Broader indices underperform, but these 10 smallcaps post double digit gain

Foreign institutional investors (FIIs) sold equities worth of Rs 10,081.08 crore, on the other hand Domestic institutional investors (DIIs) bought equities worth Rs 10,129.17 crore during the week.

The Indian market had a positive run for the fourth week in a row, with the benchmark indices reaching an all-time high despite high volatility in the week ending on March 7. However, the broader indices underperformed, with the small-cap index declining by more than 2 percent.

The BSE Sensex hit a new record high of 74,245.17 and ended 313.24 points or 0.42 percent higher at 74,119.39. The Nifty50 index also reached a new high of 22,525.65 and closed 115.15 points or 0.51 percent higher at 22,493.55.

In terms of sectors, the Nifty PSU Bank index rose by 3 percent, the Nifty Pharma index was up by 1.5 percent, while the Nifty Energy and Nifty Bank added 1.4 percent and 1 percent respectively. On the other hand, Nifty Media lost 3.2 percent, Nifty Information Technology index was down by 1.3 percent, and Nifty Realty index shed 1 percent.

Foreign institutional investors (FIIs) sold equities worth of Rs 10,081.08 crore, on the other hand Domestic institutional investors (DIIs) bought equities worth Rs 10,129.17 crore during the week.

“The Nifty gained 115 points over the week to close at 22,494. It started on a positive note last week considering global cues and stayed above an immediate support zone of 22,250-300 throughout the entire last week. This is an indication that the bulls are not willing to give up so easily. At the same time, there was marginal profit booking towards the end of the week from the resistance zone of 22,500-525. It was a week in favour of the Bulls. The broader markets underperformed as compared to the mainline indices,” said Tejas Shah, Technical Research, JM Financial & BlinkX.

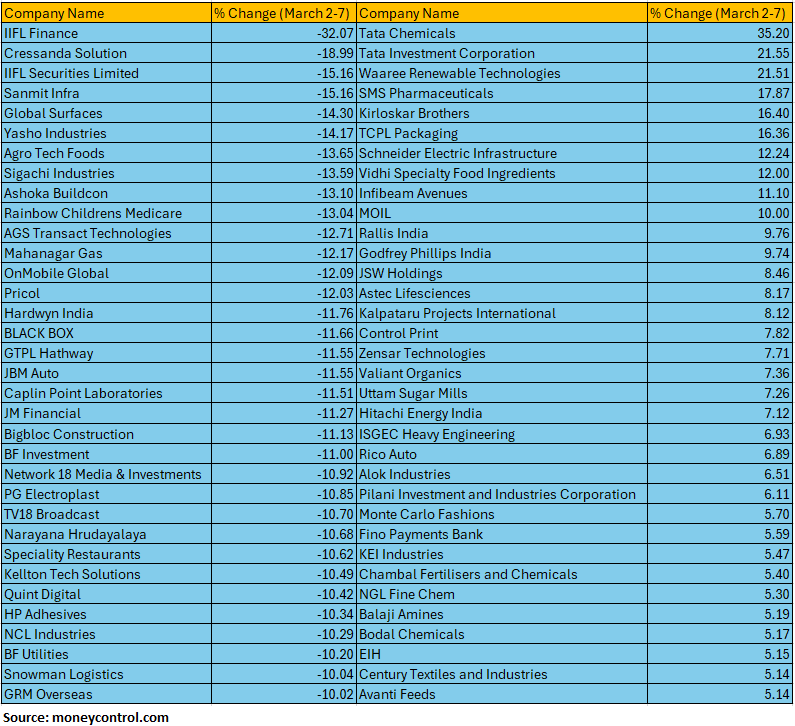

The BSE Small-cap index shed 2.6 percent with IIFL Finance, Cressanda Solution, IIFL Securities, Sanmit Infra, Global Surfaces, Yasho Industries, Agro Tech Foods, Sigachi Industries, Ashoka Buildcon, Rainbow Children Medicare, AGS Transact Technologies, Mahanagar Gas, OnMobile Global, Pricol falling between 12-32 percent.

On the other hand, Tata Chemicals, Tata Investment Corporation, Waaree Renewable Technologies, SMS Pharmaceuticals, Kirloskar Brothers, TCPL Packaging, Schneider Electric Infrastructure, Vidhi Specialty Food Ingredients, Infibeam Avenues and MOIL added between 10-35 percent.

Story continues below Advertisement

Where is Nifty50 headed?

Osho Krishan, Sr. Analyst – Technical & Derivative Research, Angel One

From a technical standpoint, the index has managed to hold the higher ground and dips augured well for the bulls, but the range is narrowing down as we head into uncharted territory, which might be a sign of caution for the coming period.

For now, 22250-22200 is likely to be seen as intermediate support, followed by the strong support of 22150 and finally, the psychological mark of 22000 from a broader term view. On the higher end, finding resilience is challenging in uncharted territory, though 22600-22650 could be seen as the following potent targets for Nifty in the upcoming week.

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas

The consolidation is a brief pause in the overall uptrend, and we expect the upmove to resume during the coming week. In the case of a dip towards, 22390 – 22340 it should be used as a buying opportunity as key hourly moving averages are placed in this range and can attract buying interest. On the upside, 22570 – 22600 shall act as an immediate hurdle zone from short-term perspective.

Bank Nifty witnessed some profit booking and traded within the range 47442 – 48161 of the previous trading session. It is steadily moving towards its support zone of 47680 – 47560 which can act as a potential trend resumption area and hence dips towards the support zone should be used as a buying opportunity.

Rupak De, Senior Technical Analyst, LKP Securities

The Nifty stayed below the psychological 22,500 mark, with call writers at the 22,500 strikes significantly increasing their positions. On the downside, support is expected to hold at 22,400. The buy-on-dips strategy is likely to persist as long as it remains above 22,400. On the upside, a decisive move above 22,500 could trigger buying interest in the market, potentially pushing the index towards 22,700 in the short term.

Bank Nifty faced resistance at the 48,000 level, finding support at 47,750. Nevertheless, the weekly closure indicates a resilient bullish momentum, with pivotal support identified at 47,500 and resistance at 48,200. A conclusive breach above the 48,200 threshold, confirmed by a closing basis, could catalyze a bullish upswing towards levels of 48,500 and 48,800.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before making any investment decisions.