Market coupling casts a shadow on IEX. What should investors do?

Market coupling refers to forming of a single power trading entity owned by the government where price discovery will happen with power getting dispatched to short-term power trading platforms

Market coupling is bad news for IEX, which is the market leader and has the highest volumes of power trading.

‘);

$(‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]);

//if(resData[stkKey][‘percentchange’] > 0){

// $(‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”);

// $(‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”);

//}else if(resData[stkKey][‘percentchange’] < 0){

// $(‘#greentxt_’+articleId).removeClass(“greentxt”).addClass(“redtxt”);

// $(‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”);

//}

if(resData[stkKey][‘percentchange’] >= 0){

$(‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”);

//$(‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”);

$(‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”);

}else if(resData[stkKey][‘percentchange’] < 0){

$(‘#greentxt_’+articleId).removeClass(“greentxt”).addClass(“redtxt”);

//$(‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”);

$(‘#gainlosstxt_’+articleId).find(‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”);

}

$(‘#volumetxt_’+articleId).show();

$(‘#vlmtxt_’+articleId).show();

$(‘#stkvol_’+articleId).text(resData[stkKey][‘volume’]);

$(‘#td-low_’+articleId).text(resData[stkKey][‘daylow’]);

$(‘#td-high_’+articleId).text(resData[stkKey][‘dayhigh’]);

$(‘#rightcol_’+articleId).show();

}else{

$(‘#volumetxt_’+articleId).hide();

$(‘#vlmtxt_’+articleId).hide();

$(‘#stkvol_’+articleId).text(”);

$(‘#td-low_’+articleId).text(”);

$(‘#td-high_’+articleId).text(”);

$(‘#rightcol_’+articleId).hide();

}

$(‘#stk-graph_’+articleId).attr(‘src’,’//appfeeds.moneycontrol.com/jsonapi/stocks/graph&format=json&watch_app=true&range=1d&type=area&ex=’+stockType+’&sc_id=’+stockId+’&width=157&height=100&source=web’);

}

}

}

});

}

$(‘.bseliveselectbox’).click(function(){

$(‘.bselivelist’).show();

});

function bindClicksForDropdown(articleId){

$(‘ul#stockwidgettabs_’+articleId+’ li’).click(function(){

stkId = jQuery.trim($(this).find(‘a’).attr(‘stkid’));

$(‘ul#stockwidgettabs_’+articleId+’ li’).find(‘a’).removeClass(‘active’);

$(this).find(‘a’).addClass(‘active’);

stockWidget(‘N’,stkId,articleId);

});

$(‘#stk-b-‘+articleId).click(function(){

stkId = jQuery.trim($(this).attr(‘stkId’));

stockWidget(‘B’,stkId,articleId);

$(‘.bselivelist’).hide();

});

$(‘#stk-n-‘+articleId).click(function(){

stkId = jQuery.trim($(this).attr(‘stkId’));

stockWidget(‘N’,stkId,articleId);

$(‘.bselivelist’).hide();

});

}

$(“.bselivelist”).focusout(function(){

$(“.bselivelist”).hide(); //hide the results

});

function bindMenuClicks(articleId){

$(‘#watchlist-‘+articleId).click(function(){

var stkId = $(this).attr(‘stkId’);

overlayPopupWatchlist(0,2,1,stkId);

});

$(‘#portfolio-‘+articleId).click(function(){

var dispId = $(this).attr(‘dispId’);

pcSavePort(0,1,dispId);

});

}

$(‘.mc-modal-close’).on(‘click’,function(){

$(‘.mc-modal-wrap’).css(‘display’,’none’);

$(‘.mc-modal’).removeClass(‘success’);

$(‘.mc-modal’).removeClass(‘error’);

});

function overlayPopupWatchlist(e, t, n,stkId) {

$(‘.srch_bx’).css(‘z-index’,’999′);

typparam1 = n;

if(readCookie(‘nnmc’))

{

var lastRsrs =new Array();

lastRsrs[e]= stkId;

if(lastRsrs.length > 0)

{

var resStr=”;

let secglbVar = 1;

var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’;

$.get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) {

$(‘#backInner1_rhsPop’).html(data);

$.ajax({url:url,

type:”POST”,

dataType:”json”,

data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs},

success:function(d)

{

if(typparam1==’1′) // rhs

{

var appndStr=”;

//var newappndStr = makeMiddleRDivNew(d);

//appndStr = newappndStr[0];

var titStr=”;var editw=”;

var typevar=”;

var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’);

var phead =’Why add to Portfolio?’;

if(secglbVar ==1)

{

var stkdtxt=’this stock’;

var fltxt=’ it ‘;

typevar =’Stock ‘;

if(lastRsrs.length>1){

stkdtxt=’these stocks’;

typevar =’Stocks ‘;fltxt=’ them ‘;

}

}

//var popretStr =lvPOPRHS(phead,pparr);

//$(‘#poprhsAdd’).html(popretStr);

//$(‘.btmbgnwr’).show();

var tickTxt =’‘;

if(typparam1==1)

