The Market That Turns Every ‘What If’ Into a Trade

Imagine a stock market where the ticker symbols aren’t companies – but questions.

Will the Supreme Court rule in favor of President Trump’s tariffs? By how much will the Fed cut rates next month? Will AI surpass human intelligence by 2030?

Welcome to the prediction market, where traders can bet on reality itself.

While Wall Street takes stakes in businesses, prediction markets allow us to trade on nearly anything else: politics, economics, sports, tech, culture, elections…

Even mentions in conversation, like how many times Trump will say the word ‘billion’ when he meets with the Saudi prime minister, or what Dell will bring up on the company’s earning call.

And the odds that emerge – say, 56% for a 25-basis-point interest rate cut in December – represent something profound: the collective probability that an event will happen.

In other words, prediction markets don’t just reflect what we think will happen.

They tell us what the world believes will happen – in real time, with real money on the line.

And it might be the most transformational financial invention since options…

What Makes Prediction Markets So Powerful

Human beings aren’t great at forecasting.

Just think about the last time there was a threat of winter weather. Meteorologists might’ve called for eight to 10 inches of snow overnight… but by the time the front had passed, just three inches covered the ground.

Predictive errors like this aren’t just a weather-related phenomenon. Economists are regularly surprised by revised data. Politicians lie. Pollsters miss.

But prediction markets combat this tendency by doing what capitalism does best – aggregating greed and curiosity into useful information.

Instead of surveys, pundits, and noise, we have incentives, liquidity, and price discovery.

And historically, when there’s enough liquidity and diversity of opinion, prediction markets are freakishly accurate. For example, Iowa’s Political Stock Market once predicted U.S. election outcomes more precisely than Gallup polls. Kalshi and Polymarket users have consistently front-run government inflation prints. And during the 2024 election, Polymarket traders nailed the state outcomes days before CNN’s data models did.

Strip away the math, the liquidity pools, and the market tickers, and what you’re left with is something ancient.

Humans have always wagered on the future. From dice in Roman taverns to Wall Street’s derivatives desks, we’ve never stopped trying to price uncertainty.

Prediction markets are simply the next evolution of that instinct: same thrill, higher IQ.

When betting becomes forecasting – when entertainment becomes insight – the entire information economy is rewritten. In a sense, prediction markets are turning the global hive mind into a Bloomberg Terminal.

Imagine a world where:

- Journalists check Polymarket odds before writing articles.

- Hedge funds hedge macro risk via Kalshi ‘event contracts.’

- Retail traders speculate on inflation, interest rates, or Tesla robot production timelines.

- Governments themselves consult markets to gauge the probability of policy outcomes.

In fact, it’s already begun…

Kalshi, Polymarket & Manifold: Where the Future Gets Priced

There are three layers to this revolution – and only a handful of names you need to know.

The Core Platforms Behind the Prediction Boom

These are the ‘exchanges of truth.’

- Kalshi is the Commodity Futures Trading Commission-regulated (CFTC), U.S.-compliant version – the Goldman Sachs (GS) of event markets. You can trade on questions like, “Will the Fed cut rates in December?” or “Will Bitcoin be above $100k by year-end?” These are technically ‘event contracts,’ not gambling – a major legal distinction; and one the courts have recently affirmed in Kalshi’s favor.

- Polymarket is the crypto-native counterpart – global, decentralized, and running on Polygon (POL/USD). It’s where the real frontier action happens. Traders speculate on everything from presidential races to SpaceX launches to AI model release dates. It’s been called ‘Twitter with skin in the game.’

- Manifold focuses on play-money prediction markets integrated with social graphs – think Reddit meets Robinhood meets Nostradamus. It’s gamified collective forecasting, and its data is increasingly used by researchers.

The Infrastructure Powering Predictive Finance

This is where investors can actually make money today because the public markets give us exposure to the picks and shovels powering the prediction revolution.

- USDC (USDC/USD) and Circle (CRCL/USD) – Every on-chain prediction market runs on stablecoins. The more people trade the future, the more demand for USDC. Circle earns interest on that float; Coinbase (COIN) gets a rev share.

Think of stablecoins as the ‘oil’ for predictive markets. - Chainlink (LINK/USD) and UMA (UMA/USD) – These are the oracles that verify outcomes. When a market closes (i.e. “Did Tesla deliver its robot?”), the oracle confirms reality and settles bets. In a world where truth is tokenized, these networks act as the final arbiters.

- Polygon – Polymarket runs on this blockchain. Every transaction, bet, and settlement adds throughput, gas fees, and brand dominance. If truth can be traded, Polygon is the marketplace where those bets clear.

- CME Group (CME) and Cboe (CBOE) – The traditional gatekeepers of derivatives. If Kalshi’s model scales, these firms could easily introduce their own event-contract products – think ‘political futures’ on Wall Street. The regulatory door is already open.

