Bernanke Review: How the former Fed boss could shake up the Bank of England

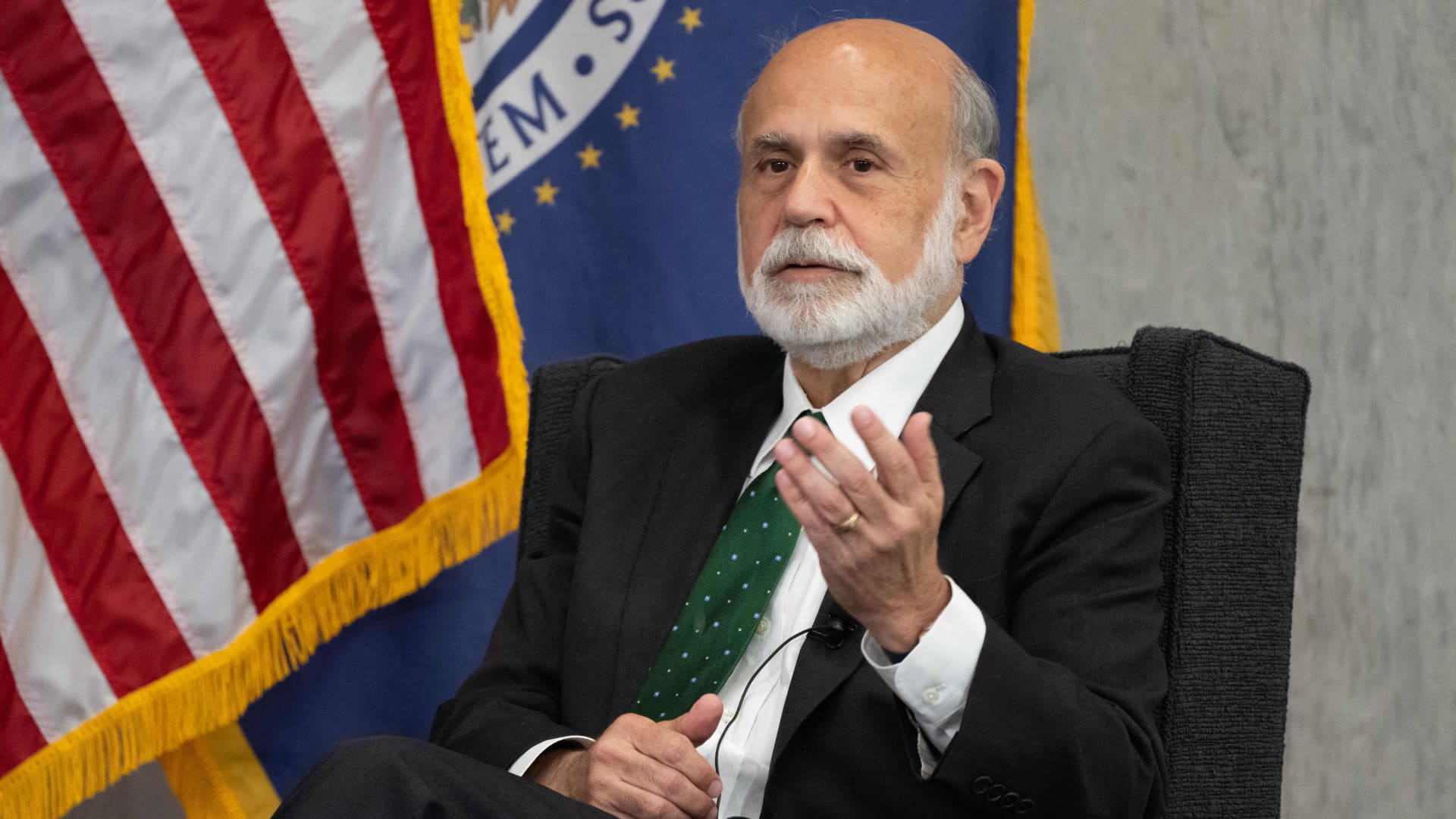

Former Federal Reserve Board Chair Ben Bernanke speaks during a discussion on “Perspectives on Monetary Policy” during the Thomas Laubach Research Conference at the Federal Reserve Board building in Washington, DC, May 19, 2023.

Saul Loeb | AFP | Getty Images

LONDON — The Bank of England will on Friday publish a long-awaited review by former Federal Reserve Chair Ben Bernanke that could lead to significant changes in its monetary policymaking.

The review was launched last summer to assess the Bank’s struggles to accurately project the huge global spike in inflation, following Russia’s invasion of Ukraine. This led to the BOE being too slow to hike interest rates and subsequently having to raise its main bank rate to a 15-year high of 5.25%.

