F&O Manual|Indices trade lower; Nifty crucial resistance at 22,500, avoid long bets, say analysts

At 11:39 hrs IST, the Sensex was down 480.83 points or 0.65 percent at 73,764.07, and the Nifty was down 137.60 points or 0.61 percent at 22,381.80

Indian benchmark indices were trading lower on April 15 after a big gap down open amid unfavourable global cues. India Vix has jumped 5 percent to around 12 levels, indicating that geopolitical developments can cause volatile swings in the markets in the upcoming trading sessions.

At 11:39 hrs IST, the Sensex was down 480.83 points, or 0.65 percent, at 73,764.07, and the Nifty was down 137.6 points, or 0.61 percent, at 22,381.80. About 699 shares advanced, 2609 shares declined, and 102 shares were unchanged.

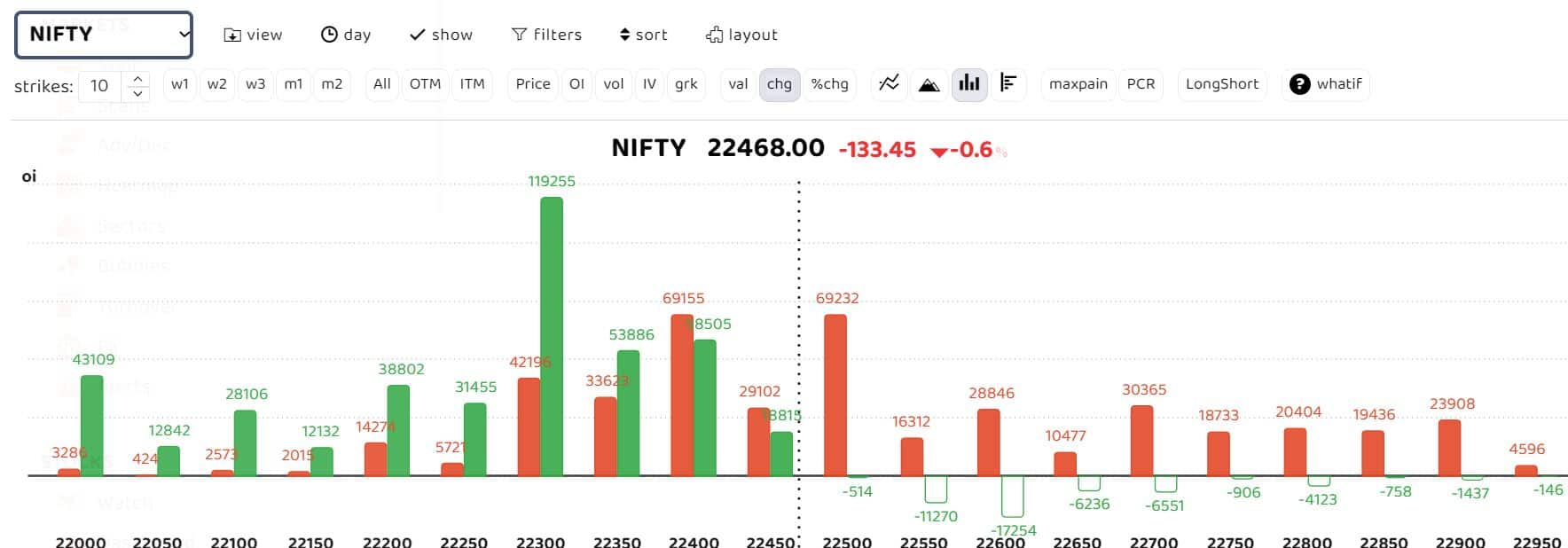

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Options data suggests heavy call writing at 22,500 forming crucial resistance for the day. As per Sheersham Gupta, Director and Senior Technical Analyst at Rupeezy: “Indian markets had a huge gap down due to geopolitical tensions in the Middle East. However, after seeing the market response post the gap-down opening, it can be assumed that the downside may be limited provided there is no escalation in the geopolitical tensions. In response, Asian markets have demonstrated a significant rebound as well.”

For Nifty, Gupta believes that the zone of 22,100-22,150 should act as strong support for the market. On the upside, 22,500 after role reversal, is now the resistance.

“Traders should avoid taking aggressive bets now owing to the uncertainty surrounding geopolitical tensions, ” said Gupta.

Bank Nifty

According to Soni Patnaik, Assistant Vice President of Derivative Research at JM Financial, “Bank Nifty is hovering around its support of 48,000, and if it closes below 47,800, then it could test lower support zones of 47,000. If it manages to hold the 48,000-48,200 closing basis, then Bank Nifty can bounce back towards 49,000.”

Story continues below Advertisement

Patnaik advises traders to hedge their positions if Bank Nifty breaks below 47,800 on a closing basis.

“Otherwise, it’s advisable to avoid initiating fresh long positions at the current levels,” he said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.