F&O Manual| Market trades positive, Nifty faces next hurdle at 22,150

At 09:56 hrs IST, the Sensex was down 81.50 points or 0.11 percent at 72,345.14, and the Nifty was down 9.40 points or 0.04 percent at 22,031.30.

The Indian benchmark indices were trading in the green on February 19 morning after the Nifty ended the previous week above the psychological mark of 22,000.

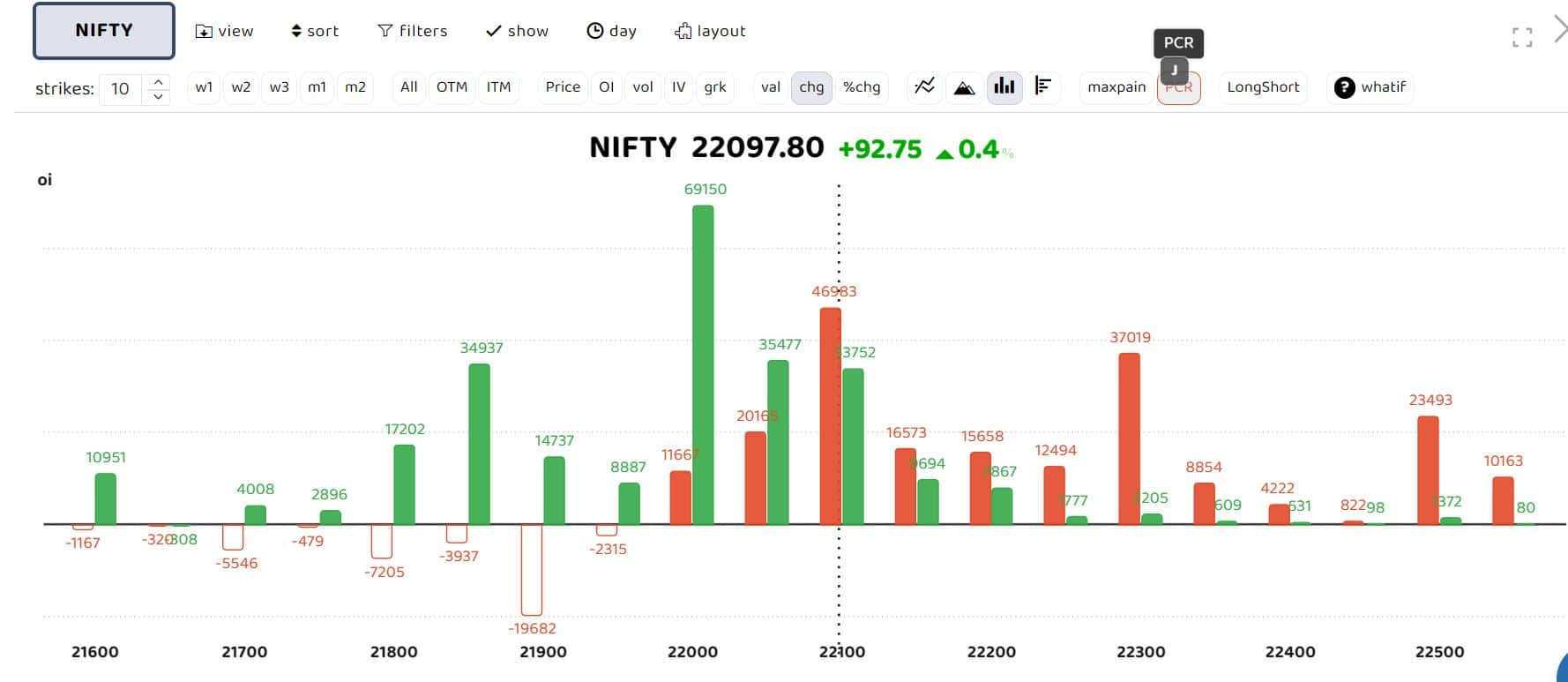

According to analysts, key support for the index is at 21,900-21,950 for the day, with the index expected to face resistance in the 22,130-22,160 zone.

If the index falls below 21,900, the Nifty can slide to the 21,830-21,790 range.

