Small caps underperform – ‘Quality’ stocks in focus?

Quality

The BSE Small Cap index has shown remarkable growth, increasing by 219 percent since the beginning of 2020, while the BSE Sensex has gained 79 percent in the same period. Looking at monthly returns, in the past 51 months from January 2020, the BSE Small Cap index has outperformed the BSE Sensex in 31 months, with an average monthly outperformance of at least 4 percent.

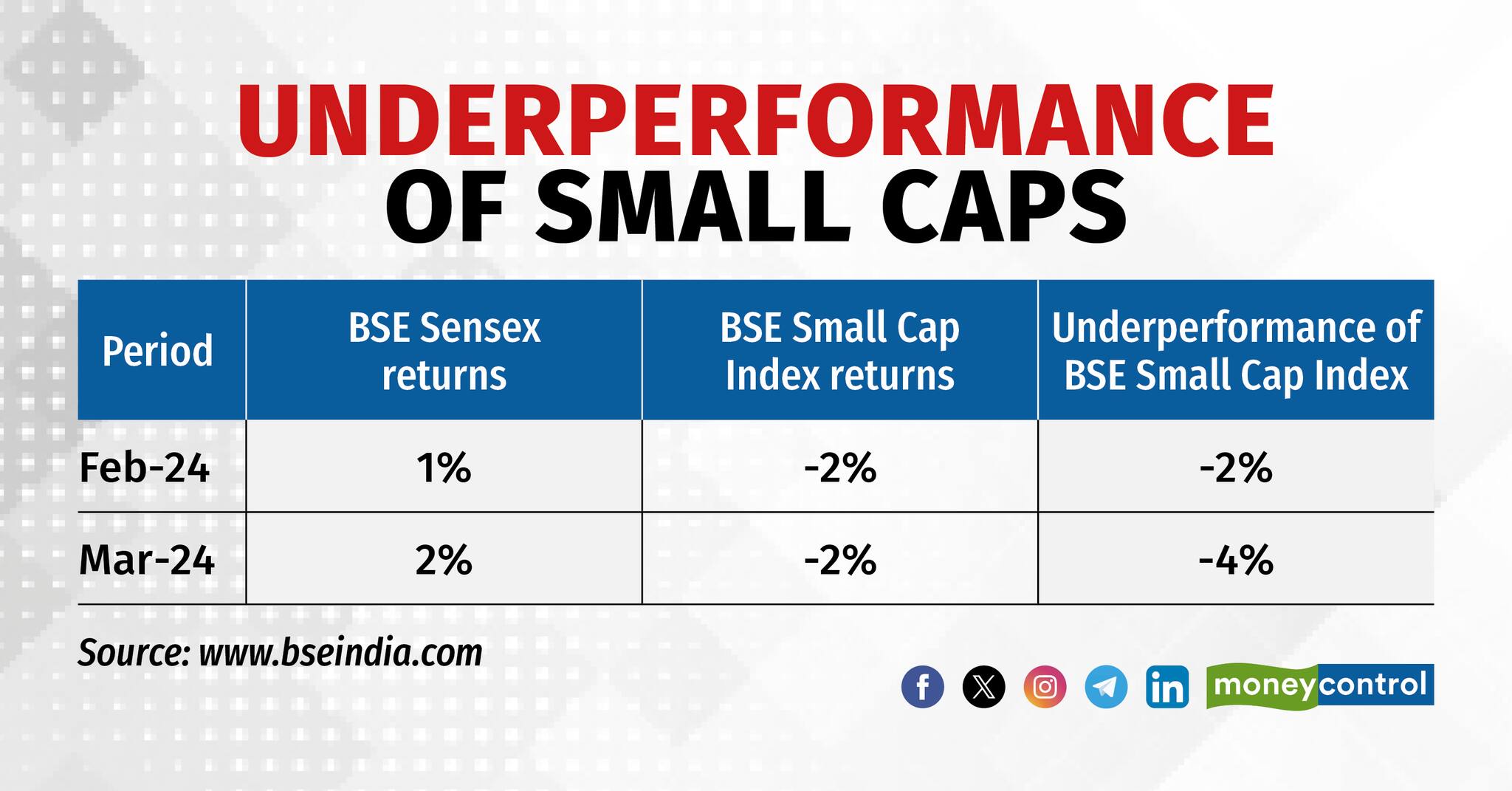

However, recent performance shows that small caps have been underperforming large caps in the past 30 and 60 days. If the BSE Small Cap Index continues to underperform the BSE Sensex in March, it will only be the sixth time since January 2020 that the small-cap benchmark index has underperformed the key benchmark index for two consecutive months.

