Stocks to Watch | 3 counters which are showing positive derivative set-up for March series

Zydus Life, IOC, and Axis Bank have a robust derivative setup and are set to move up in March.

The Nifty, which hit a new high on March 4 again and ended the session in the green, is trading in positive territory. According to JM Financial, the benchmark index will on March 5 likely face resistance is at 22,450 and if manages to go past it, the index can test 22,600. Intraday support is at 22,350.

For March, JM Financial analysts have identified three stocks which have a robust derivative setup and are poised for a further upside amid the Nifty’s record-breaking spree.

Nifty Outlook

The Nifty witnessed only a 1 percent open interests (OI) unwinding with a flat price closing and its PCR_OI stands at 1.30, indicating a neutral to positive outlook.

The 22,400 straddle witnessed the maximum OI additions on March 4 , with 0.52 lakh contracts added for CE and 0.50 lakh contracts for PE. On the CE side, some OI additions were observed in 22,450/22,500 CE, each adding around 0.21 lakh contracts. On the PE side, 22,200 PE saw the second-highest OI, totaling around 0.35 lakh contracts.

Soni Patnaik, Assistant Vice President-Derivatives Research at JM Financial, said , “Intraday resistance is at 22,450, above which it can test 22,600. Intraday support is at 22,350, followed by important support at 22,200. If the 22,350 spot level breaks, buy on those declines around 22,300/22,250 with a stop loss at 22,180 and a target at 22,450/500 (spot levels).

Among stocks, Akshay Bhagwat, Vice President-Derivative Research at JM Financial, said Zydus Life, IOC, and Axis Bank are showing robust derivative data for a strong upside in the March series.

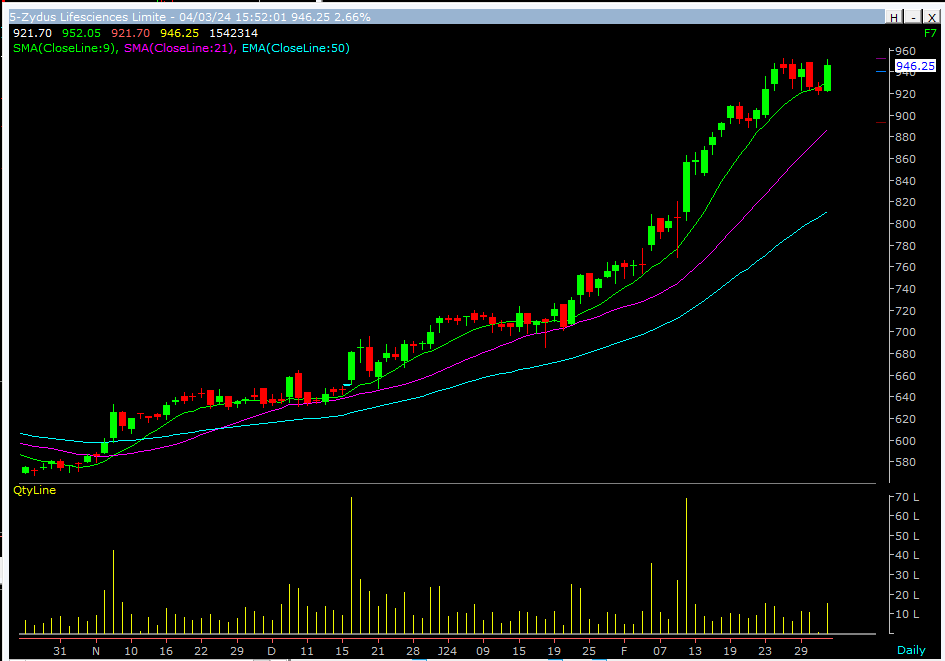

BUY: Zydus Lifesciences| Cmp Rs 946 | Targets of Rs 984/998 |Stop loss Rs 918

Story continues below Advertisement

The stock trades in a firm uptrend evident from the chart structure. Momentum regained at the 9-day moving average defining the swing low support area of Rs 920.

As per Bhagwat, “Broader options chain setup has high OI reading at 880 in puts and 1000 in calls. Yesterday’s day trading noted a price momentum surge along with volumes . Though, Rs 955 is a short term barrier, the broader setup hints for the breakout soon to be on cards for the stock to resume its uptrend.”

BUY: Axis Bank| Cmp Rs 1106 | Targets of Rs 1140/1162 |Stop loss Rs 1082

The weekly chart is still in a firm uptrend. Last few weeks have, however, seen some turbulence in the 1,040-1,140 area. Bhagwat predicts that a time correction seems to be unfloding before the stock reattempts the swing highs of 1,150 and then a breakout. Derivatives data has seen positive rolls for the March series. Highest OI is at the 1100 strike where ATM trades. “Unwinding in calls has already been noted with shift in ce writing bets building up at higher strikes of 1150 and 1200 which hints at a positive view reaffirming the technical setup targets of 1150 in short term, ” Bhagwat said.

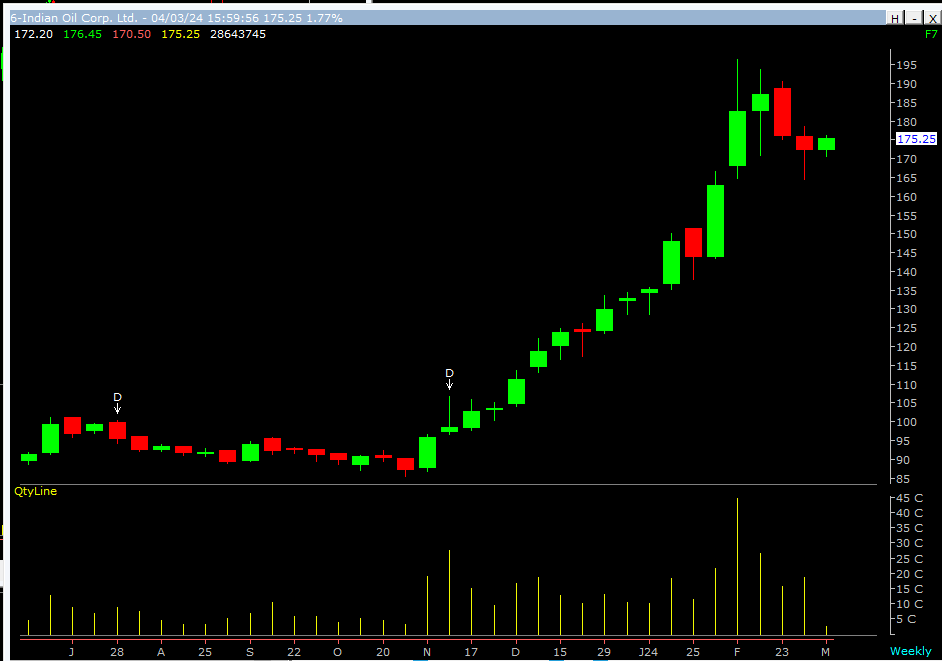

BUY: Indian Oil Corporation| Cmp Rs 175 | Targets of Rs 187-194 |Stop loss Rs 165

The weekly chart shows the stock is in the process of building up a short-term support base at 165. Profit booking was seen ahead of February series expiry, as the stock had a strong run up in the February series. “March series rollovers in derivatives space hint long rolls with the put writing base setting up at 170. CE writing strike is at 180 which decides the immediate stopover target. Mar series hint for a range of 175-195 to be building up. The momentum regain at supports of 165-170 provides an excellent trade from a risk reward payoff, ” said Bhagwat.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.