Sensex inches closer to record high; these smallcaps rise upto 32%

The BSE Oil & Gas index is down 2 percent and the BSE Information Technology index is down 1 percent.

Bulls continued to dominate the Indian market led by positive domestic and global factors with Nifty hitting a fresh record high. Meanwhile, broader indices mixed with the Midcap index ended the week with a minor change, while Large and Smallcap indices gained 1 percent each.

This week, BSE Sensex rose 716.16 or 1 percent to close at 73,142.8 and inched closer to its record high level of 73,427.5. On the other hand, the Nifty50 index touched a fresh record high of 22,297.50 before closing the week at 22,212.70, up 172 points or 0.78 percent.

On the sectoral front, the BSE Realty index added 4 percent, the BSE Telecom index rose 3.8 percent, BSE FMCG and Power indices gained 1.5 percent each. The BSE Oil & Gas index is down 2 percent and the BSE Information Technology index is down 1 percent.

Foreign institutional investors (FIIs) continued to remain sellers this week also as they sold equities worth Rs 1,939.40 crore, on the other hand, Domestic institutional investors (DIIs) bought equities worth Rs 3532.82 crore during the week.

However, from February till now, the FIIs sold equities worth Rs 15,857.29 crore, while DIIs bought equities worth Rs 20,925.83 crore.

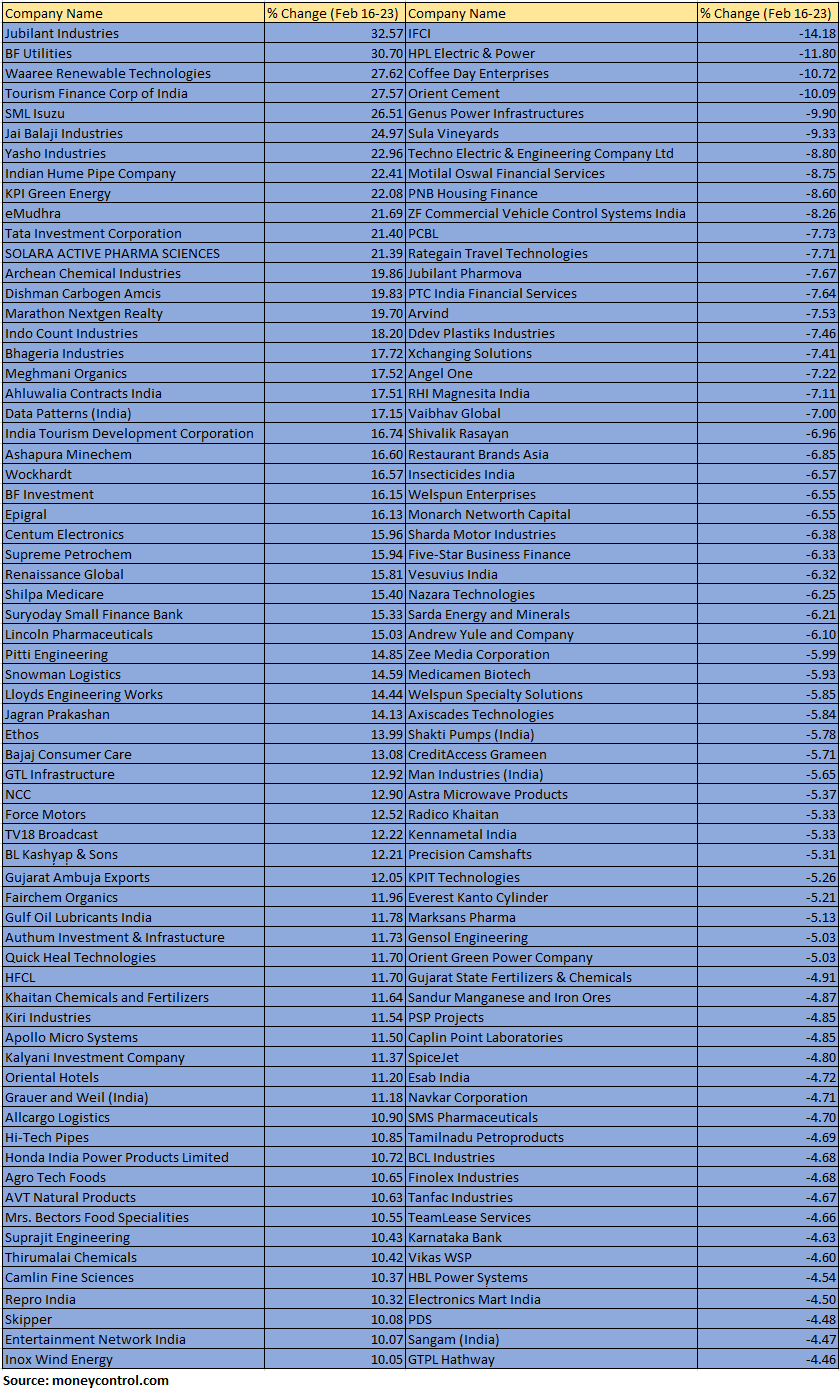

The BSE Small-cap index added 0.8 percent with Jubilant Industries, BF Utilities, Waaree Renewable Technologies, Tourism Finance Corp of India, SML Isuzu, Jai Balaji Industries, Yasho Industries, Indian Hume Pipe Company, KPI Green Energy, eMudhra, Tata Investment Corporation and Solara Active Pharma Sciences adding 21-32 percent.

On the other hand, losers included IFCI, HPL Electric & Power, Coffee Day Enterprises, Orient Cement, Genus Power Infrastructures, Sula Vineyards, Techno Electric & Engineering Company, Motilal Oswal Financial Services, PNB Housing Finance and ZF Commercial Vehicle Control Systems India.

Story continues below Advertisement

Where is Nifty50 headed?

Siddhartha Khemka, Head – Retail Research, Motilal Oswal Financial Services

The market might take a pause ahead of various global economic data releases. US would be reporting its Q4 GDP numbers along with Initial jobless claim, PCE data and Consumer Confidence for February. However, the overall trend remains positive and thus we recommend investors continue with buy on dips strategy.

Osho Krishan, Sr. Analyst – Technical & Derivative Research, Angel One

For now, the 22000 mark is likely to provide a firm cushion for any intra-week blip, followed by the 20 DEMA around 21900 – 21850, while any further blip could disrupt the intermediate trend for the index. On the higher end, finding resilience is challenging in uncharted territory, though 22350-22500 could be seen as the following potent targets for Nifty in the upcoming week, provided banking participates.

If Nifty has to sustain at higher levels, a contribution from the heavyweight banking space is a must. Since it is struggling around the bearish gap, it is better to wait for further clarification to project higher levels in Nifty.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before making any investment decisions.