Indian markets look pricey but robust macros attract foreign investors

Foreign institutional investors are back betting big on the Indian markets with the inflationary environment beginning to cool off, fueling hopes of less aggressive rate hikes by the central banks world over, bond yields easing out, and the dollar index going down.

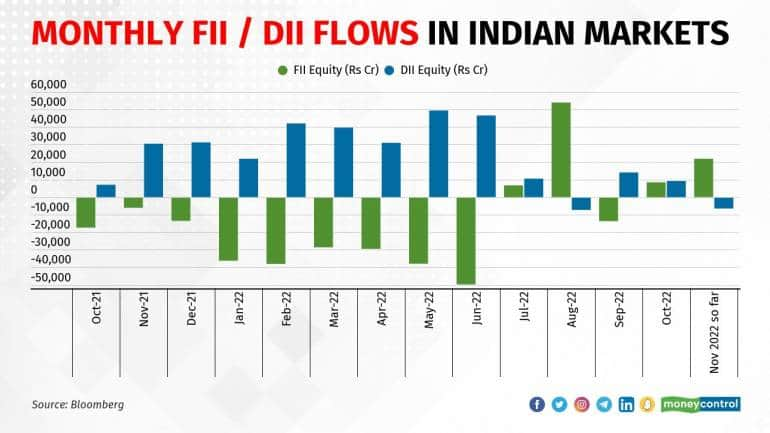

The FIIs have bought Indian equities worth Rs 55,754 crore in the last four months from July to October 2022 and in November so far, they have purchased Rs 21,927 crore worth of Indian shares. This has been a sharp rebound from one of the worst churns the Indian markets have seen with FIIs pulling out Rs 2.54 trillion in 9 months from October 2021 to June 2022. The exodus of foreign investors had pulled the benchmark NIfty50 from its record high of 18,604 in October 2021 to below 15,200 in June 2022.

The return of foreign investors have through the last five months has sent the Nifty within the striking distance of its all-time high as it touched its 52-week high of 18,428 on November 15.

The rally in the market, however, is intercepted by a raging volatility triggered by various geopolitical crises. Talks of soaring valuations have become widespread and there are increasing doubts over the sustainability of the up-move.

The fundamentals and domestic macros come to the rescue. There are more chances that the rally will not lose steam in the immediate future, according to experts. “A lot will depend on the global risk appetite and FPIs have been buyers off late, which reflects the rising risk appetite,” argued Deepak Jasani, Head of Retail Research at HDFC Securities.

The apparent negative factors such as sluggish economic growth, soaring inflation and rising interest rates are discounted positively in the sense that these negatives are already in the price and any improvement from here could push valuations higher.

India is not cheap. Will the FIIs stay?

“Last four months have seen strong cumulative inflows indicating a reversal of trend and with CPI inflation in India and in US showing signs of relief which, coupled with most of the uncertainties being priced in for now, we believe that this rally could continue for the next few months,” said Divam Sharma, Founder of Green Portfolio.

Historically the last two months of the calendar year have always been good for global equities and this time, too, this has turned out to be true.

Most global stock markets delivered negative returns on a year-to-date basis. “Vietnam and Russia are down more than 40 percent, while the US, Hong Kong, Korea, New Zealand and many European markets are on track to close the year anywhere between minus-10 to minus-25 percent returns,” said Gopal Kavalireddi, Head of Research, FYERS.

India has outperformed its emerging market peers and is trading at a premium to some other comparable markets now and may continue to do so in the foreseeable future. “On absolute basis, the Nifty is trading around 21-22x trailing (TTM) earnings which is not expensive, given the healthy growth trend in corporate earnings,” said Gaurav Dua, Senior VP and Head of Capital Market Strategy at Sharekhan by BNP Paribas.

According to Ram Kalyan Medury, Founder and CEO, Jama Wealth, the profit-to-earning ratio is a function of liquidity and a P/E of around 20 is quite attractive, even if it looks higher relative to other markets since the Nifty touched 40 only in February 2021.

