U.S. Housing Crunch: The Policy Shift That Could Trigger a Market Rebound

If you’ve ever heard older folks talk about the way the housing market was ‘back in their day,’ it probably sounded more like fiction than fact. I’ll never forget how bewildered I felt when my grandmother told me her first house cost $11,000…

At that time – in the early 1950s – the average home price was around $8,000, while average household income was about $4,000 per year. In other words, the price-to-income ratio back then was about 2:1 – far and away from today’s reality, estimated between four- and 5X income.

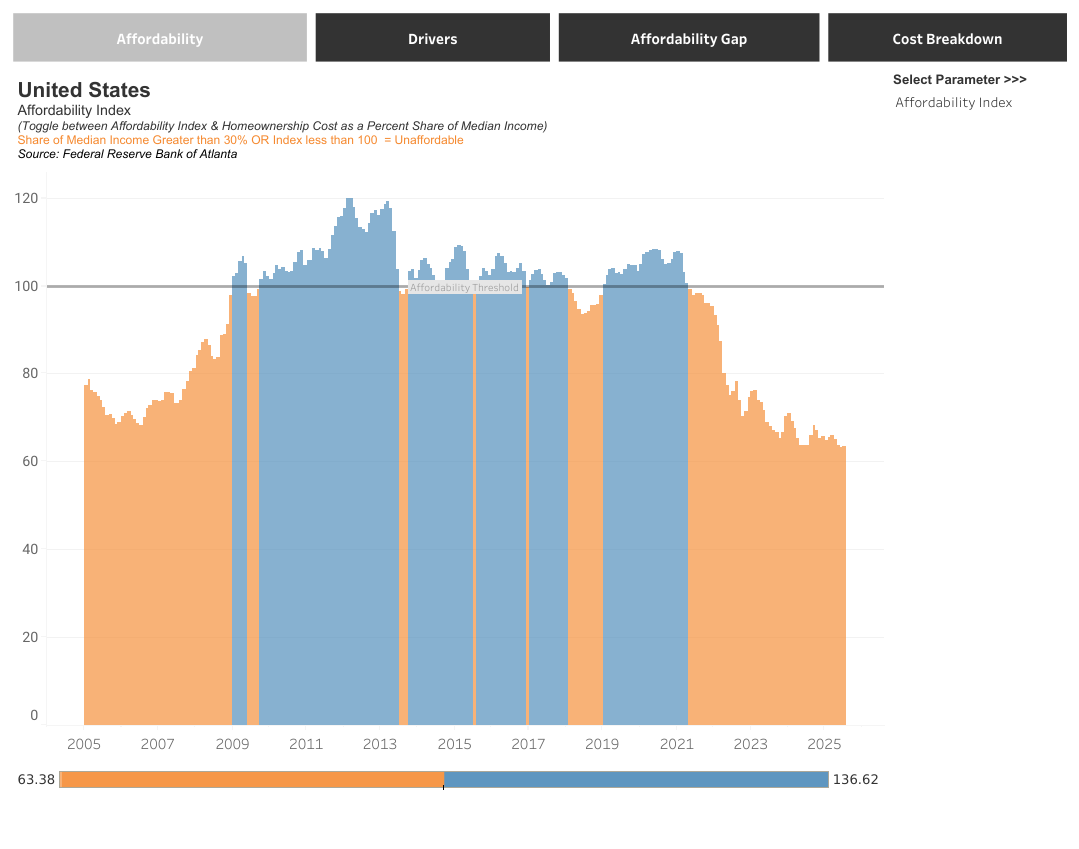

By almost every measure, affordability is at all-time lows…

Unfortunately, supply is stuck near record lows as well. As of July 2025, America’s housing shortage has grown to an all-time high of 4.7 million units, according to research from Zillow.

Younger people can’t afford to buy. Older homeowners aren’t selling. New construction hasn’t kept up with demand. The result? The worst housing crisis in modern U.S. history.

But the White House may be gearing up to do something about it.

Treasury Secretary Scott Bessent recently hinted that the administration could declare a National Housing Emergency this fall. He didn’t share details, but make no mistake: Washington has plenty of levers it could pull to reset this market.

We’re talking tariff and material-cost relief, incentives and grants for first-time buyers, down-payment assistance, streamlined permitting, changes in housing finance, even the use of federal land for new development.

If that happens, the market will thaw; and housing stocks should fly…

Meaning this is a prime time to start accumulating housing-related names.

How the Housing Crisis Reached a Breaking Point

To understand why a policy shock could matter so much, you need to understand just how broken things are.

Over the past four decades, the U.S. housing market was defined by one structural tailwind: falling mortgage rates. From the early 1980s until the early 2020s, 30-year mortgage rates trended down, enabling buyers to afford higher home prices while keeping monthly payments manageable.

That all changed in 2022.

Between early 2022 and late 2023, mortgage rates spiked from 3% to 8%. That’s a 500-basis-point move – the steepest increase on record, with data going back to 1990. And rates haven’t really come down since. The average 30-year mortgage has hovered around 7% for two years now.

