F&O Manual | Market in the red; Bank Nifty falls below crucial support of 47,500

At 13:07 hrs IST, the Sensex was down 365.83 points or 0.49 percent at 73,753.56, and the Nifty was down 89.40 points or 0.40 percent at 22,404.10

The Indian benchmark indices were trading lower amid a negative global cues on March 11 afternoon, while the banking index, Bank Nifty, breached the crucial support of 47,400-47,500.

At 12.42 pm, the Sensex was down 323.95 points, or 0.44 percent, at 73,795.44, and the Nifty was down 84.60 points, or 0.38 percent, at 22,408.90.

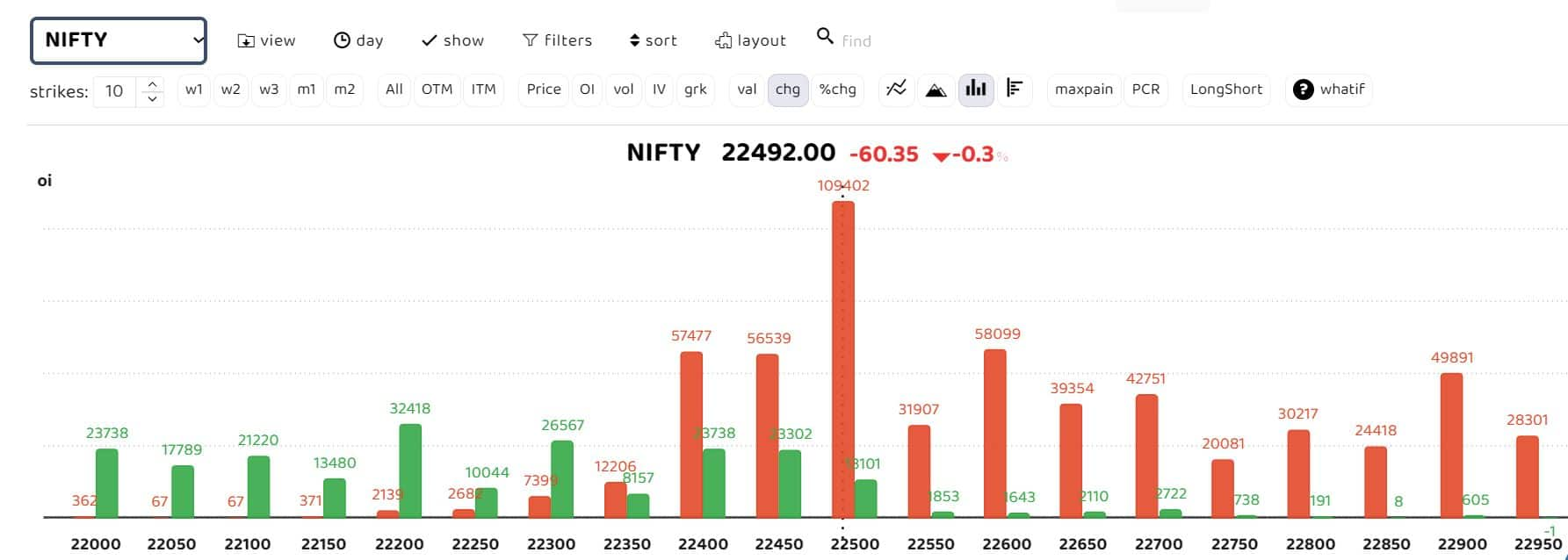

Bars in red indicate the change in open interest (OI) of call writers, while the green show the change in OI of put writers