The Retail Catalyst: 23 Million Users Enter Predictive Markets

In March 2025, Robinhood (HOOD) did something nobody saw coming: It launched its own Prediction Markets Hub, built in partnership with Kalshi.

Now 23 million retail investors can trade event contracts on macro and sports outcomes without leaving Robinhood’s platform.

For HOOD, this was a genius play. It merges brokerage, betting, and behavioral finance into one experience.

Just a few months later, Robinhood’s Prediction Markets business is already at a $300-million run-rate, with October contract volume surpassing contract volume throughout all of Q3 2025.

This is big business in hypergrowth.

In our view, Robinhood’s launch was the ‘aha’ moment: prediction markets are going mainstream.

And if this catches fire as we expect, Robinhood could be the first public-market beneficiary of the prediction-market boom.

A Strategic Basket for the Truth Economy Boom

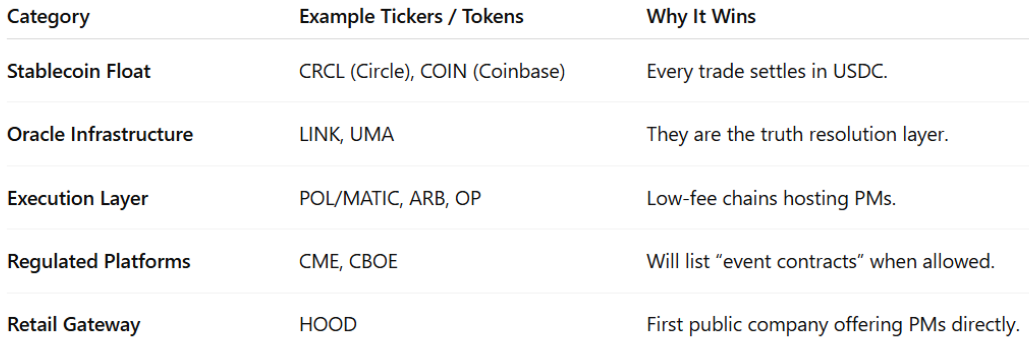

We created the following ‘Truth Economy’ basket to highlight some potential prediction market investment opportunities.

These are stocks and cryptos that should benefit as prediction markets continue to grow, perhaps becoming a global ubiquity.

As you can see, there are five pillars to this basket – the stablecoin, infrastructure, execution, platform, and exchange plays.

All are compelling – but HOOD looks especially attractive to us.

Risks, Regulation, and the Future of Prediction Markets

Now, every gold rush has a sheriff to lay down the law. And in this one, it’s the regulators.

If the CFTC or Congress re-labels event contracts as gambling, U.S.-based platforms could face short-term turbulence.

There’s also wash-trading risk on crypto product managers. Some studies suggest Polymarket’s true volume is smaller than it looks.

Plus, stablecoin revenue is sensitive to Fed rates. Lower yields = smaller spreads for Circle and Coinbase.

But none of that changes the trajectory.

Information wants to be free – and tradable.

We think truth markets are inevitable, meaning regulation can only delay, not derail, that evolution.

The Final Word on the Next Evolution of Markets

Zooming out, the big picture here is clear… and bullish…

Prediction markets sit at the intersection of finance, media, and AI – and may eventually feed all three.

Imagine:

- AI agents that automatically trade probabilities, turning collective human beliefs into machine-readable data.

- Bloomberg terminals displaying ‘probability of Fed rate cut: 47%, powered by live market odds.’

- Social networks where every post can become a market, and every opinion can be priced.

In that world, truth becomes a tradable commodity.

And those who own the rails – the stablecoins, the oracles, the chains, the exchanges – own the economy of reality.

So, if you missed the rise of sports betting…

The DeFi boom…

Or the AI wave…

Don’t miss the Truth Economy: the next great financial frontier.

And unlike Vegas, the house doesn’t win here. The smartest traders do.

Now, the same way prediction markets turn belief into data, artificial intelligence is turning data into wealth.

After a trip to Silicon Valley, I’ve returned with a bold new thesis: the AI “Hyperscale Revolution” is minting millionaires faster than any tech cycle in history. And one small company could become the next Amazon – only in a completely unexpected sector.

P.S. While I focus on long-term megatrends like the rise of predictive markets, Jonathan Rose zeroes in on the short-term ‘surge points’ that occur inside those same trends – the moments when momentum and innovation collide. It’s how he’s spotted trades like +959% on Albemarle (ALB), +534% on MP (MP), and +233% on Rigetti (RGTI).

Now, with the Fed cutting rates and volatility heating up, it’s likely a new profit window has just opened…

That’s why we recently teamed up for The Profit Surge Event, which aired this past Monday. By combining my long-term conviction with his short-term precision, we’ve created a blueprint for trading the biggest wealth event of our lifetimes.

Watch that event replay to learn how to capture five-fold profit potential.