The impact on demand has been devastating. Zillow data shows that U.S. households are now spending an average of more than 35% of their yearly income on mortgage payments for a new home, compared to less than 25% just a few years ago.

Anything above 30% is considered “unaffordable.” Bloomberg estimates that you need nearly $120,000 in annual income to afford the average home today. But the median U.S. household income? About $80,000. That math simply doesn’t work.

Of course, high rates didn’t just destroy demand. They froze supply, too.

Anyone who bought a home in the last 25 years almost certainly locked in a mortgage rate well below today’s market. Unsurprisingly, casual sellers have vanished. Why would you trade a 3% loan for a 7% one? The only people putting homes on the market are those who have to move. On top of that, elevated borrowing costs have made building new homes more expensive, choking off fresh supply.

So, here we are: low demand, low supply, sticky-high prices, and affordability in the gutter.

The Fed Can’t Fix Housing Alone

Now, rate cuts could help, and the Federal Reserve has started down that road. But let’s be realistic: this market is too broken for monetary policy alone to fix. It will take a policy sledgehammer.

That’s where the White House comes in.

If the administration does move forward with a National Housing Emergency, it has several levers it can pull, many of which could have fast, tangible impacts:

- Tariff and material cost relief. Reducing tariffs or granting exemptions on imported lumber, steel, or other key building materials could immediately lower construction costs.

- First-time buyer support. Grants, down-payment assistance, or expanded Federal Housing Administration (FHA) benefits would directly ease affordability challenges.

- Regulatory streamlining. Federal guidance could push localities to accelerate permitting timelines, especially on multifamily and affordable housing projects.

- Mortgage finance tweaks. Agencies like the Federal Housing Finance Agency (FHFA) and Department of Housing and Urban Development (HUD) could cut fees or loosen restrictions, while Fannie Mae and Freddie Mac could be nudged toward more flexible underwriting or targeted affordable housing initiatives.

- Use of federal land. Large swaths of federally owned land could be opened to housing development, particularly in areas where zoning and local politics have created bottlenecks.

Individually, none of these measures would fix the housing market. But combined, they could meaningfully boost both supply and demand within a year. And that’s the sort of synchronized intervention that could trigger a housing boom unlike anything we’ve seen since the post-financial-crisis rebound nearly two decades ago.

The Stock Market Angle: Housing Stocks That Could Soar

If the White House pulls this trigger, housing-related stocks should rip.

The obvious trade is in homebuilders.

Lennar (LEN), PulteGroup (PHM), DR Horton (DHI), KB Home (KBH), NVR (NVR), Toll Brothers (TOL), Meritage Homes (MTH), Green Brick Partners (GRBK) – these are the blue chips of America’s housing construction industry. They’ll benefit directly from any boost in demand, lower material costs, or faster permitting timelines. Their order books will swell, their margins will expand, and their earnings will jump.

But here’s where I’d go a step further: the real upside lies in housing tech.

- Zillow (Z): The closest thing we have to a digital super-app for housing. If more buyers flood the market, Zillow becomes the go-to platform, especially for millennials and Gen Z.

- Opendoor (OPEN): The iBuying model thrives in higher-volume markets. If Washington can thaw out supply, Opendoor’s algorithm-driven instant offers will look increasingly attractive to sellers.

- Compass (COMP): A tech-first brokerage that could win market share as agents flock to platforms offering better digital tools.

- Rocket Mortgage (RKT): A policy-driven housing boom paired with falling mortgage rates could unleash a massive refi wave. And Rocket dominates that space; perhaps the biggest winner of them all.

These are structural disruptors poised to gain share as housing transactions migrate online. And a National Housing Emergency could be the catalyst that accelerates that shift.

Why Investors Need to Position for Housing Now

Housing affordability is becoming a generational issue, and it’s climbing the policy agenda.

The administration is looking for wins heading into 2026. And unlike many avenues, housing intervention has the potential to deliver visible, near-term relief to millions of families.

And since markets are forward-looking, if the White House even hints at a concrete emergency package, housing stocks could gap higher overnight.

Waiting until the details are out will mean missing much of the move. That’s why now is the moment to start building exposure. Whether through the builders or the tech disruptors – or both – investors who position ahead of a National Housing Emergency declaration could be looking at one of the strongest tailwinds of the next 12 months.

And we think it could happen any day now. If so, the combined impact of lower material costs, more federal land, easier mortgages, and support for first-time buyers could trigger a boom unlike anything we’ve seen since the 2008 financial crisis.

The builders will benefit. But the real asymmetric upside lies in the housing tech stack – names like Zillow, Opendoor, Compass, and Rocket Mortgage.

We face the worst affordability crunch in modern history. That’s the problem. The opportunity? When the policy hammer falls, the rebound could mint fortunes.

Most investors won’t know where to look… But Eric Fry’s Apogee system does.

It’s already identified five stocks entering what he calls the “10X Zone.” And Eric is revealing every ticker right now – before the crowd catches on.

But if you want to know more, time is of the essence: this offer closes at midnight.