F&O manual | Indian indices trade range-bound; Nifty shows no signs of reversal, analysts advocate buying on dips

Representative image

Indian benchmark indices are trading range bound to negative as consolidation at higher levels begins. Nifty is testing the upper band in the zone of 22,450-22,500. Currently, there is no sign of a top reversal as Nifty continues to register higher highs on both the daily and weekly charts. According to experts, the bulls are firmly in control of the markets at the current juncture and are capitalising on every minor correction to establish long positions.

At 10:06 hrs IST, the Sensex was up 42.76 points or 0.06 percent at 74,128.75, and the Nifty was up 22.20 points or 0.10 percent at 22,496.20.

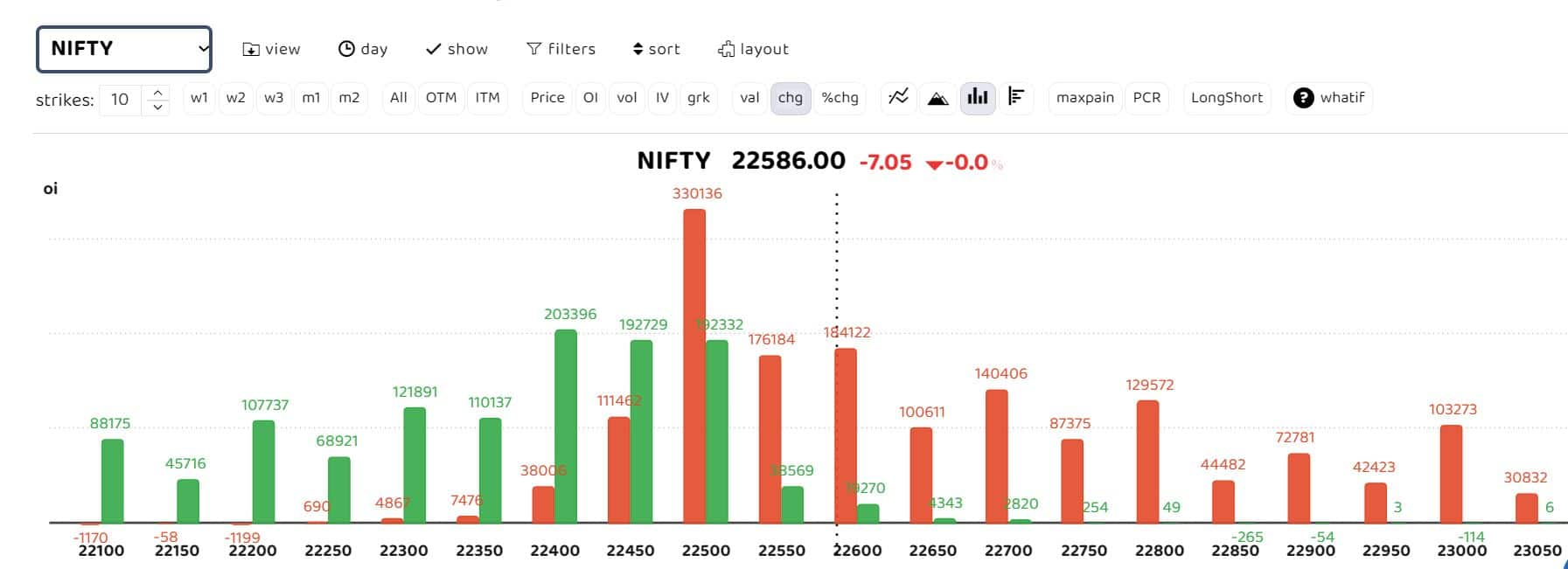

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Options data indicates significant straddle positions at 22,500 and 22,450 strikes. Nifty Futures saw a 7.72 percent increase in Open Interest with a 0.7 percent rise in prices, signaling a build-up of long positions in the indices. The Nifty PCR stands robust at a level of 1.34, with noticeable call writing observed across 22,500-22,600 strikes. Simultaneously, put writing was noted in 22,400-22,200 strikes, suggesting that the expected range for the coming sessions could be 22,360 on the downside and 22,600 on the upside.