In February, the BSE Small Cap index underperformed the BSE Sensex by 2 percent, and this underperformance has been magnified in March. The BSE Small Cap index has decreased by 2 percent, while the BSE Sensex has increased by 2 percent, resulting in an underperformance of 4 percent.

Small Caps underperform as of March 07

Small Caps underperform as of March 07

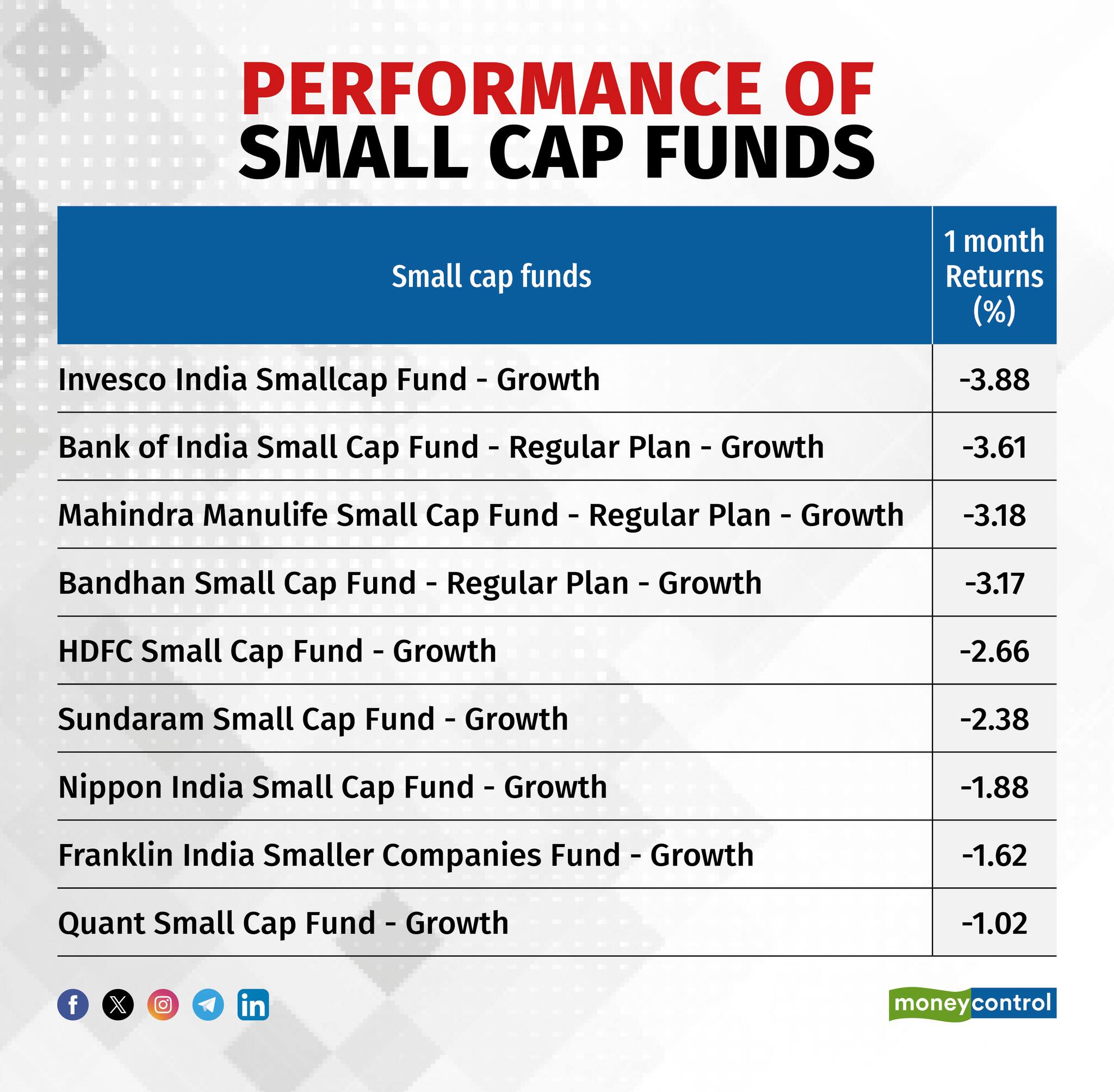

Actively managed Small cap fund are also down by more than 2 percent each on an average.

Small cap MFs give negative returns

Small cap MFs give negative returns

Time correction in small cap stocks

According to Neeraj Chadawar, Head – Fundamental and Quantitative Research, Axis Securities,” We believe style and sector rotation will play a critical role in the alpha generation. Also, with a strong catch-up of midcaps and small-caps in the last couple of months, the margin of safety in terms of valuations for these segments at current levels has reduced compared to that available in large-caps. With this view, the broader market may see some time correction in certain pockets in the near term, and flows will likely shift to large caps. However, the long-term story of the broader market continues to remain attractive.”

