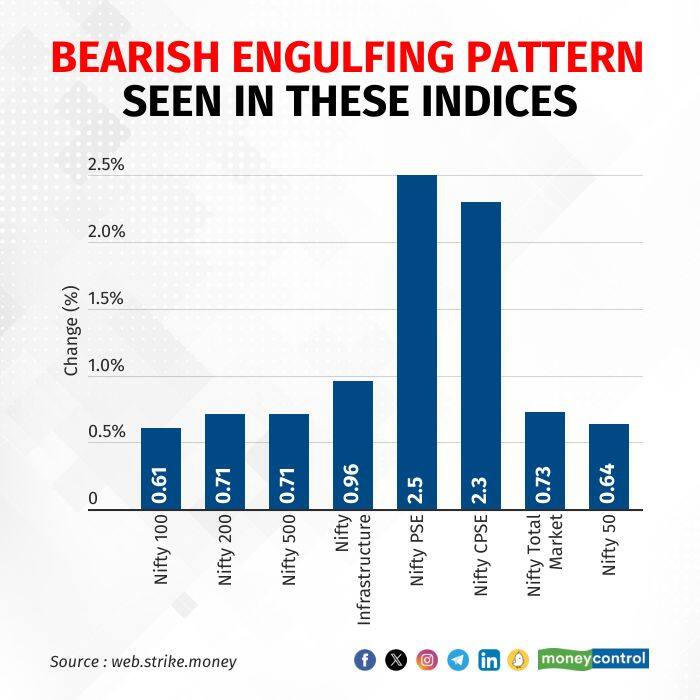

Bearish engulfing pattern seen in these 8 Nifty indices. Time to be cautious?

Nifty indices

The market ended the February 21 session lower as all sectoral indices, except realty, traded with losses.

At least eight Nifty indices formed a bearish engulfing candlestick, which indicates that sellers dominated the buyers and also alerts traders and investors to negative price action.

Losses in (%)

Losses in (%)

According to Prashant Sawant, Founder Catalyst Wealth, the broader market bullish structure is still in place and there is a possibility of market making fresh highs from here. However, the bulls are loosing strength and one should be cautious in such markets.

“For the Nifty to show any strength, it has to close above the crucial level of 22250. Nifty then can rally another 300 points to touch 22500-22600 levels,” he said.

RIL and metal stocks are looking good, while weakness is coming from IT pack. If IT stocks deliver, the Nifty can easily cross the barrier and make new highs, Sawant said.

On the down side, the major support for Nifty is at around 21,800 levels. As long as the index doesn’t slip below 21,800, we can expect the positive trend to continue, he said.

Market Movers

Story continues below Advertisement

Tata Steel, SBI and JSW Steel were the top Sensex gainers on a weak day for the markets.

HDFC Bank contributed to almost 25 percent of the fall. NTPC, Power Grid and Wipro were among the top index losers.

ZEEL slipped 14.56 percent with change in volume of 2.15 times. Shyam Metalic slipped by 2.93 percent, while SPARC was down 2.1 percent. Hindustan Copper, Deepak Nitrate and Astral traded down by more than a percent each with rising volumes.

Whirlpool shares traded to close to 52 week low after the stock slipped by 2.17 percent. TCI Express, Gmmpfaudler, Sumitomo Chemicals, Atul , Bata India and Page Industries were seen trading with losses and close to 52 week lows.

A bearish Engulfing pattern was seen in Swan energy, Sonacoms, BHEL and Rajesh Exports.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.