Nvidia Earnings Smash Expectations – and Prove AI Bubble Fears Wrong

For the past several weeks, fears about an ‘AI bubble’ have been hammering AI stocks.

Big Tech’s soaring capex has traders worried that firms are overspending only to underdeliver – and that’s been weighing heavily on the AI trade.

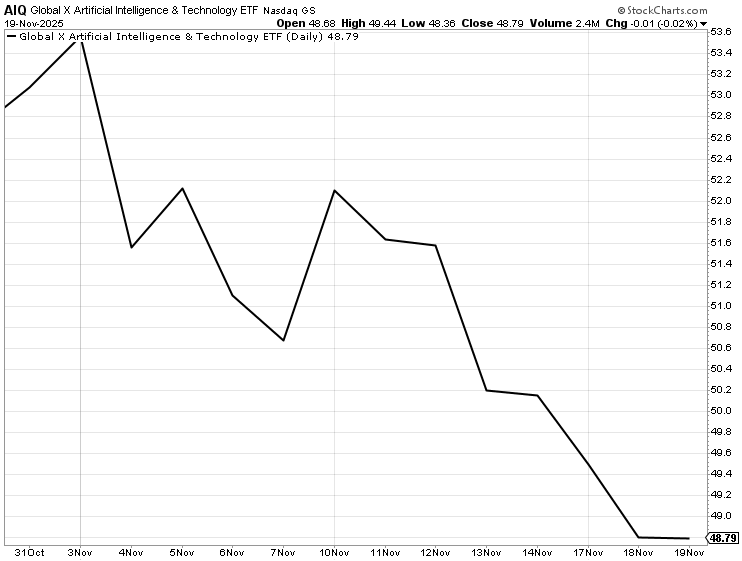

This is illustrated by the Global X Artificial Intelligence & Technology ETF (AIQ) – a strong proxy for the industry – which has been on a downward slope since late October.

That slump mirrored fading confidence in AI demand – until Nvidia (NVDA) changed the tone last night… and resuscitated the AI stock rally.

The tech titan delivered a monster third-quarter earnings report – with even more monstrous guidance for Q4; the sum of which confirms that the AI frenzy is speeding up, not slowing down.

Revenues rose 62% in Q3 and are expected to rise 65% next quarter. This is the first time since late 2023 that Nvidia’s sales growth rate has re-accelerated in two consecutive quarters.

After six straight quarters of slowing growth, the AI plumbing just hit the gas again – and the numbers tell the story…

Nvidia Earnings Overview: The AI Engine Is Accelerating Again

Let’s go over a quick rundown of Nvidia’s latest numbers so you can see just why we’re so bullish here:

- Q3 revenue: $57 billion, up 62% year-over-year (YoY) and 22% quarter-over-quarter (QoQ)

- Data center revenue: $51.2 billion, up 66% YoY and $10 billion sequentially

- Q4 guidance: ~$65 billion in revenue, up ~65% YoY at the midpoint

- Gross margin: ~73-75% non-GAAP – at this scale

We feel it’s important to highlight that this isn’t some tiny high-growth software start-up. Nvidia is running at a $200 billion-plus annualized revenue pace and still compounding north of 60%.

And growth is picking up steam.

For the past six quarters, Nvidia’s sales growth rate had been slowing. Bears believed it to be “the beginning of the end.” But what this quarterly performance just proved is that AI demand wasn’t dying – it was digesting before its next leg up.

Now:

- Growth has re-accelerated to 62%.

- Management is calling for even faster growth next quarter at 65%.

- And that’s with essentially zero China data center revenue baked in.

If you’re looking for evidence that the AI Boom is “slowing,” you won’t find it in Nvidia’s financials.

And that’s just from what we can see on the surface…

The AI Boom Is Speeding Up, Not Slowing Down

Under the hood, the story is even more bullish than what the headline numbers suggest.

