F&O manual | Market continues to show weakness as Nifty trades near crucial support of 22,250

Representative image

Indian benchmark indices on March 6 are trading in negative amid weakness seen across sectors except banking. Nifty is currently trading near its crucial support zone of 22,25o, breaching which may lead to a downside in tomorrow’s expiry day session.

Except banks, all other sectoral indices are trading in the red with IT, metal, oil and gas, power and realty down 1 percent each.

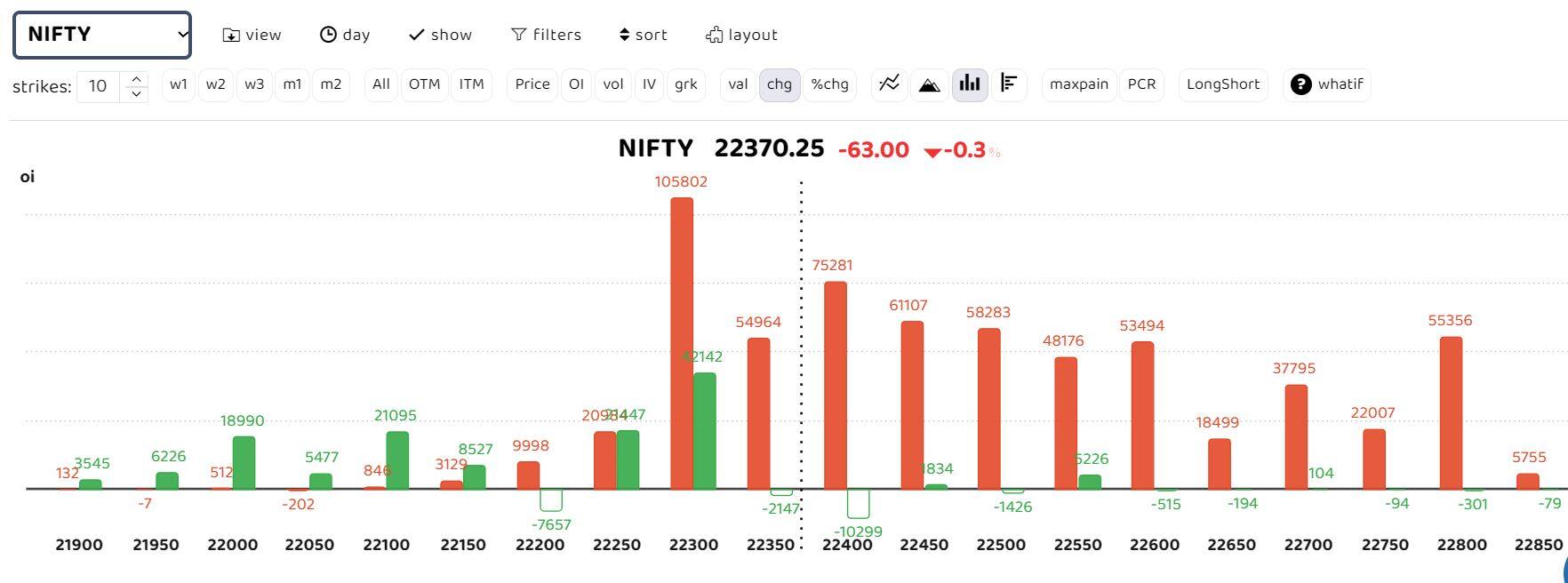

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Options data suggests that call writers are dominant for the day with heavy Call writing seen at 22,400 and 22,500 levels.

As per Tejas Shah, vice-president technical research at JM Financial: “Nifty once again formed DOJI candle on its daily chart, which indicates indecisiveness prevailing in the market place at the current juncture. Presently, there is no sign of top reversal as of now since Nifty is still making higher high on the weekly charts. We expect an upward trending activity to continue and the index should move towards the next resistance zone of 22,450-500 either continuously from the current levels or may be after a minor dip or consolidation.”

Read more: Bank Nifty hits 48,000 on expiry day, crucial support now at 47,700

Shah notes that supports for the Nifty are now seen at 22,250-300 and 22,125-150 levels. On the higher side, immediate resistance zone for Nifty is at 22,450-500 levels and the next resistance is at 22,700 mark.

As per ICICI Securities: “The Nifty remained muted as upsides were capped due to selling pressure seen among IT stocks. Considering noteworthy Call bases at 22400 and 22500 strikes, these levels are expected to act as immediate hurdle while on the downside 22200 is expected to act as support.”

Story continues below Advertisement

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.