Small-cap Stress: 82% of stocks in the small-cap index fall in the past three weeks

High-frequency trading firms (HTFs) – or algo firms on steroids –use complex algorithms and powerful computers to execute trades at lightning speeds.

The sentiment around small- and mid-cap stocks is turning weak with the majority of them slipping into the red. More than 80 percent of stocks in the BSE Small-cap index have recorded negative returns since February 19 when the index started falling. During the same period, the Nifty has gained nearly one percent.

The nervousness in small-caps is on account of a multitude of factors that are thwarting liquidity in the segment. Operator activity that was rampant in the sector and was causing fundamentally weak stocks to rise rapidly is coming under stress after ED raided Dubai-based hawala operator Hari Shankar Tibrewal and 13 other entities who also “operate” stocks. This is making market participants cautious, brokers said.

The other big reason these stocks are spooked is Sebi’s advisory asking mutual funds to safeguard investor interests amid concerns about froth building up in small-cap and midcap schemes.

While Sebi has only asked for additional disclosure related to the liquidity of mutual fund portfolios thus far, it has ruled out mandating any other action, be it stopping flows or selling down stakes. However, concerns arise over whether fund managers will sell down stakes in less liquid stocks as regulatory scrutiny on portfolios increases and liquidity becomes a key priority.

Yet, fund managers said, the correct was a welcome move. “The kind of correction we have seen so far is very welcome. There were a lot of undesirable stocks that were going up which was bad. This is a healthy and much needed,” said Ruchit Mehta, head of research, SBI Mutual Fund.

Several fund managers Moneycontrol spoke to said that the segment had gone overboard in terms of valuations and there was froth in the sector. The bigger funds have been facing serious problems deploying money profitably, with several of them shutting down their window for fresh sales.

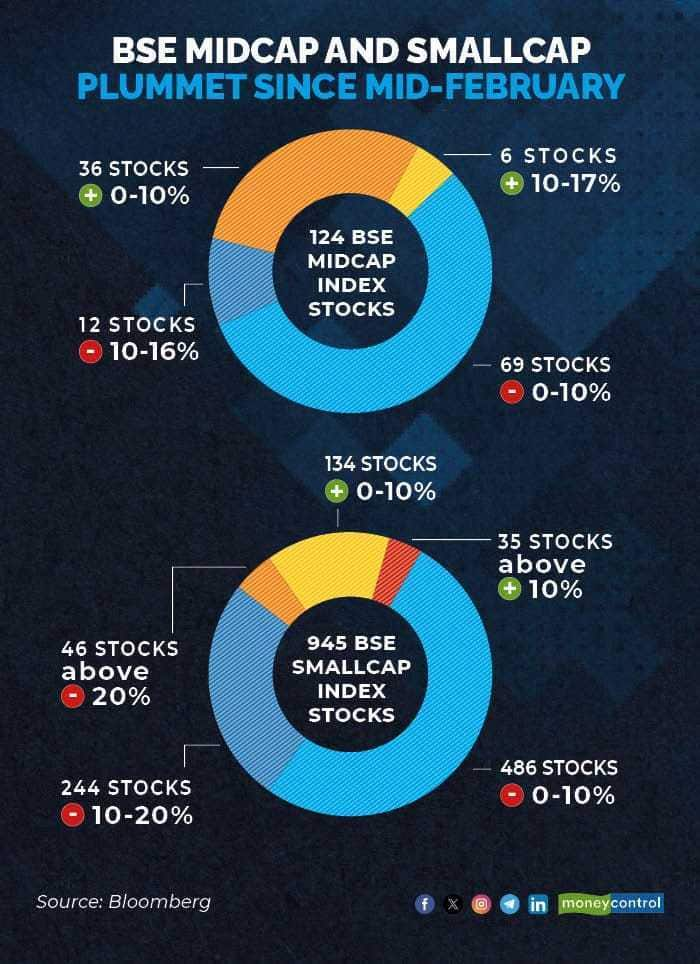

Since February 19, the BSE MidCap index dropped by 2 percent, and the BSE SmallCap index experienced a loss of over 7 percent. But the headline numbers camouflage the weakness embedded in individual stocks. In the BSE SmallCap, out of 945 stocks, 485 saw losses between 0-10 percent; 244 declined between 10-20 percent; and 46 stocks saw declines above 20 percent. In all, 82 percent of stocks posted negative returns since February. Among gainers, 134 stocks saw increases between 0-10 percent, while 35 stocks gained above 10 percent.