With inflation now falling faster than the MPC had anticipated, some economists have argued that the Bank is committing the same mistake in the opposite direction — by now being slow on the mark to cut rates, even as the economy flatlines.

In a research note out on Tuesday, Goldman Sachs suggested Bernanke’s recommendations will focus on two key areas. The first deals with how the Bank of England communicates uncertainty around its central forecasts.

“We expect that Bernanke will recommend that the fan chart should take a less prominent role or be retired completely, while suggesting that the Bank use alternative scenarios more extensively,” Goldman economists Jari Stehn and James Moberly.

“We think that scenario analysis would communicate the conditionality of the forecast more clearly, help to convey uncertainty, and better represent the range of views on the Committee.”

The “fan chart” is the Bank’s long-held method of presenting the probability distribution that forms the basis of its inflation forecasts.

“That said, some of the information that the scenarios would contain is already captured by the MPC’s judgement on the risk skew and in MPC members’ communications,” Stehn added.

Deutsche Bank also advocated this will be a focal point of Bernanke’s assessment. Senior Economist Sanjay Raja suggested in a note last week that he could recommend a scenario-based approach during exogenous shocks.

A central problem for the Bank of England and other major central banks around the world in the aftermath of the Covid-19 pandemic was quantifying the upside risks to inflation forecasts from global supply chain disruptions, whether from lockdowns and subsequent demand bottlenecks or from the war in Ukraine.

Fan charts took the brunt of the blame for the MPC’s failure to keep track of these inflationary pressures, and Raja anticipates that they will “likely be dropped going forward.”

“One possible recommendation coming from the Bernanke review could be for the MPC to adopt scenario-based analyses during times where exogenous shocks raise uncertainty around the Bank’s central projections,” he said.

“The use of alternative scenarios would also allow for differing views on the committee to be reflected more formally (i.e., hawkish vs dovish risks as reflected in the current make-up of the MPC).”

A change to the interest rate conditioning path

The second area of focus, Goldman notes, is likely to be the conditioning path for interest rates. The Bank currently publishes two forecasts for GDP, unemployment rate and inflation — one based on the market-implied trajectory for interest rates and another assuming constant interest rates.

This differs from the European Central Bank, which produces a single forecast based on the market-implied path for interest rates, and from the Fed, which presents a “dot plot” through which each member charts their course of policy stance, inflation, real GDP and employment.

“While it is not out of the question that Bernanke could recommend that the MPC adopt a “‘dot plot’ or publish a Committee forecast for the policy rate, we think this is less likely. The drawback of giving a policy rate forecast would be that it could be misconstrued as a commitment to a particular rate path,” Stehn noted.

“That said, if the MPC were to switch from conditioning on the market-implied rate path to a forecast policy path, this would represent a more significant change in the policy framework than the use of scenarios.”

Deutsche Bank’s Raja suggested Bernanke could recommend sticking to one set of conditioning assumptions and publishing a collective projection for GDP, unemployment rate and inflation.

“This could include an endogenous view on rate expectations, replacing the market yield curve with a preferred interest rate profile,” Raja said.

“The main advantage here would be in avoiding marked shifts in BoE projections as a result of market interpretation of policy expectations or global spillovers that impact market pricing heading into a forecast round. Relying on an internal interest rate conditioning path may be less volatile and could avoid a ‘tail wagging the dog’ scenario.”

Streamlining communication

A further focus of the review, Deutsche Bank says, could be on streamlining the Bank of England’s communication, to reduce documents, statements and projections to digest at each meeting — and strengthening the MPC’s core message from meeting to meeting, as a result.

Raja said this could be achieved by making “fewer and smaller tweaks” to the policy statement, aligning the process more closely with the concision and consistency of Fed and ECB policy statements. This, in turn, will make it easier for the market to interpret and isolate “new news.”

While the use of scenario-based analysis or an endogenous interest rate path could improve transparency around the Bank of England’s policy outlook “on the margins,” however, Raja was doubtful that it would be a “game changer” for markets or the near-term trajectory of monetary policy.

Bernanke’s recommendations will not be put in motion immediately. Incoming BOE Deputy Governor Clare Lombardelli has been charged with leading the implementation when she takes her seat in July.

“Moreover, the MPC remains independent, and ultimately, all votes and decisions by MPC members will remain independent,” Raja said.

“The Bernanke Review, therefore, will provide a reset to how the Bank runs its forecasts rounds and importantly, how it communicates its projections (and decisions) to the wider public.”