Nvidia Earnings Smash Records, but Wall Street Panics Anyway

Just a few days ago, Nvidia (NVDA) delivered some of the most impressive earnings results we’ve seen all season…

Record revenue of $57.0 billion, +22% quarter-over-quarter (QoQ) and +62% year-over-year (YoY)…

And record data center revenue of $51.2 billion, +25% QoQ and +66% (YoY).

Plus, CEO Jensen Huang couldn’t have been more enthusiastic during the company’s quarterly call.

“Blackwell sales are off the charts, and cloud GPUs are sold out… Compute demand keeps accelerating and compounding across training and inference – each growing exponentially. We’ve entered the virtuous cycle of AI. The AI ecosystem is scaling fast – with more new foundation model makers, more AI startups, across more industries, and in more countries. AI is going everywhere, doing everything, all at once.”

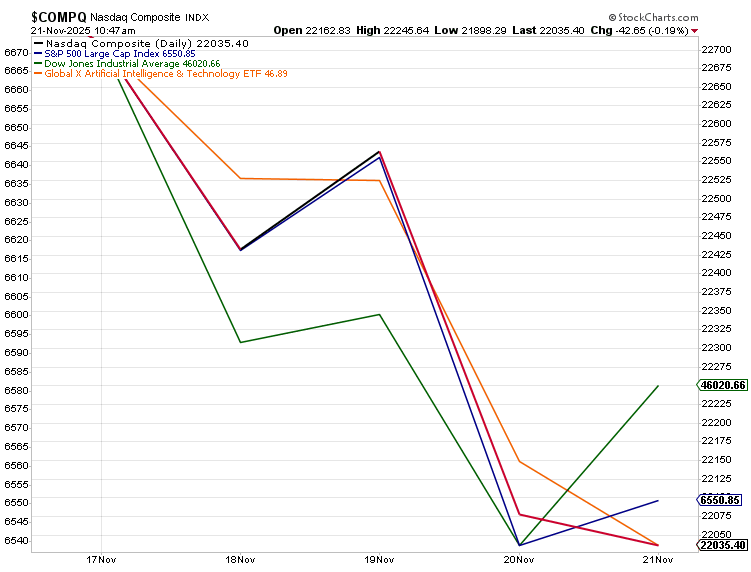

Initially, the Street reacted positively to this blockbuster report – but that enthusiasm was quickly replaced by investors’ overwhelming skepticism.

After a few short hours of gains, stocks sold off sharply – and they’ve largely been floundering ever since… especially AI stocks.

So, let’s unpack Wall Street’s freakout, shedding light on why some of those worries are real – but manageable – and, most importantly, why we still think this is a buy-the-fear moment for AI stocks…

Nvidia’s Quarter: Record-Breaking Results Across the Board

First, the facts – for its fiscal Q3 2026, Nvidia reported:

- Revenue: $57.0 billion, up 22% QoQ and 62% YoY

- Data center revenue: $51.2 billion, up 25% QoQ and 66% YoY

- GAAP EPS: $1.30, up 67% from a year ago

- Gross margin: mid-70s, still absurdly high for a hardware company

- Q4 guidance: $65 billion in revenue, plus or minus 2% – another big sequential step-up

On top of that, the balance sheet is immense:

- Operating cash flow: $23.8 billion this quarter, up from $17.6 billion a year ago

- Accounts receivable: $33.4 billion with 53 days sales outstanding, actually down from 54 days last quarter

- Inventory: $19.8 billion, up from $15.0 billion last quarter, as the firm stocks up for Blackwell and future architectures

- Supply commitments: $50.3 billion

- Multi-year cloud service agreements: $26.0 billion, up from $12.6 billion in just one quarter

These colossal numbers don’t reflect a ‘bubble stock’ trying to hold it together but, rather, one of the best growth-and-profit stories in market history.

So, then, why did the broader AI trade wobble? And why are traders suddenly doom-posting about circular financing and accounts receivable blowups?

We see three main reasons…

Why Wall Street Sold the News on Nvidia’s Earnings

Expectations Were In the Stratosphere

Nvidia is no longer just another earnings report. It’s the heartbeat of the entire AI trade.

The stock has exploded over the past three years. And investors came into this quarter with one implicit assumption: ‘Show me perfection… or else.’

After that kind of run, even a great quarter can turn into a “sell the news” event.

Options were pricing in a big move. AI bubble narratives were already swirling. Nvidia basically had to beat, raise, and also make everyone feel safe about the next three to five years of AI capex in a single call.

That’s a nearly impossible bar.

The ‘Cisco Moment’ Fear Explained – and Why It’s Overblown

This is the part you’re seeing all over X:

- Accounts receivable jumped, leading bears to believe the company is ‘booking fake growth’ by letting customers pay later.

- Inventory rose to almost $20 billion.

Bears: ‘If GPUs are ‘sold out for years,’ why is inventory piling up?’ - Cloud commitments doubled to $26 billion, fueling fears about circular financing.

Bears: ‘Nvidia commits to buy cloud capacity from customers, customers buy more GPUs from Nvidia, and everyone pretends it’s organic demand.’

Layer on top of that huge supply commitments with foundries and suppliers and very concentrated revenue in a handful of hyperscalers and AI clouds – and you get a neat bearish story: “This isn’t real, broad-based demand. This is a small group of U.S. hyperscalers overbuilding AI capacity, helped along by Nvidia’s own balance sheet. When the music stops, so does Nvidia’s growth.”

That narrative hits an emotional nerve, especially for investors who remember the ‘Cisco moment’ of the dot-com era. Cisco Systems (CSCO) seemed like the indispensable backbone of the internet boom, trading at impossible multiples… until enterprise spending froze, and the stock lost nearly 90% from its 2000 peak.