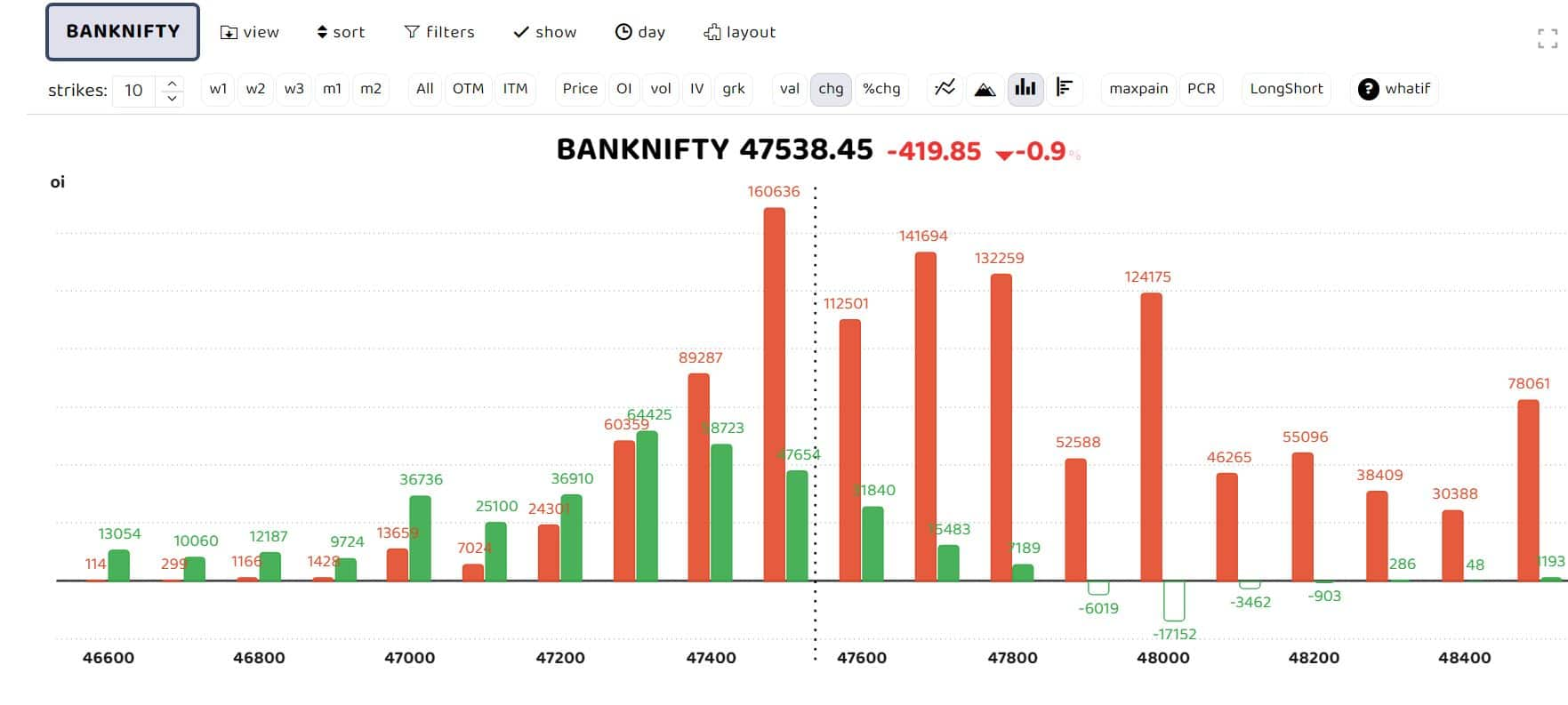

Bars in red indicate the change in open interest (OI) of call writers, while the green show the change in OI of put writers

The options data show that call writers are dominant for the day, with heavy call writing at 22,500 and 22,600 strikes.

As long as the Nifty doesn’t close below 22,300, the trend will remain bullish, said Soni Patnaik, Assistant Vice president derivative research at JM financial. If it closes below 22,300 spot, it may see some consolidation and struggle to test 22,800 and23,000.

The market has been directionless for the past two months, mirroring the global markets. Clarity on the interest rates , especially from the US Federal Reserve, is need for a trend to emerge, Sheersham Gupta, Director and Senior Technical Analyst at Rupeezy, said.

“Nifty fell after making a new all-time high today. The zone of 22,300 – 22,350 is the demand zone and is likely to act as a strong support for Nifty. On the upside, 22,500 is the resistance and we can expect fresh buying after Nifty decisively breaches 22,500, ” Sheersham said.

Story continues below Advertisement

Akshay Bhagwat, Senior vice president derivative research at JM Financial, said the Bank Nifty is trades around at key day trading support in the 47,400-500 area. Significant put writers are placed at 47,500 for March 13 weekly expiry. “Overall call writers writing action too is heavy with current OI PCR readings seen at 0.77. In case prices sustain below 47,500 it can lead to unwind of pe writing which can see downside till 47,200/47,000. As we deal with pivotal level, today’s second half of trade will justify the validity of the 47500 support zone,” he said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.