According to Sudeep Shah, DVP and Head of Derivative and Technical Research at SBI Securities: “The momentum in the last few sessions is clearly supporting the large-cap space. Hence, the index is likely to sustain this strong momentum and continue creating record highs in the coming sessions, as long as it remains above 22340-22360. Below 22340, we may witness profit booking, leading to a potential decline to 22250-22230.”

As per Tejas Shah, Vice President of Technical Research at JM Financial, “On expected lines, Nifty almost tested the upper band of our target zone of 22,450-22,500. Presently, there is no sign of a top reversal as Nifty is still making higher highs on both the daily and weekly charts. The bulls are in full control of the markets at the current juncture and are utilizing every minor correction to create long positions.”

“The short-term moving averages are just below the price action and should continue to support the indices on any decline. “

Story continues below Advertisement

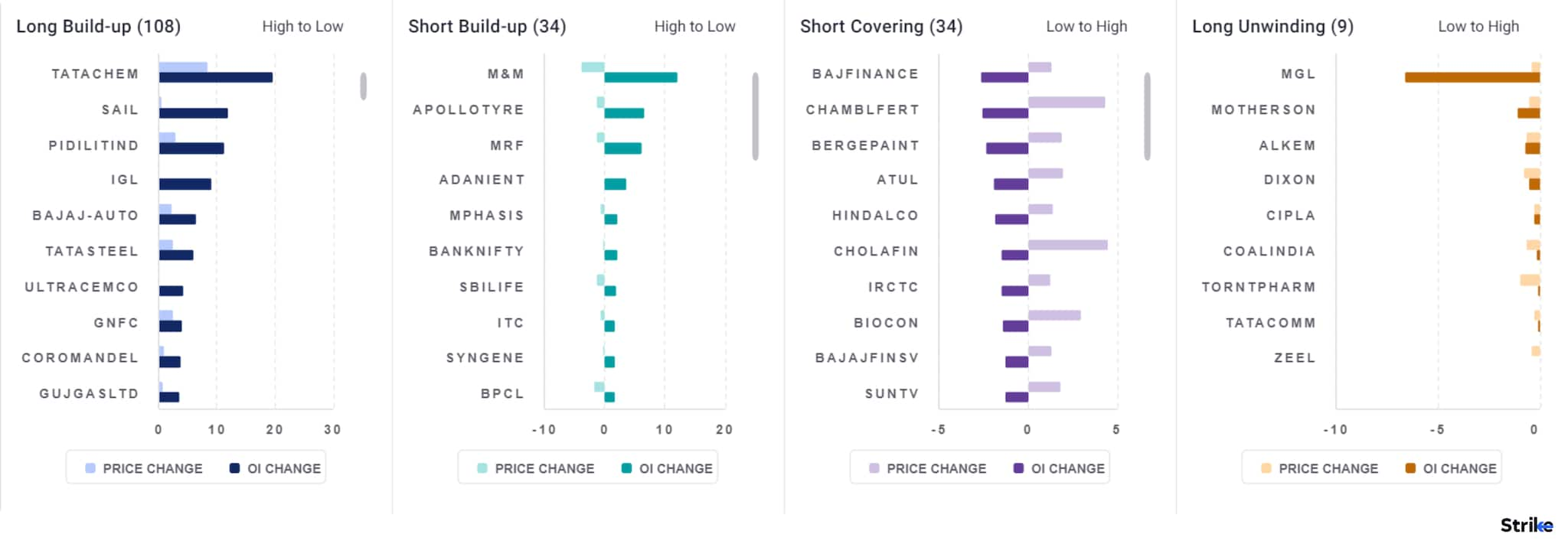

Among individual stocks, Tatachemical, SAIL, IGL and Pidilitind witness long build up. M&M, Apollotyres and MRF are showing short build up.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.