Cloud Providers Are Sold Out

On the Nvidia’s conference call, management said the clouds are sold out and that the GPU installed base – Blackwell, Hopper, and older Ampere – is fully utilized.

Translation: there is no sign of hyperscalers slamming on the brakes. If anything, they’re still flooring it.

With current GPU capacity tapped, attention now turns to how far hyperscalers are willing to expand.

AI Capex Spending Is Surging

That full utilization is exactly why Nvidia now sees visibility into roughly $500 billion of Blackwell + Rubin revenue through the end of 2026 – and that number has been increasing as new AI factory deals get signed.

Meanwhile, external estimates now see AI infrastructure spending heading toward $3- to $4 trillion by 2030.

If this were a bubble that was about to pop, we’d be seeing missed estimates, weak guidance, slowing orders, and contracting capex plans.

Instead, we’re witnessing beat-and-raise performance, re-accelerating growth, and bigger long-term capex envelopes.

The ‘AI Bubble’ Fear Just Got Debunked

A recent fund manager survey from Bank of America (BAC) said the ‘AI bubble’ is the No. 1 perceived tail risk, with ~45% of managers citing it.

In effect, Nvidia’s response to Wall Street’s top fear was: ‘Appreciate the concern. See: 62% growth, 65% forward guidance, and sold-out clouds.’

Jensen Huang literally said he doesn’t see an AI bubble – he sees real, widespread demand across clouds, enterprises, and emerging “agentic” and physical AI use cases. And Nvidia’s numbers back him up.

What Nvidia’s Results Mean for AI Stocks

When Nvidia – the core infrastructure tollbooth of AI – is growing faster again, it sends one clear macro signal: The AI Boom is not ending but compounding.

We’re still early in three overlapping transitions:

- CPU → accelerated computing

- Static software → generative AI

- Screen-bound apps → agentic + physical AI (aka robotics)

Each wave adds a new layer of demand on top of the last one. That’s how you end up with a world where AI chips, clouds, power, magnets, and storage all become multi-trillion-dollar ecosystems…

Which brings us to the fun part: what to buy on the AI rebound.

Now, this is not an exhaustive list by any means. But here are some of the names we’d consider on an AI-stock rebound.

Nvidia – The Core AI Tollbooth

This is still the primary index fund of the AI Boom.

- 62% revenue growth.

- 65% estimated growth in Q4.

- 66% data-center growth.

- 73- to 75% gross margins.

- Sold-out clouds.

- Half-trillion-dollar product pipeline visibility.

Until those facts change, Nvidia remains the core AI holding.

AMD – The Fast-Growing Challenger

If Nvidia is the tollbooth, AMD (AMD) is the bypass lane that keeps getting bigger.

- Its MI300/MI350 roadmap is aiming for massive gains in AI inference – up to 35x improvement for future chips versus current gen.

- At its analyst day, AMD projected data center chip revenue reaching $100 billion and overall earnings more than tripling by 2030, implying ~35% annual growth.

As hyperscalers move toward a multi-vendor strategy, AMD is positioned to capture a big slice of incremental AI accelerator demand.

CoreWeave – The Specialized AI Cloud

CoreWeave (CRWV) is basically the Nvidia-as-a-Service company – a specialized AI cloud built on Nvidia GPUs.

- Q3 revenue grew 134% YoY.

- It has multi-billion deals with Microsoft (MSFT), OpenAI, and Meta (META) for AI infrastructure capacity, plus a big cloud capacity agreement with Nvidia itself.

Yes, there are financing and concentration risks. But if you want leveraged exposure to AI compute demand without buying a chip designer, this is about as direct as it gets.

Nebius – The Stealth AI Player

Nebius (NBIS) is a Yandex spin-off turned Western AI cloud, now cutting huge deals of its own:

- Spun out of Yandex to focus on AI cloud infrastructure.

- Signed a $19.4 billion AI infrastructure deal with Microsoft, supplying dedicated GPU capacity from a New Jersey data center through 2031.