With Nvidia, bears see a similar setup today: an essential supplier riding a technology revolution whose customers might soon overbuild and then pull back.

Macro Pressures Add to AI Capex Concerns

Not to mention, the macro overlay has many people worried.

AI capex is running at a massive annualized clip, with Big Tech projected to spend approximately $400- to $405 billion in 2025. And the Federal Reserve is still in tightening/QT mode.

That has skeptics asking the same question over and over: “Are we really getting enough ROI from all these GPUs to justify the spend?”

So, when they see rising AR, inventory, and multi-year commitments, they mentally connect the dots to ‘overbuild’ and ‘capex hangover’ – even if the income statement and cash flow statement still look flawless today.

Why Nvidia’s Fundamentals Still Signal Strength

Now, let’s be fair; the bears are not crazy. There are some valid concerns and real risks here:

- Customer concentration – A huge percentage of Nvidia’s data-center revenue is tied to a handful of hyperscalers and AI cloud providers. The 10-K/10-Q is blunt: multiple customers are over 10% of revenue. If those big buyers decide they’ve overbuilt, Nvidia feels it fast.

- Vendor financing & guarantees – Nvidia’s multi-year cloud agreements and willingness to guarantee data center leases for partners like CoreWeave (CRWV) do increase its exposure. If one of these partners stumbles, Nvidia may be on the hook.

- Big inventories and supply commitments – Nearly $20 billion of inventory and $50 billion of supply commitments is a massive demand bet. If the AI curve bends down, that becomes a problem.

So, yes – there is real cyclicality risk in the AI infrastructure build-out. This is not a risk-free straight line.

But that’s also where the bear case starts to overshoot.

The Panic Is Overdone

First, so far, the AR scare is mostly a nothingburger.

AR is high in absolute terms – but so is revenue. And Days Sales Outstanding sit at 53 days – actually better than last quarter’s 54.

If Nvidia were juicing numbers by shoving product out the door on crazy terms, you’d expect AR to grow much faster than revenue and DSO to spike higher.

Instead, revenue is up 62% YoY, DSO is flat-to-down, and operating cash flow hit $23.8 billion in the quarter.

That’s not what ‘fake growth’ usually looks like.

Second, the inventory spike is explainable – even logical – in the context of Blackwell.

Management explicitly says they’re ordering ahead to secure long lead-time components and support the Blackwell ramp and future architectures.

In other words, they see so much demand coming that they’d rather eat the working capital today than lose share or miss orders tomorrow.

Could that prove too aggressive if demand slows? Absolutely. But it’s also exactly what you’d want a dominant supplier to do when it keeps telling you ‘cloud GPUs are sold out’ and the backlog is enormous.

Third, the ‘circular financing’ story ignores the other side of the equation: AI is already driving real revenue for Nvidia’s customers.

- Meta (META) credits AI recommendation and ad tools for its revenue re-acceleration and strong margins.

- Alphabet (GOOGL) just posted its first $100-billion quarter and is ramping AI-related capex because search, YouTube, and cloud are monetizing AI features.

The hyperscalers doing the bulk of the spending are already increasing engagement, improving ad performance, lowering compute costs with more efficient AI stacks, selling more software, etc.

That doesn’t mean there won’t be overbuild at the margin. There always is. But it does mean this isn’t some empty, revenue-less, fiber-optic bubble.

The Big Picture: The AI Boom Is Just Evolving

Let’s step back from the quarter and look at the trajectory.

Earlier this year, Nvidia’s revenue growth had been slowing. Now it’s reaccelerating – 56% YoY in Q2, 62% YoY in Q3. And management just pointed to another big step-up for Q4.

Data center – the heart of the AI story – is compounding even faster at +66% YoY.

If this were truly the ‘top’ of an AI bubble, you’d expect:

- Growth decelerating sharply

- Guidance rolling over

- Customers quietly pausing capex

But we’re seeing the opposite.

What is happening is that the market is shifting from AI euphoria to AI underwriting.

Early in this boom, it was like businesses got paid just for saying ‘AI’ in a press release.

But here in late 2025, investors are finally asking companies to show them the cash flows, the balance sheet discipline – and that it’s more than just financial engineering.

That’s healthy. It’s exactly what needs to happen for the AI trade to evolve from speculative mania into a long, durable bull market.

Investor Playbook: Turn Fear Into Opportunity

Our take here is pretty simple.

Yes, Nvidia and the AI complex have real risks – customer concentration, capex cycles, the potential for overbuild.

Yes, some smaller AI clouds and second-tier players will blow up or get acquired when the cycle turns.

But no, this quarter doesn’t support the idea that AI was a ‘mirage.’

The income statement, cash flow, and guidance all suggest the same thing: the AI Boom is still very much alive.

We are in the middle of a massive capex and productivity cycle, not the bitter end of a bubble. For investors, that means we can:

- Use the fear around AR, inventory, and circular financing as an opportunity – not an exit signal.

- Focus on high-quality AI infrastructure names (chips, networking, storage, power) and the big software/cloud platforms that are already monetizing AI in their profit & loss statements.

- Treat this phase as what it is: A transition from ‘AI hype trade’ to ‘AI cash-flow trade.’

When the market starts obsessing over bookkeeping details in the middle of 60%-plus revenue growth and record cash flow, it’s usually not the end of a boom. More often than not, it’s the buyable wobble before the next leg higher.

In fact, we see this as the makings of one of the best buying opportunities the AI Boom has offered thus far.

We don’t catch falling knives, of course. But we do prepare our buy list so we can pounce when technical support arrives. And there’s one stock in particular we think could go vertical when these market tides shift.

It’s one with the potential to upend a $1.9 trillion industry – and mint millionaires along the way.

Find out the name of the stock we see as the ‘next Amazon.’