{

var modalContent = ‘Watchlist has been updated successfully.’;

var modalStatus = ‘success’; //if error, use ‘error’

$(‘.mc-modal-content’).text(modalContent);

$(‘.mc-modal-wrap’).css(‘display’,’flex’);

$(‘.mc-modal’).addClass(modalStatus);

//var existsFlag=$.inArray(‘added’,newappndStr[1]);

//$(‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’);

//if(existsFlag == -1)

//{

// if(lastRsrs.length > 1)

// $(‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’);

// else

// $(‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’);

//

//}

}

//$(‘.accdiv’).html(”);

//$(‘.accdiv’).html(appndStr);

}

},

//complete:function(d){

// if(typparam1==1)

// {

// watchlist_popup(‘open’);

// }

//}

});

});

}

else

{

var disNam =’stock’;

if($(‘#impact_option’).html()==’STOCKS’)

disNam =’stock’;

if($(‘#impact_option’).html()==’MUTUAL FUNDS’)

disNam =’mutual fund’;

if($(‘#impact_option’).html()==’COMMODITIES’)

disNam =’commodity’;

alert(‘Please select at least one ‘+disNam);

}

}

else

{

AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’;

commonPopRHS();

/*work_div = 1;

typparam = t;

typparam1 = n;

check_login_pop(1)*/

}

}

function pcSavePort(param,call_pg,dispId)

{

var adtxt=”;

if(readCookie(‘nnmc’)){

if(call_pg == “2”)

{

pass_sec = 2;

}

else

{

pass_sec = 1;

}

var postfolio_url = ‘https://www.moneycontrol.com/portfolio_new/add_stocks_multi.php?id=’+dispId;

window.open(postfolio_url, ‘_blank’);

} else

{

AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’;

commonPopRHS();

/*work_div = 1;

typparam = t;

typparam1 = n;

check_login_pop(1)*/

}

}

function commonPopRHS(e) {

/*var t = ($(window).height() – $(“#” + e).height()) / 2 + $(window).scrollTop();

var n = ($(window).width() – $(“#” + e).width()) / 2 + $(window).scrollLeft();

$(“#” + e).css({

position: “absolute”,

top: t,

left: n

});

$(“#lightbox_cb,#” + e).fadeIn(300);

$(“#lightbox_cb”).remove();

$(“body”).append(”);

$(“#lightbox_cb”).css({

filter: “alpha(opacity=80)”

}).fadeIn()*/

$(“.linkSignUp”).click();

}

function overlay(n)

{

document.getElementById(‘back’).style.width = document.body.clientWidth + “px”;

document.getElementById(‘back’).style.height = document.body.clientHeight +”px”;

document.getElementById(‘back’).style.display = ‘block’;

jQuery.fn.center = function () {

this.css(“position”,”absolute”);

var topPos = ($(window).height() – this.height() ) / 2;

this.css(“top”, -topPos).show().animate({‘top’:topPos},300);

this.css(“left”, ( $(window).width() – this.width() ) / 2);

return this;

}

setTimeout(function(){$(‘#backInner’+n).center()},100);

}

function closeoverlay(n){

document.getElementById(‘back’).style.display = ‘none’;

document.getElementById(‘backInner’+n).style.display = ‘none’;

}

stk_str=”;

stk.forEach(function (stkData,index){

if(index==0){

stk_str+=stkData.stockId.trim();

}else{

stk_str+=’,’+stkData.stockId.trim();

}

});

$.get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?classic=true&sc_id=’+stk_str, function(data) {

stk.forEach(function (stkData,index){

$(‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]);

});

});

function redirectToTradeOpenDematAccountOnline(){

if (stock_isinid && stock_tradeType) {

window.open(`https://www.moneycontrol.com/open-demat-account-online?classic=true&script_id=${stock_isinid}&ex=${stock_tradeType}&site=web&asset_class=stock&utm_source=moneycontrol&utm_medium=articlepage&utm_campaign=tradenow&utm_content=webbutton`, ‘_blank’);

}

}

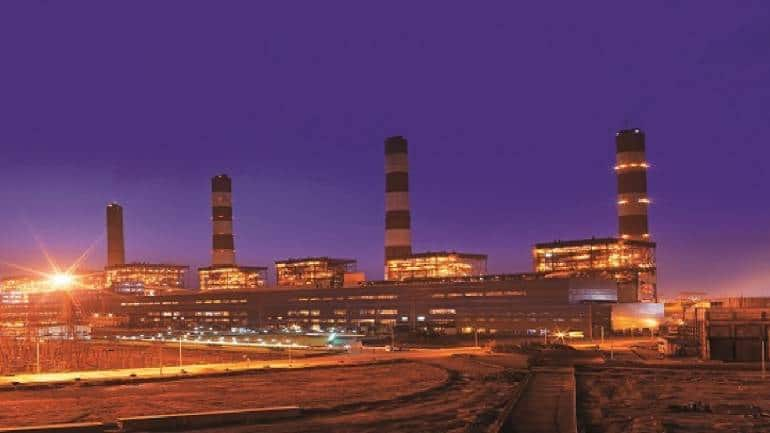

The implementation of the market coupling method for spot power trading has cast a shadow on Indian Energy Exchange (IEX). This is evident from the 22 percent crash in the stock price in just two days. The stock even hit a 52-week low of Rs 116.05 on June 9 morning.

