When Innovation Meets Timing: The Profit Surge Begins

Something rare is happening in the markets right now – a convergence of forces that appears only once in a generation.

The Federal Reserve has started a rate-cutting cycle, a development investors have been waiting years for.

That pending liquidity is about to merge with a wave of innovation across artificial intelligence, automation, quantum computing, and energy infrastructure.

- AI is evolving into essential infrastructure.

- Robots and algorithms are scaling from factory floors to offices and hospitals.

- Quantum computers are moving out of labs into prototypes at real data centers.

- And the nation’s power and data grids are being rebuilt to support it all.

This combination of easier money and accelerating technology creates a narrow window where innovation and momentum collide… and fortunes can shift almost overnight.

Every so often, the market gives you a setup you can’t ignore.

Right now is one of those times.

Regular readers of Hypergrowth Investing know my dedication to tracking these shifts. However, spotting the next NVIDIA (NVDA) or Amazon (AMZN) early isn’t the only way to capitalize.

The market moves with a regular rhythm – and reading those short‑term inflection points in real time when a big trend ignites can produce huge gains..

That’s why I’m teaming up on Monday afternoon with veteran trader Jonathan Rose for The Profit Surge Event, alongside our InvestorPlace colleagues Louis Navellier and Eric Fry. We all share the same lens on the world – the belief that technological change drives opportunity – but we operate on different time horizons. (Reserve your spot for that free event here.)

I map the road ahead; Jonathan spots the signposts that say “turn now.”

Jonathan focuses on the crossroads where innovation meets timing – and that’s where hypergrowth can happen in just days.

Here’s how it happens…

Combine Long-Term Vision With Short-Term Trading Edge

My research focuses on the scalable technology shifts that will define the next decade: artificial intelligence, advanced automation, quantum computing, clean energy, and the backbone infrastructure that powers them – from data centers and chips to rare‑earth materials and next‑gen power grids.

These hidden arteries of the new economy don’t always make headlines… until they do.

Over the past year we’ve watched that story play out, with demand for high‑performance chips surging and energy providers setting new benchmarks.

Taiwan Semiconductor (TSM) posted a 40% year‑over‑year revenue jump last quarter, Constellation Energy’s (CEG) earnings have grown around 25% with a five‑year average near 50%, and Bloom Energy (BE) has recorded four straight quarters of record sales thanks to booming demand for on‑site power.

Jonathan drives in the next lane over. He focuses on the short bursts that occur as these megatrends move from early adoption into mainstream enthusiasm.

His ability to spot unusual trading activity in stocks has delivered lightning‑fast gains across the very same themes I’m bullish on for the long haul.

To name a few highlights:

Mobileye (+100% in about a month), MP Materials (+833% in two weeks and +534% in three days), UiPath (+206% in two months), Rigetti Computing (+204% in five days), NuScale Power (+100% in under three weeks), Unity Software (+300% in six weeks) and TeraWulf (+132% in five days).

His readers have also racked up triple‑digit wins on Comstock Resources (CRK), which supplies natural gas to AI‑hungry data centers, and enjoyed a 700%‑plus windfall on MP Materials (MP) as well as a 659% run on lithium giant Albemarle (ALB). Those aren’t lucky streaks; they’re the product of a system designed to capture high‑velocity bursts inside broader technology stories.

Lessons From the Hype Cycle: Separating Signal From Noise

Although Jonathan and I work on different time horizons, we both see markets as mechanisms that translate breakthrough ideas into wealth.

I identify where the world is going; Jonathan identifies when the market wakes up to it. That shared philosophy extends to cutting through hype. Not every hyped‑up technology will deliver overnight riches.

For instance, Klarna‘s (KLAR) experiment with AI customer‑service “agents” proved that even promising tools can fail when deployed too early – the company ended up rehiring the very people it tried to replace.

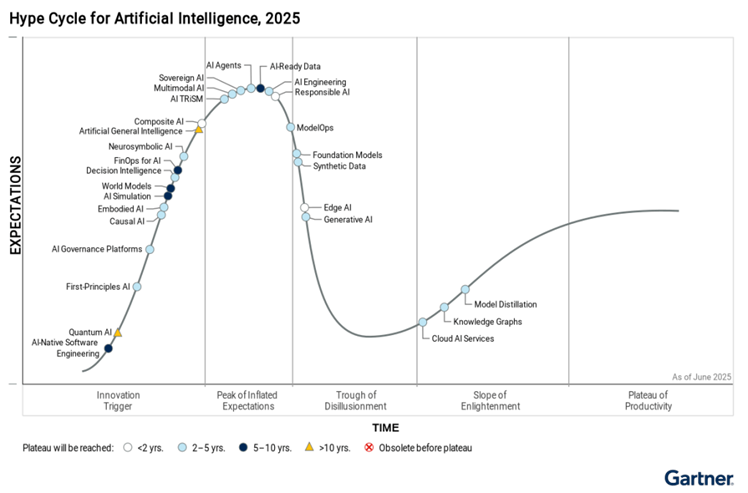

Gartner’s Hype Cycle shows why.

Flashy “AI agents” sit at the peak of inflated expectations while more fundamental models and services are only now climbing from disillusionment toward practical value. Our job as investors is to distinguish between hype and enduring trends.

This discipline matters even more now because the macro backdrop is about to amplify everything. As rate cuts reignite liquidity, pent‑up capital will flow back into risk assets just as multiple innovations hit critical mass.

We’ve seen similar patterns in the past – cheap money fueled the mobile and cloud boom in the early 2010s and supercharged digital adoption in 2020 – but the current innovation curve is steeper.

AI is industrializing, automation is scaling, quantum prototypes are operational, and our energy and data systems are being rebuilt. Add volatility like we’re seeing in the market over the past week or so, and you get short, sharp rotations that can turn a well‑timed trade into a triple‑digit gainer.

All of this makes now the perfect time to align long‑term conviction with short‑term precision. You want to capitalize on today’s volatility without losing sight of tomorrow’s megatrends – and that’s exactly what our combined strategy is designed to do.

The Profit Surge Event: Where Innovation Meets Action

This unique market window is why I’m joining forces with Louis, Eric, and Jonathan for The Profit Surge Event, a free broadcast on Monday, November 10, at 1 p.m. Eastern time.

During the event, Jonathan will reveal the trading system that has delivered his followers an average gain of 267% in just 36 days this year – and show how it could amplify portfolio returns by 500% or more in the new cycle.

We’ll walk you through the core trends driving the next leg of this bull market – from AI and automation to the new energy revolution and the overlooked infrastructure plays that enable them.

When you reserve your spot, you’ll also immediately receive three free stock picks – one each from me, Louis, and Eric – tied to the surging trends we’ve been tracking. Consider those a taste of the opportunities that emerge when our vision meets Jonathan’s timing.

I’ve spent my career looking years ahead, identifying the technologies that will rewrite the rules of how we live, work, and invest. Jonathan has mastered the art of catching those ripples in as they happen.

By combining my long‑term road map with his real‑time pulse, investors can capture the best of both worlds: the vision to see what’s coming and the precision to profit as it unfolds. Join us at The Profit Surge Event on Monday, November 10at 1 p.m. ET to learn how innovation and timing together can set up the next great wave of wealth – and how you can be there to catch it.