Story continues below Advertisement

Mid-caps were better off. In the BSE MidCap, 69 out of 124 stocks fell between 0-10 percent while 12 stocks lost between 10 and 16 percent. On the other hand, 36 stocks gained between 0-10- percent while six stocks advanced between 10-17 percent.

Sneha Poddar, analyst with Motilal Oswal, said, “In the near term would suggest switching to large caps where the risk-reward is favourable. In the meantime the investors should also take this correction as an opportunity to accumulate quality names for long term which post sharp runup had become too expensive. The overall long-term trend remains intact as India is currently enjoying the best of both macro and micro tailwinds with ~7 percent+ GDP growth, moderating inflation nos, rangebound crude prices, easing 10-year G-sec yield, stable currency, and resilient corporate earnings.”

On 27 March, the Association of Mutual Funds of India announced that a mandatory disclosure format for mutual funds, focusing on stress testing, will be released by March 15. The disclosure aims to assess how quickly mutual fund schemes can exit their portfolios during stress or redemption pressures. Buch emphasized the challenge mutual funds face in managing redemptions in illiquid markets during adverse conditions. The new disclosure will inform investors about potential outcomes in small-cap and mid-cap funds during stressed situations.

AMFI recently outlined detailed guidelines for stress tests in small-cap and midcap schemes. Following SEBI’s instructions, AMFI directed fund houses to submit stress test results every 15 days, with the first report due by March 15. Stress tests will reveal a portfolio’s liquidity, indicating how swiftly fund managers can unwind positions in the event of a market collapse and increased redemption requests.

Analysts said the steep decline in small and midcaps was anticipated due to frothy valuations post the 2023 bull run. With the Nifty smallcap gaining 74 percent and the midcap 100 index up by over 60 percent in the past year, exuberant valuations raised caution among analysts. The ongoing market correction is deemed healthy, and expected to bring some counters out of the overbought zone, analysts added.

Kranthi Bathini, Director of Equity Strategy at WealthMills Securities said while there may be some areas with excessive speculation, the key is to focus on individual stocks. Investors should be specific about their stock choices and understand the inherent risks associated with investing in mid and small-cap stocks. The recent frenzy in these segments highlights the importance of recognizing the high beta nature of mid and small-cap stocks. These stocks are highly responsive to changes in regulations and market sentiment, exhibiting hyper-volatility. Before investing, investors must comprehend the consequences of high-beta stocks and the nature of volatility in this space.

Overall, in 2023, mid-cap mutual fund schemes attracted nearly Rs 23,000 crore, while the same for small-cap schemes was at over Rs 41,000 crore. In 2022, mid-cap funds saw an inflow of Rs 20,550 crore and Rs 19,795 crore in small-cap funds. On the other hand, large-cap mutual funds experienced an outflow of nearly Rs 3,000 crore in 2023 and an inflow of Rs 7,281 crore in 2022.

BSE MidCap index currently trades at 25.6x of its one-year forward price-earnings compared to its 10-year average PE of 24.61x while the BSE Smallcap 1-year forward PE trades at 23.16x versus its 10-year average PE of 21.55x.

Gaurang Shah, Senior Vice-President at Geojit Financial Services said excessive liquidity drove up midcap and smallcap stock prices, often exceeding their justified values based on earnings. The surge in funds flowing into these segments compelled fund managers to invest, further inflating valuations. Authorities have acknowledged the situation and proposed potential regulations.

Given the historical volatility of small and midcap stocks, investors must exercise caution in allocating funds, whether directly in stocks or through mutual fund SIPs. Investors should be prepared for the inherent volatility in small, mid, and microcap stocks, as corrective phases have occurred before. Regulatory steps aim to safeguard the interests of small retail investors. Shah added.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.