Six reasons to bet on India’s conventional and new energy firms, according to SBI MF

India is the fifth most cost-effective player in both solar and wind energy generation.

The energy sector in India provides investors with a multi-decade investment opportunity, riding on the ‘Aatmanirbhar Bharat’ story, said Raj Gandhi, Fund Manager, SBI Mutual Fund, on the sidelines of the launch of a new energy sector thematic fund.

“Today, in India, we are in a sweet spot where traditional energy companies will make money, and there is money to be made even on the new energy side as well,” said Gandhi. SBI Mutual Fund has launched the NFO (February 6–20) of the Energy Opportunities Fund, which will be a mix of around 20–25 stocks across the power ancillaries, green energy, oil value chain, gas value chain, and power value chain.

Also read: Substantial portion of infra capex to be used for energy sector: PM Modi at India Energy Week

Here are six reasons why this is the right time to invest in energy, according to Gandhi:

India is a growing energy market

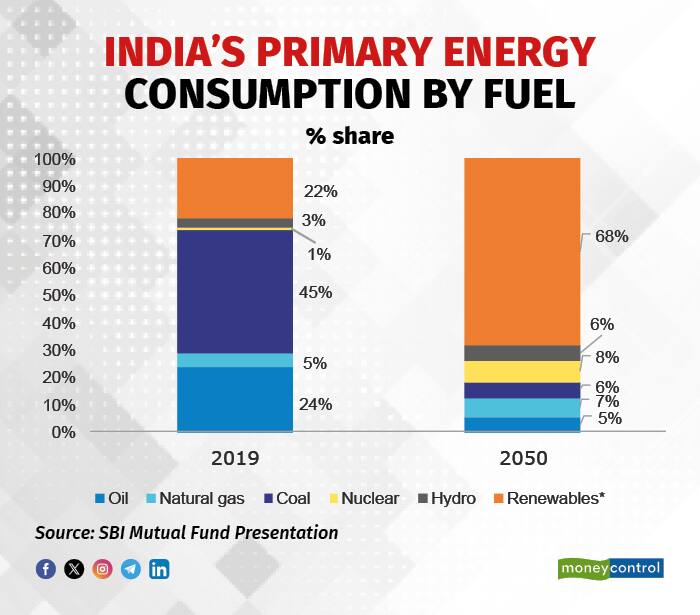

According to Gandhi, India is among the very few markets that have a three-decade period of growth ahead at a CAGR of 2.5 percent; and this is at a time when most global economies like Europe, the US, and Japan are looking to reduce absolute energy consumption through 2050. India is currently the third-largest energy market. Excluding coal and oil, energy consumption is expected to grow by 6.4 percent as the share of renewables increases to 68 percent from the current 22 percent. Gandhi said this will move India from energy dependency to energy self-sufficiency. “Today we are 85 percent dependent on oil, 100 percent dependent on coking coal, etc. As and when we move to more energy self-sufficiency, the profit pool capture will happen here, right here in our capital markets, and the policy, which was a bit of a risk factor from a headwind, will become more of a tailwind for the sector going ahead.”

At the ongoing India Energy Week, on February 7, Prime Minister Narendra Modi, said that as the economy grows, India is set to witness a $67 billion investment in the energy sector over the next 5 to 6 years.

Story continues below Advertisement

Energy consumption and GDP growth

The 2019 Economic Survey had highlighted that energy is the mainstay of the development process of any economy, adding that ensuring access to sustainable and clean energy sources was a priority as “India’s economic future and prosperity is dependent on her ability to provide affordable, reliable and sustainable energy to all her citizen.”

Today, India’s energy consumption is one-third of the global average. In a lot of sectors, India’s per capita consumption is lower than the global benchmarks. But the catch-up can be very fast in the energy sector, said Gandhi. While a large part of the country has been electrified, a lot is still left, added Gandhi. “The system was a bit fractured with T&D losses being very high.”

But that is now changing due to various measures introduced. The per-capita energy consumption in peers such as Thailand, Indonesia and Vietnam is many times more than that in India. For example, China’s consumption is 4 times that of India, and Korea’s is 9.5 times. As India grows to become the third largest economy, energy consumption could also see a significant rise, said Gandhi.

Also read: How Budget 2024 embraces the Indian revolution in renewable energy

Favourable government green energy policies

India has the advantage of also “walking the talk” when it comes to green energy through various policy changes. In the recent Budget, Finance Minister Nirmala Sitharaman reiterated the government’s focus on green energy and its goal to become net zero by 2070 and introduced reforms for solar and wind energy.