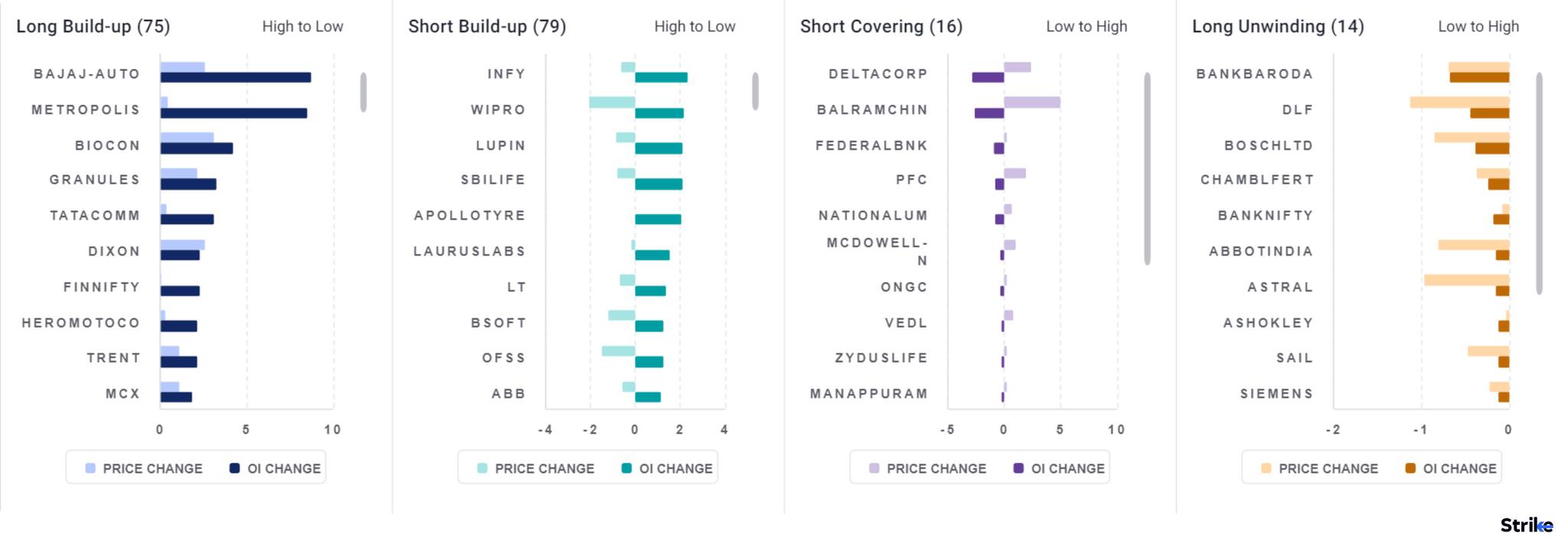

Bajaj Auto, Adani Ports, Dr Reddy’s Labs, Adani Enterprises and Coal India were among the major gainers on the Nifty. Information technology names dominated the list of losers which included Wipro, TCS, L&T, HDFC Life and LTIMindtree.

The options data suggests strong support for the Nifty at 22,000.

The Nifty continued to outperform on January 16 and closed above the psychological resistance of 22,000, which is a positive sign, Tejas Shah, Vice President Technical Research at JM financial, said.

The moving averages are just below the price action and should continue to support the indices on every decline. “22,000 is an immediate support to watch, while the bigger area of support stands at 21,800-850. On the higher side, the crucial resistance zone is at 21,125-150 levels (all time high levels),” Shah said.

Story continues below Advertisement

Bank Nifty

According to Avani Bhatt, Senior Vice president derivative research at JM Financial, a weekly close above 46,200 ensured the continuation of the upward trajectory, targeting 47,000 with a minor obstacle around the 46,500-46,600 area.

The presence of a bullish engulfing pattern on the weekly charts further strengthens the bullish perspective, she said.

On the downside, key supports are at 46,000 and 45,800. “Intraday, the support levels are at 46,200 and 46,000, while resistance is expected around 46,630-46,750, ” she said.

Derivative strategy recommended by JM Financial

Actionable: Continue with the bullish seagull strategy for the week ending on February 21. (Strategy Marked-to-Market as of Friday’s close: 35 points profit)

Execute the following options positions:

Buy 46,300 CE @ 470-480

Sell 46,500 CE @ 370-380

Sell 45,000 PE @ 100-110

Target: 100-150 points Stop Loss (SL): Below the 44,900 spot level.

Among individual stocks, a long buildup can be seen in Trent, Dixon and Bajaj Auto. While a short-covering rally is being seen in Federal Bank, PFC and Nalco, Zydus Life and ONGC.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.