Nifty closes the week above 22,000; smallcaps give double digit return despite index ending flat

Foreign institutional investors (FIIs) extended the selling in this week ad they sold equities worth of Rs 6,237.55 crore

Bulls marched Dalal Street pushing benchmark indices higher by 1 percent each. Despite starting on a weaker note, the Nifty closed above 22,000 comfortably.

Nifty, this week, added 258.2 points or 1.18 percent to end at 22,040.70, while BSE Sensex rose 831.15 or 1.16 percent to close at 72,426.64.

On the sectoral front, BSE Auto index rose 5 percent, BSE Oil & Gas index gained 3 percent, BSE Energy index rose 3 percent. On the other hand, BSE Telecom, FMCG and Metal indices down 0.5 percent each.

Foreign institutional investors (FIIs) sold equities worth Rs 6,237.55 crore, while Domestic institutional investors (DIIs) equities worth Rs 8,731.60 crore during the week.

Foreign institutional investors (FIIs) sold equities worth Rs 5,871.45 crore in the week ended February 9.

The FII net sell, from February 1 till now stands at Rs 13,917.89 crore, while DIIs bought equities worth Rs 17,393.01 crore.

“Heavy buying in the banking sector helped broader indices inch towards new heights, countering the subdued beginning of the week characterised by concerns over elevated valuations and higher exchange margin requirements. The Indices continued their resilient rally, unlike other Asian peers, buoyed by weaker-than-expected inflation data from the US. Investor expectations of a rate cut from the Fed were bolstered as US retail sales data declined. Moreover, a disinflation trend in the eurozone and expectations of increased consumption demand in China after the New Year holidays provided further support,” said Vinod Nair, Head of Research, Geojit Financial Services.

“The Indian auto sector had a strong week, lifted by anticipated high demand and a favourable earnings outlook. PSU Banks, benefiting from improved asset quality and the government’s focus on fiscal prudence, are attracting investors. Large caps gained traction, with mid and small caps seeing profit booking, driven by valuation gaps.”

Story continues below Advertisement

“Looking ahead, a correction in PSU banks seems likely due to higher valuation risks. Meanwhile, sectors such as metals, FMCG, and capital goods are anticipated to gain momentum driven by robust construction demand, an order backlog, rural revival prospects, and India’s narrowing trade deficit. This is boosted by softer commodity prices and government-led manufacturing initiatives,” he added.

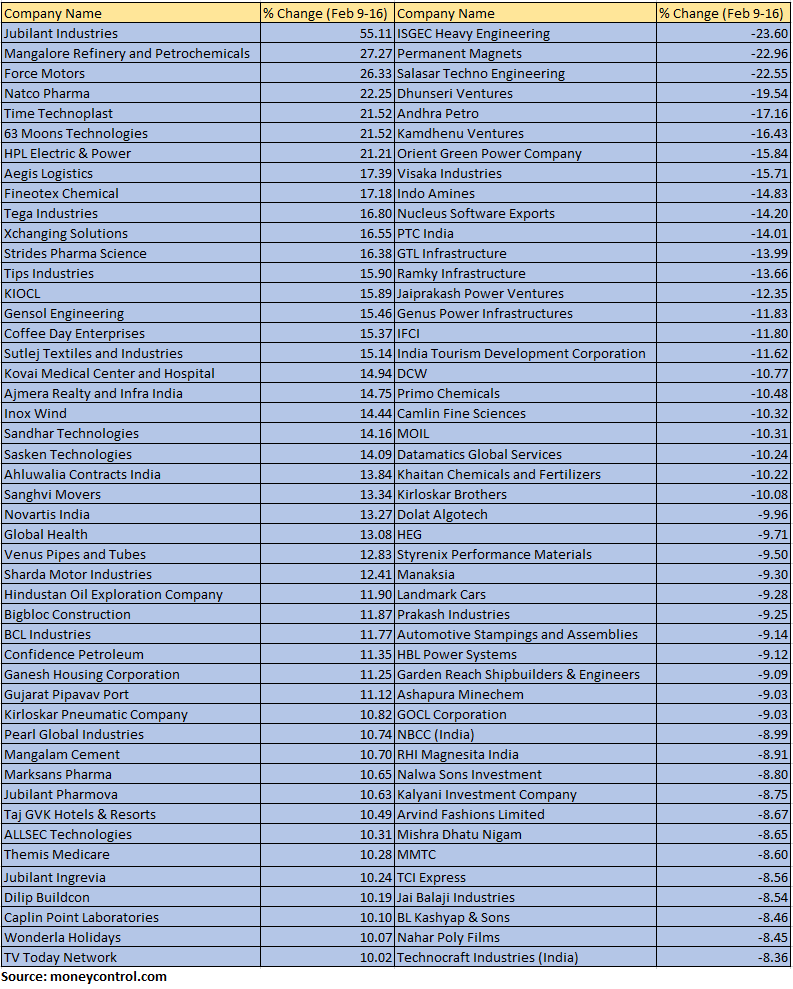

The BSE Small-cap index ended on a flat note. Jubilant Industries, Mangalore Refinery and Petrochemicals, Force Motors, Natco Pharma, Time Technoplast, 63 Moons Technologies and HPL Electric & Power rose 21-55 percent, while ISGEC Heavy Engineering, Permanent Magnets, Salasar Techno Engineering, Dhunseri Ventures, Andhra Petro, Kamdhenu Ventures, Orient Green Power Company and Visaka Industries lost between 15-23 percent.

Where is Nifty50 headed?

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas

The Nifty is now approaching the upper boundary placed in the zone of 22100 – 22150 where it has faced resistance on two occasions which increases its importance. The steep rise in the last three trading sessions is losing momentum and is evident on the hourly momentum indicator which is on the verge of a negative crossover. Overall, we are expecting the range-bound action to continue. The inability to decisively cross the recent swing high of 22150 can lead to a fall in the Nifty and hence caution is advised.

Rupak De, Senior Technical Analyst, LKP Securities

A surge in buying interest for large-cap stocks propelled the Nifty back above the recent consolidation level, leading to highest ever closing on the weekly timeframe. The Nifty has consistently closed above the 21EMA for the last few days, indicating a positive trend.

The momentum indicator RSI has experienced a bullish crossover following a base formation. In the short term, the index might move towards 22,200; a move above 22,200 could potentially take the Nifty towards 22,600. Support on the lower end is placed at 22,750.

Ajit Mishra, SVP – Technical Research, Religare Broking

We suggest maintaining a positive yet cautious stance as Nifty is set to retest its record high. We need sustainability above 22,150 to end the consolidation and march towards the 22,500+ zone else profit taking may resume. Traders should closely watch the banking index for cues while others may continue to play a supportive role on a rotational basis. Besides, the performance of the global indices, especially the US, will remain on their radar.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.