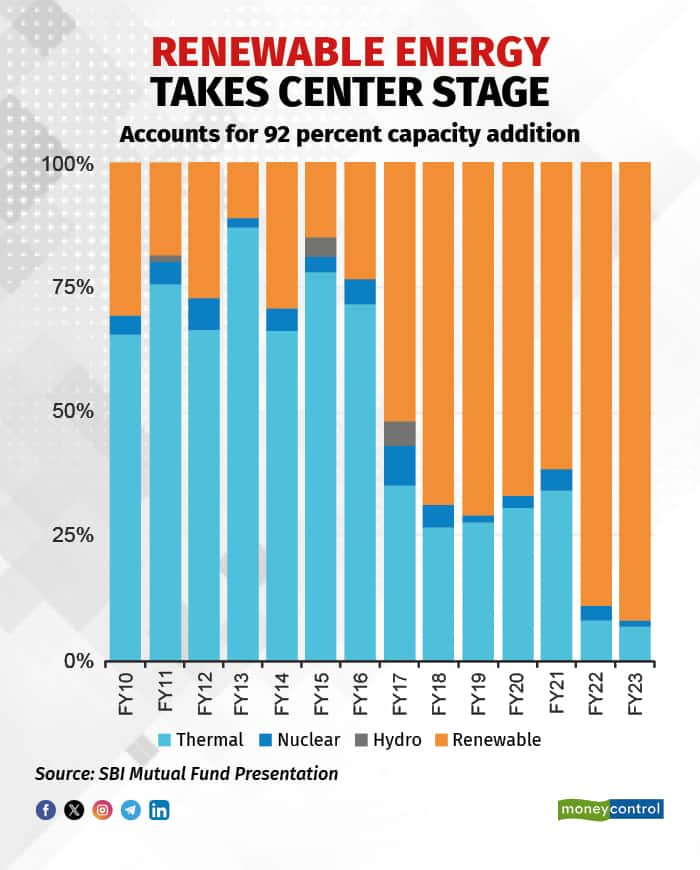

According to SBI Mutual Fund data, as of FY2023, renewable energy accounts for 92 percent of capital addition, with the majority of growth seen in solar energy. Among the government initiatives in this sector are production linked incentives (PLI) to develop solar and hydrogen value chains locally, an ethanol blending programme, and mandatory biogas blending from FY2026.

In a 2020 note, the International Energy Agency had said that renewable electricity is growing at a faster rate in India than any other major economy, with new capacity additions on track to double by 2026.

Reasonable valuations

.

.

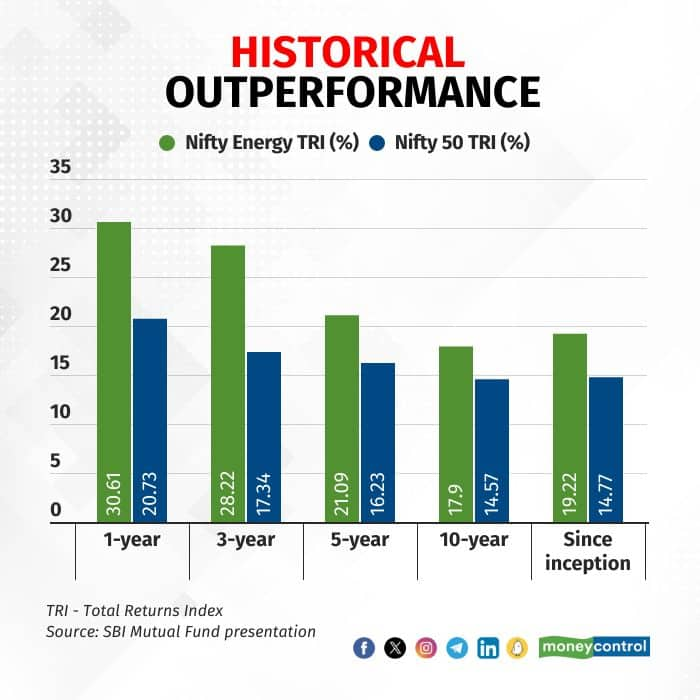

Despite the outperformance of the segment in comparison to the Nifty 50 index, valuations for the segment are reasonable and trading at a discount. Gandhi said that the Nifty Energy Index (TRI) has outperformed the Nifty 50 (TRI) index on both a short- and long-term basis. On a trailing basis, as of December 9, the Nifty Energy Index PE was at 15.8x – at a 25 percent discount to Nifty.

Natural gas value chain at a turning point

Gas value chain outlook is quite positive too, said Gandhi. Although over the past decade, gas consumption fell by around 0.6 percent. But FY23, he adds marked a turning point due to the policy environment being conducive to infrastructure development across the value chain. While gas imports have increased, domestic gas consumption is also starting to grow.

A January 2024 report on Natural Gas outlook by McKinsey states that Global gas demand is projected to grow past 2030 in all scenarios, with a total projected growth of between 10 and 15 percent.

India on the path to global leadership in new energy

India is the fifth most cost-effective player in both solar and wind energy generation. Currently, the majority of the solar value chain resides in China, controlling a dominant global market share of around 80–85 percent. Despite importing from China, the Indian solar market is competitive, said Gandhi. Plant Load Factors in regions like Kutch and Rajasthan surpass those in China. India has the trifecta of hydro, solar, and wind energy, which provides a unique advantage by ensuring uninterrupted power availability round the clock, he added.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.