However, while the market level valuation ratios look high compared to other markets, one needs to keep in mind that India is a more domestic economy with less impact of global factors.

“While the global economy might struggle with major regions like Europe going through possible recession for a couple of quarters, India is not going to be impacted that much,” said Vikas Gupta, CEO and Chief Investment Strategist at OmniScience Capital.

The domestic factors for the Indian economy are quite favourable with robust demand from consumers, and the private and government sectors. Also, the government capital expenditure plans are quite robust and substantial.

Experts believe that over the next few years, India will benefit from a higher percentage allocation of foreign capital in the emerging market space.

“While there will be pullbacks from time to time but on a relative basis India will continue to outperform and rally in India markets is intact supported by domestic positive cues,” said Raj Vyas, Portfolio Manager at TejiMandi.

Reasons for ensuing bullishness

The global population has just crossed 8 billion and India is home to 17.5 percent of these people. A large part of the country’s demography comprising young working-age population offers the advantages of considerable human capital, higher economic growth and improved standard of living.

“Even in the current times where uncertainty and volatility are the order of the day, the Indian economy is projected to grow at 7 percent, a healthy rate by most standards and with emerging opportunities for investment, a large demography for supporting consumption, considerable natural resources and a reform-oriented and stable government, India has all the ingredients necessary for attracting sustainable foreign capital, and leapfrogging into the cluster of top 3 economies of the world,” said Kavalireddi of FYERS.

India’s robust domestic economic environment is bolstered by the solid participation of local investors in the market in times of crisis. When the FIIs went on selling spree, domestic institutional investors breathed Rs 2.99 trillion over 9 months into equities, keeping an imminent crash at bay.

Mutual fund SIP inflows hit an all-time high of Rs 13,040 crore in October, after five straight months of inflows above Rs 12,000 crore.

“Within the emerging market constituents, heavyweight markets like China and Taiwan are facing country-specific issues in terms of sharp slowdown or geopolitical uncertainty, while India’s response to pandemic was fiscally prudent (unlike some of the peers) and has not led to imbalances seen in some other economies,” Dua pointed out.

These factors prompt experts to remain bullish on India – in the medium to long term.

Which sectors will provide legs for the next phase of rally?

In the next phase of the rally, experts expect banks, autos, engineering and select consumer companies to lead the rally. While on the other hand, the global commodities-driven business and exports-driven companies could remain laggards in the coming months.

“The brightest spot in the current earnings season belongs to the Indian banking sector and the trends across PSU and private banks indicate waning NPAs, rising credit growth and healthy profits,” said Kavalireddi.

Consumerism across India has returned, on the back of higher discretionary consumption. “With 3.2 million weddings planned over the next 9-10 weeks across India, estimations call for Rs 3 lakh crore worth of business to be generated over a short time,” said Kavalireddi. The wedding industry provides a multiplier effect, boosting business for home improvement, travel, food and beverage, automotive, hotels, jewellery, footwear, apparel, electronics, finance, event management, and many allied services.

While these opportunities could be short-term, they could provide the necessary impetus to an economy witnessing subdued exports and lower global demand. Domestic consumption has and will continue to support the rise of the Indian economy in the years to come.

Vyas of TejiMandi, expect the infrastructure sector to pick up in sync. “Why we say this is because we have our next general election in 2024 and prior to this (say 18-24 months) we generally see a pick-up in infrastructure activities and as infrastructure activity picks up, we will see pick-up in cement and steel, which act as its raw material,” he said.

This year, IT has underperformed and experts do not expect further downside to it. With easing inflation in the US and expectation of slowdown in interest rates over there as well, the risk-reward in the IT sector looks favourable.

Sharma of Green Portfolio is bullish on many incumbents of chemicals and pharma space. These sectors have underperformed over the last one or two years and their valuations have now become attractive. “In the pharma space, we have seen some large players reporting good set of numbers and the same was also reflecting in the rally in their share prices”. He expects this rally to go broader into the sector going forward.

Disclaimer: The views and investment tips of investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.