Budget 2024: Anticipating growth in India’s infrastructure landscape

The industry anticipates heightened government emphasis on safety and timely infrastructure upgrades in the country.

The government is set to announce the interim budget on February 1, primarily as a vote-on-account ahead of the upcoming general elections in April-May 2024. Industry stakeholders are keenly awaiting the FY2025 target for government’s capital spending, a pivotal factor for economic growth.

At the recently concluded Vibrant Gujarat Global Summit, Prime Minister Narendra Modi highlighted his vision for the growing infrastructure sector, expressing the government’s goal to attract significant investments. These remarks suggest the possibility of policies and incentives in the Interim Budget 2024 to foster substantial growth in the infrastructure space, said analysts.

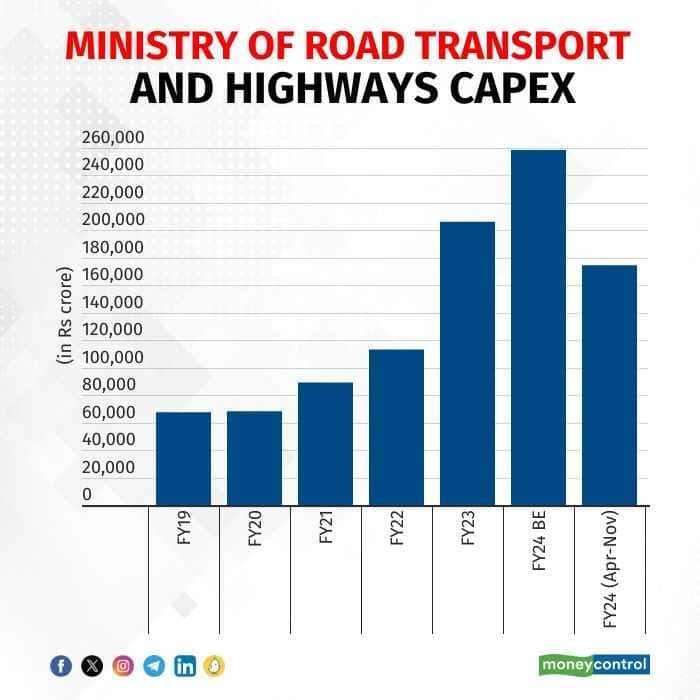

Last month, Moneycontrol reported that the Ministry of Road Transport and Highways has requested a budgetary allocation of Rs 3.25 lakh crore for FY 2024-25, marking a 25 percent YoY increase. This move aims to minimise market borrowings for the National Highways Authority of India in the upcoming financial year.

In the FY24 budget, the finance minister allocated around Rs 10 lakh crore for infrastructure capital expenditure, a 33 percent increase from the previous year. The industry anticipates heightened government emphasis on safety and timely infrastructure upgrades in the country.

Despite government pledges for infrastructure development, execution has lagged. In the first eight months of FY24, the Ministry of Road Transport and Highways awarded projects to construct 2,816 km of roads, down from 5,382 km in the same period in 2022-23.

What to expect from the Budget 2024:

The Interim Budget 2024 is expected to prioritise rural and urban connectivity, railways, ports, aviation, and highways for their significant impact on growth and employment. With a potential increase in capital allocation, these sectors are anticipated to serve as India’s growth engine in the upcoming years, enhancing the overall quality of life, according to broking firm Teji Mandi.

Story continues below Advertisement

NHAI’s focus on reducing external debt is expected to persist through asset monetization, BOT mode project awards, and increased budgetary spending. CARE Ratings expects a 20 percent YoY rise in budgetary allocations for the roads and highways sector in Union Budget 2024-25. Tax relief on capital gains and interest income from InvIT can enhance investor interest in InvITs, unlocking asset monetization potential for the roads sector.

ICRA predicts a 16-21 percent YoY increase in road execution activity to 12,000-12,500 km in FY24, falling short of the government’s target of 14,000 km. In FY23, the Centre constructed 10,993 km of national highways, missing the 12,500 km target. The national highway network expansion was initially announced at 25,000 km in FY23, later clarified as a cumulative target for FY23 and FY24. To meet this target, India needs to add 8,500 km in just over three months.

Stocks in Focus:

The budget is expected to positively impact stocks like KNR Constructions, PNC Infratech, RITES, KEC International, and PSP Projects, driven by the government’s increased focus on overall infrastructure development, especially in highways, railways, and urban infrastructure.

In the cement sector, Ambuja Cement, Shree Cement, Dalmia Bharat Ltd, JK Cement, and JK Lakshmi are likely to be in focus. Last year witnessed significant margin expansion in the cement sector due to high demand and fuel cost deflation.

In its recent note, Morgan Stanley anticipates sustained demand, increased utilisation, and further margin expansion as fuel costs normalise. Expecting continued margin improvement in the coming years, Morgan Stanley foresees a positive industry re-rating and stock outperformance over the next 12 months. The cement industry is seen in a multi-year demand upcycle, with an anticipated 7 percent CAGR in industry demand from 2024 to 2026, driven by infrastructure, housing, and industrial/commercial segments.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions