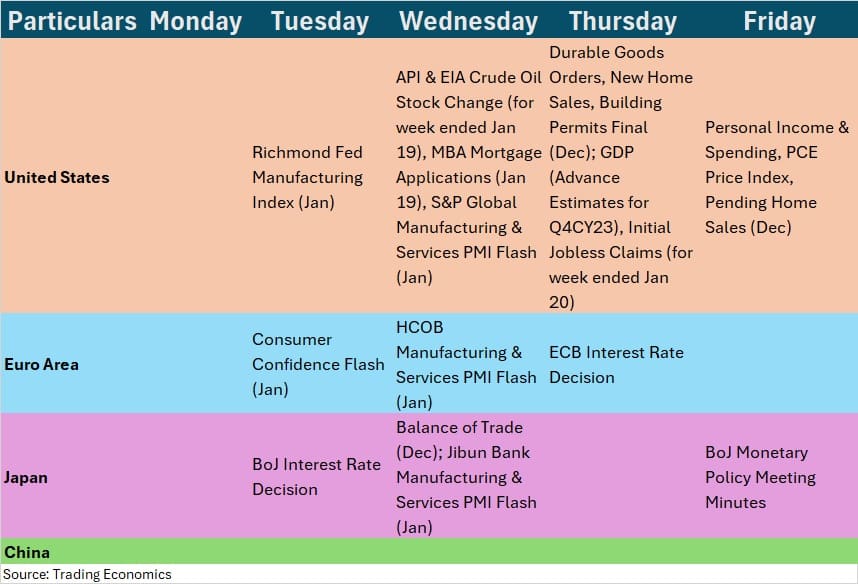

Global economic data points

Here are key global data points to watch out for:

Pre-Budget mood

Like last year, this year too the Street expects big bang public capex announcement. The excitement is visible in railway and power stocks that rallied to new highs amid heavy trading volumes in the week gone by.

However, foreign broking firm Jefferies foresees a potential slowdown in government capex growth, possibly below 10 percent, due to fiscal consolidation. This could disappoint the market, leading to corrections in stocks exposed to government capex programs.

Also Read: Union Budget 2024 | Jefferies says capex growth to slow down, will disappoint market

Foreign institutional investors (FIIs) turned massive sellers in the cash market having sold equity worth Rs 24,147 crore in three days from 17th through 19th January. There are two others reasons why FPIs turned sellers, believes Dr. V K Vijayakumar, Chief Investment Strategist, Geojit Financial Services.

“One, the US bond yield started rising with the 10-year yield rising from the recent level of 3.9 percent to 4.15 percent triggering capital outflows from emerging markets like India, Taiwan, South Korea and Hong Kong. Two, since the valuations in India are high, FPIs used the excuse of less-than-expected results from HDFC Bank to press massive sales. FPIs increased their short positions, too,” he said.

Going ahead, it has to be monitored if this trend intensifies.

Epack Durable will close its Rs 640 crore IPO on January 23 and Medi Assist will list on the same day. While Nova AgriTech’s IPO will open for bidding on January 23 and close on January 25. It is planning to raise Rs 143 crore.

In the SME segment, Brisk Technovision will open on January 23 followed by DelaPlex and Fhonebox Retail issues on January 24. Harshdeep Hortico and Megatherm Induction IPOs are set to open on January 25.

Also Read: 68% HNIs, 43% retail investors flip IPO trades in first week, says Sebi chair Madhabi Buch

Technical view

For the Nifty, analysts believe the support lies at the 21,300-21,400 zone, break of the support can bring more selling pressure. “The 21,750-21,850 zone is expected to be a key hurdle on the higher side. While maximum option writing stands at 21,500 and 21,800,” Arvinder Singh Nanda, Senior Vice President, of Master Capital Services said.

“Shifting focus to Bank Nifty, a crucial support level lies at 45,000 with the possibility of the price remaining sideways in the range of 45,000 to 47,000. While hurdles are placed at 46,500 to 47,000. A breach may trigger selling pressure, potentially leading to a downside,” he added.

F&O cues

On the weekly options front, the 22,500 strike owned the maximum Call open interest, followed by 22,000 strike, and 21,700 strike, with meaningful Call writing at 21,700 strike, then 22,400 strike, and 21,900 strike, while on the Put side, the maximum open interest was seen at 20,500 strike, followed by 21,000 strike and 21,500 strike, with writing at 21,000 strike, then 21,100 strike.

The above options data indicated that 21,700 is likely to be immediate resistance for the Nifty 50 and holding of which can drive the index towards 21,900-22,000 area, while the immediate support may be 21,500 and the crucial support at 21,000 mark.

“The option activity at 21,500 strike will provide cues about Nifty’s direction in the coming days. If Put writers exit from the 21,500 strike, the fall can extend further until 21,000 levels,” Ashwin Ramani, derivatives & technical analyst, Samco Securities said.

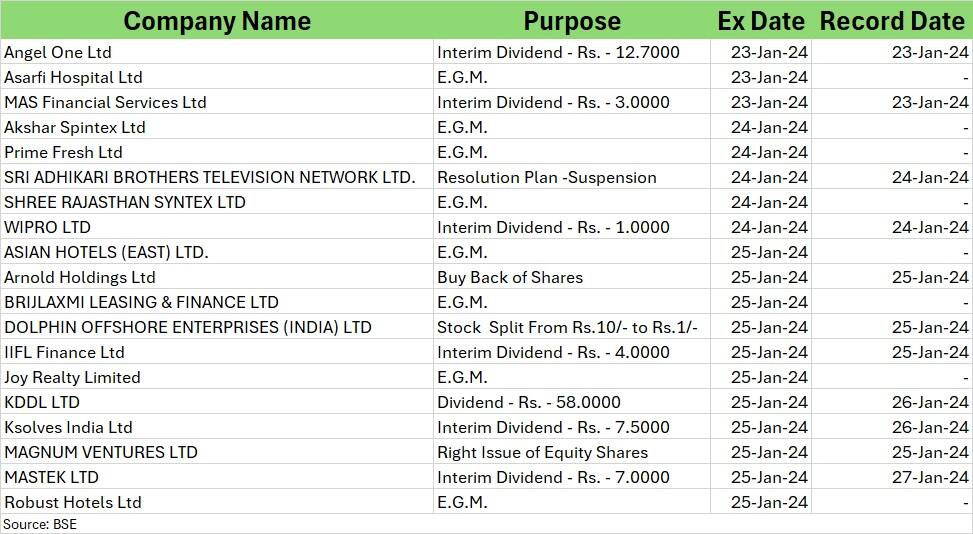

Corporate Action

Here are key corporate actions taking place in the coming week:

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.