Story continues below Advertisement

Out of 946 BSE Small Cap index constituents at least 704 stocks have given negative returns while at least 789 stocks have underperformed BSE Sensex returns of 3.77 percent in the past one month.

Quality stocks

Neeraj adds that ‘Growth at a Reasonable Price’ and ‘Quality’ look attractive at the current juncture.

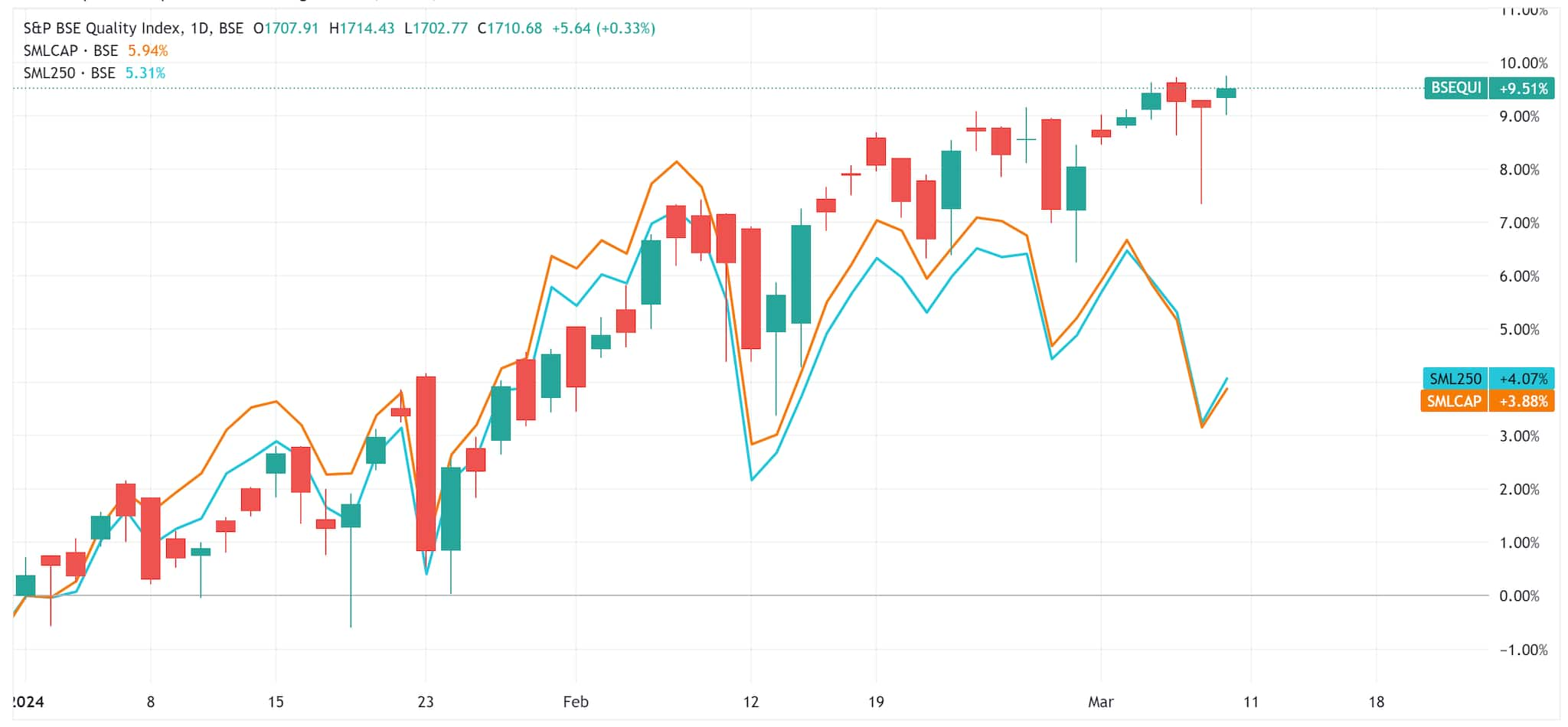

If we look at the performance of BSE Quality index, the recent outperformance over small cap stocks is visible on year-to-date basis. The below chart highlights the outperformance of BSE Quality index over BSE Small cap index and BSE Smallcap 250 index on year-to-date basis.

BSE Quality index tracks the performance of high quality stocks in the S&P BSE LargeMidcap as determined by their quality score calculated based on return on equity, accruals and financial leverage ratio.

What are quality stocks?

