F&O Manual | Indices slump as corrective momentum stays, Nifty sees support at 21,200

The BSE Large-cap Index shed 1.3 percent for the week after hitting new record high of 8495.26 on January 16. Losers included HDFC Bank, LTIMindtree, FSN E-Commerce Ventures (Nykaa), IndusInd Bank and ICICI Prudential Life Insurance Company, while gainers were One 97 Communications (Paytm), Life Insurance Corporation of India, Indian Oil Corporation, Oil and Natural Gas Corporation and Punjab National Bank.

The benchmark Indian indices traded in the red on January 23 as the correction momentum continued despite a gap-up opening after the Ayodhya event. Bank Nifty has tumbled over 800 points, down 2 percent, and BSE Midcap and Smallcap indices were down 1 percent each. Except for IT and pharma, all sectoral indices traded down.

As of 1:06pm, the Sensex was down by 619.31 points or 0.87 percent at 70,804.34, and the Nifty was down 198.10 points or 0.92 percent at 21,373.70. About 931 shares advanced, 2,404 shares declined, and 90 shares remained unchanged.

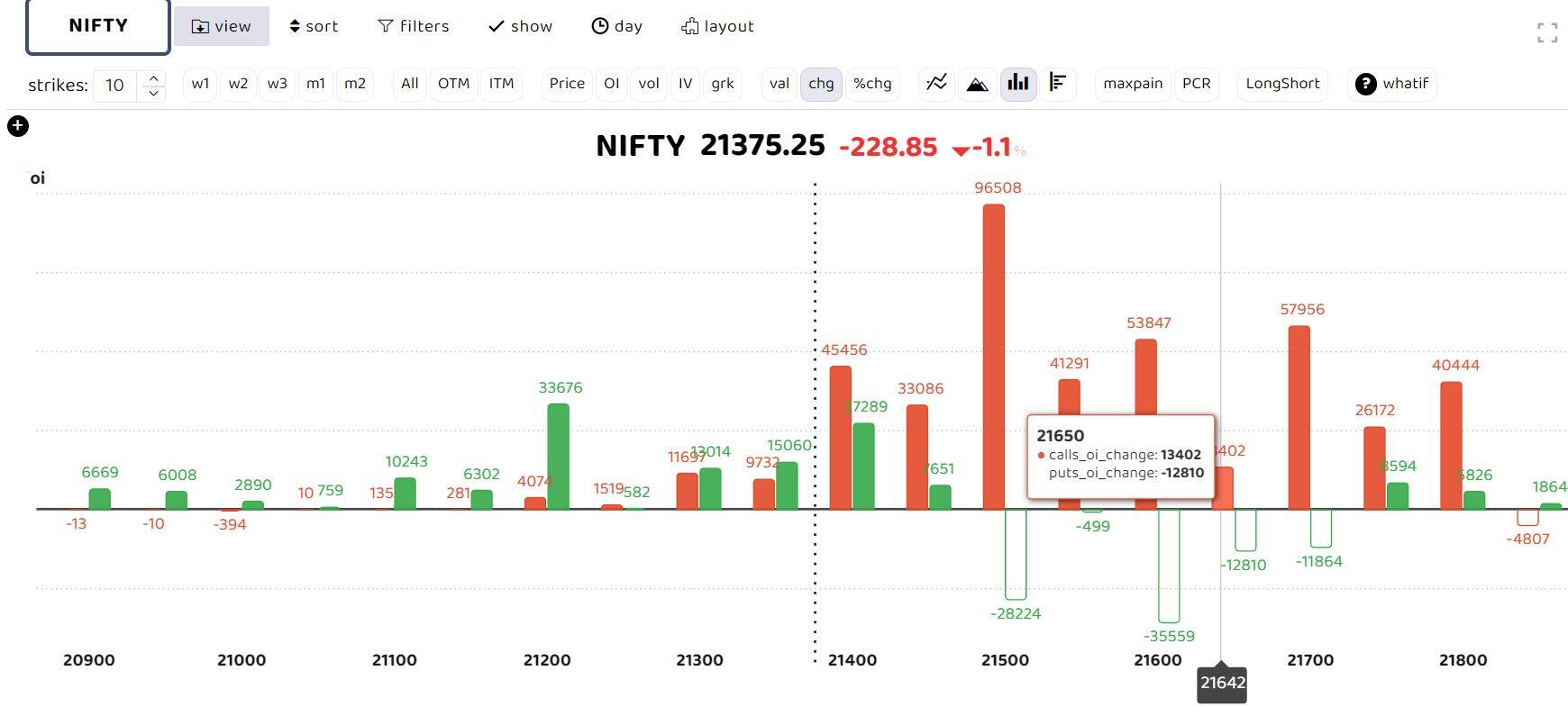

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Options data suggests that call writers dominate the day, with heavy call writing at 21,500, 21,600, and 21,700 levels forming strong resistance. Support is seen at 21,200 strike having heavy put writing. “The Nifty has given away almost 900 points from highs and closed the week losing 1.5 percent. Going ahead, we expect that sustainability above series VWAP of 21750 may trigger a fresh up move, and till then, the Nifty is likely to witness some pressure in the shortened settlement week,” ICICI Securities said.

Bank Nifty

“Bank Nifty may continue to ‘underperform’ the Nifty and was the major reason behind the sudden weakness in the headline index. Bank Nifty witnessed its worst session last week in nearly two years. The pressure was seen primarily among private sector banks, which led to the recent declines. Going ahead, we believe that 47,000-47,200 levels are likely to remain a crucial hurdle in the monthly settlement week,” ICICI Securities said.

Story continues below Advertisement

Among individual stocks, long build-up is seen in Lupin, Godrej Properties and Cipla. While short build-up is seen in Torrent Pharma, Cholafin and Dabur.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.