- Reported 355% revenue growth – and a $3 billion AI contract with Meta.

In other words: another hyperscale-adjacent GPU landlord directly riding the AI infrastructure wave.

Oklo – Powering the AI Grid

AI doesn’t just need chips. It needs enormous amounts of power provided 24/7.

That’s where Oklo (OKLO) comes in:

- Sam Altman–backed micro-reactor company focused on small modular nuclear.

- Signed a framework deal with Switch to supply up to 12 GW of nuclear power to data centers through 2044 – one of the largest corporate power agreements ever.

- Boosted its Aurora reactor design to 75 MW explicitly to meet AI data-center demand, and partnered with Vertiv (VRT) to co-design nuclear-powered, AI-optimized data-center infrastructure.

If Nvidia is the brain of the AI era, Oklo is a candidate to be part of its circulatory system.

MP Materials – The Magnet Supplier for Physical AI

Every joint, AI-optimized fan, and EV-style drive unit in a humanoid robot needs rare earth magnets to function. That’s MP Materials‘ (MP) domain.

MP is:

- America’s only fully integrated rare earth miner + magnet manufacturer.

- A key supplier of neodymium magnets used in EVs, smartphones, robots, and now increasingly data centers and AI hardware.

If you believe in physical AI – humanoids, warehouse bots, robotaxis – you definitely want exposure to the magnet supply chain.

Celestica – The AI Hardware Builder

Of course, someone has to actually build all the servers, racks, and systems that hold up the AI industry.

Celestica (CLS) has quietly become a ‘dark horse’ in this arena:

- Q3 revenue grew ~28%, with management raising its 2025 outlook on surging AI/hyperscaler demand.

- Hyperscalers now make up 77% of its Connectivity & Cloud Solutions segment, up from 51% in 2022.

As AI server volumes explode, Celestica becomes a picks-and-shovels play on the physical build-out.

Seagate – The Storage Backbone of AI

After chips, clouds, and power, there’s still one unsung hero of the AI stack: storage. All those tokens and model checkpoints have to live somewhere.

- Seagate (STX) is shipping 30TB-plus hard drives to specifically meet the surge in AI data-center storage demand – with 40TB drives already sampling and 44- to 50TB on the roadmap.

- AI data centers are creating a global HDD shortage, with backorders stretching out years and Street targets rising for both Seagate and Western Digital (WDC).

If AI is a data engine, Seagate is one of the key beneficiaries of the storage bottleneck.

Bottom Line: Nvidia Earnings Signal AI’s Second Leg Up

Nvidia just did the one thing the bears didn’t want it to…

After six quarters of slowing, it showed that AI revenue growth is re-accelerating – and likely to keep gaining speed.

That’s not the profile of a bubble about to pop. That’s the profile of a structural boom grinding higher through the noise.

So, yes – we think this report will go a long way toward putting “AI Bubble” fears to bed, at least for a while. And if it sparks the rebound rally we expect, names like NVDA, AMD, CoreWeave, Nebius, Oklo, MP, Celestica, and Seagate are exactly the kind of AI infrastructure plays we want on our buy-the-dip list.

It is time to get positioned for the AI rally coming back to life.

That said, the center of gravity in Big Tech is shifting beneath our feet. The innovation race that once belonged to Silicon Valley is now being refereed in Washington, D.C., where the government holds the purse strings for AI infrastructure, chip exports, and the next generation of trillion-dollar breakthroughs.

So, don’t just watch earnings… watch where the influence is coming from. In the AI age, the winners won’t just build the best chips… they’ll build the closest ties with our government. Policy, power, and positioning now determine which companies get subsidized, which get throttled, and which are left behind.

Because of how critical this moment is, I jumped on camera to break it all down in a short video… you’ll see what’s changing, which stocks stand to benefit, and why this moment matters more than any single earnings report.

Watch our special briefing here.