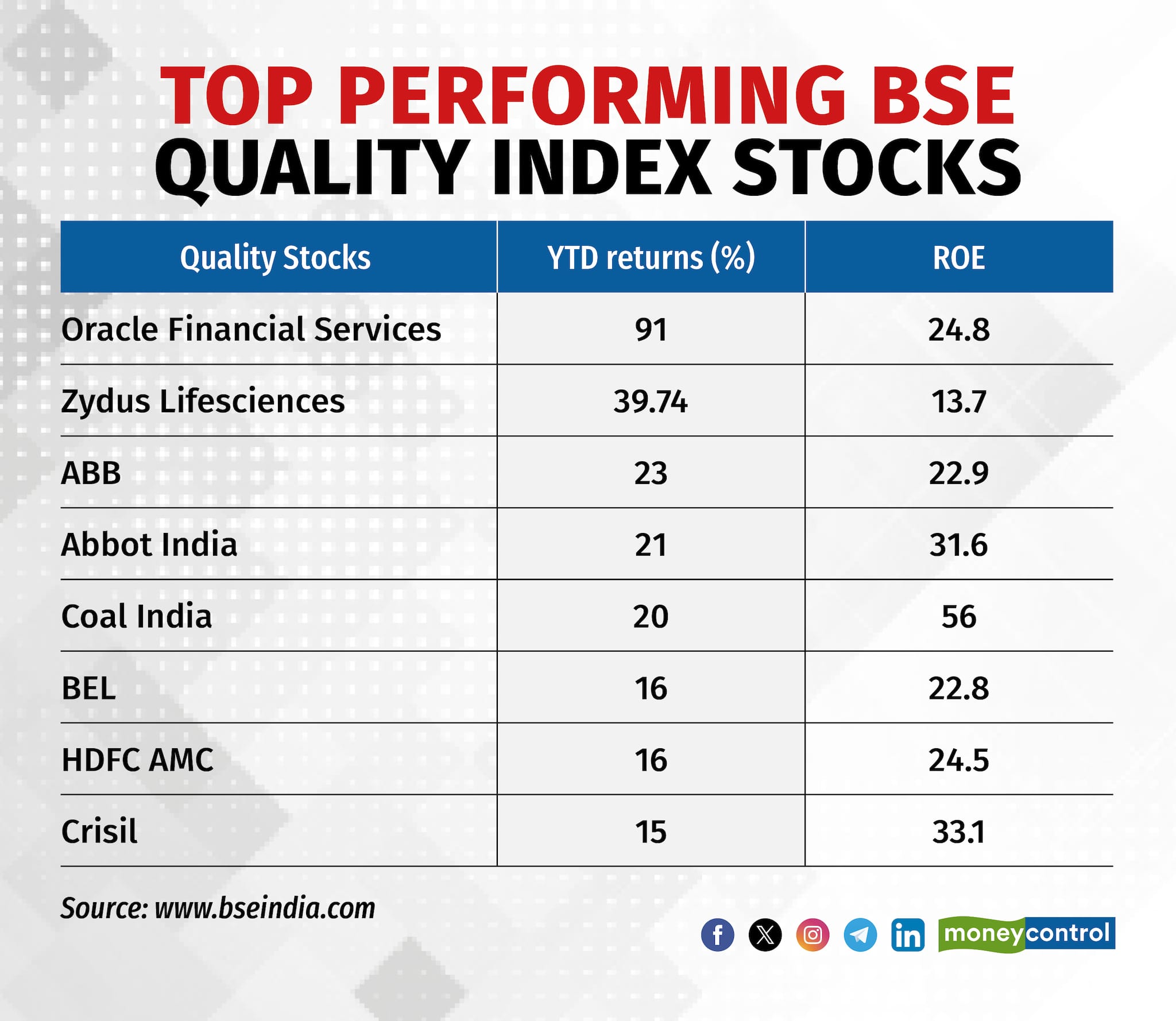

If we look at the BSE Quality index we find index constituents such as Oracle Financial Services Software, Zydus Lifesciences, ABB, Abbot India, Coal India, BEL, HDFC AMC and CRISIL outperforming markets on year-to-date basis. All these stocks showcase high return on equity (RoE). The average RoE for these 8 BSE Quality index constituents is 28.6.

Quality stocks outperform

Quality stocks outperform

Says Nimesh Chandan, CIO, Bajaj Finserv AMC, “Quality companies have a business with a competitive advantage and management which allocates capital in the areas that lead to long term shareholder value creation. In terms of financials, these businesses are likely to display high Return on Capital or Assets and healthy cashflow.”

Why Quality stocks?

Looking at the complex market situation given the high valuation, major event ahead in terms of general elections, possibility of US recession and rate cut getting delayed fund managers are likely to focus on quality aspects of the stocks.

Nimesh Chandan believes that quality business have a certain high predictability and visibility of growth and hence it may outperform in the long term.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.