What has triggered this selling?

The Ministry of Power (MoP) recently announced its decision to go ahead with market coupling.

MoP has directed the Central Electricity Regulatory Commission (CERC) to speed up the consultation process and to implement market coupling in a timely manner.

What is market coupling?

Market coupling refers to forming of a single power trading entity owned by the government where price discovery will happen with power getting dispatched to short-term power trading platforms.

How would market coupling impact IEX?

With market coupling, IEX is seen becoming a price taker from a price maker.

Previously, IEX acted as a “price maker,” meaning it had a significant role in setting the price of electricity traded on its platform.

As a result of market coupling, the Exchange is now considered a “price taker.” This means that the price of electricity traded on the platform is influenced by broader market conditions and the prices established in interconnected markets. The IEX no longer has the sole authority to set prices, but instead accepts the prevailing market prices determined by interconnected markets.

IEX–an Indian electronic system-based power trading exchange–is a market leader and has the highest volumes in terms of power trading, according to ICICI Securities.

Read more | Sugar stocks in a sweet spot, El Nino arrival sparks shortage fears

IEX enjoys a virtual monopoly in trading of electricity with around 90-95 percent market share, some market experts say. IEX is said to command a near 100 percent market share in Day-Ahead Market (DAM) and Real-Time-Market (RTM) segments, which contribute 75-80 percent of exchange volumes.

IEX’s dominant position is almost monopolistic in the segment, said Nirav Karkera, Head of Research, Fisdom. “Under market coupling, dominance won’t matter much, considering uniformity in pricing across exchanges. IEX’s advantageous position as a platform for price discovery could lose its sheen as the market coupler takes over,” he explained.

Karkera added that the strength in the service layer and pricing structures will play a more important role going ahead, and such a shift will pave the way for existing competition to start nibbling into IEX’s dominant position. The development is also expected to level the playing field, inviting interest of new players, which will eventually threaten IEX’s monopolistic dominance, he added.

Currently, IEX is the most trusted platform for electricity spot price determination in India, which is its business moat, Nuvama Institutional Equities said.

Read more | IEX says market coupling will kill innovation, move akin to clubbing Ola, Uber

However, introduction of a full-fledged market coupler implies an independent third party will collate all buy or sell bids and derive a uniform market price across all exchanges, and this potentially negates the moat of the IEX, as other exchanges can eat into its market share over time, explained Nuvama Institutional Equities.

The firm has maintained its ‘reduce’ rating on the stock with a target price of Rs 127.

ICICI Securities added: “This (development) will dry up volumes in a significant manner for IEX among other power trading platforms and snatch away the moat of creating liquidity and price discovery by IEX.”

Antique Stock Broking pointed out that a coupling operator will pose a new challenge for dominant exchanges like IEX. Incentives by competitor exchanges like Hindustan Power Exchange (HPX) and Power Exchange India Ltd (PXIL) can eat into volume growth, the firm said while downgrading its rating on shares of IEX to ‘sell’ with a target price at Rs 105.

Nuvama Institutional Equities has built in a compounded annual growth rate in volume of around 16 percent over FY24–30 and sees headwinds in the near term due to implementation of market coupling, high power price-driven shift in power volumes away from the spot market to longer-duration instruments, and rising competition.

Follow our live blog for all the market action

What are HPX and PXIL?

Currently, India operates three power exchanges, namely IEX, HPX, and PXI.

HPX is a power exchange in the Indian electricity market, promoted by PTC India, BSE and ICICI Bank. PXI, which also provides an electronic platform for transactions in power and allied products, is backed by NSE and National Commodity & Derivatives Exchange.

Technical view

IEX experienced a significant decline after a remarkable rally concluded in October 2021. The stock attempted to stabilize around the Rs. 130 level, but unfortunately, this proved unsuccessful, and it has since resumed its downward trajectory, pointed out Santosh Meena, Head of Research, Swastika Investmart.

Read more | Axis Securities is betting on these mid, smallcaps for up to 32% upside

“Currently, it appears that the immediate downside target is around Rs 107, with a potential bottom around Rs 98. This level represents a 78.6 percent retracement of the previous bull run, which spanned from Rs 38 to Rs 318,” he said.

For new investors, he suggests caution and to avoid rushing into buying IEX shares at this time, as there are no clear indications of a reversal in the stock’s performance. On the other hand, existing investors may consider holding onto their positions, as the worst of the decline seems to be behind us.

Sameet Chavan, Head Research, Technical and Derivatives, Angel One, pointed out that the stock has been a laggard in the past 15 odd months.

Chavan said, “Technically speaking, we do not see any near term relief in the prices as the decline is backed by humongous volumes. The stock is trading at new 2-year lows and hence, we advise traders to stay away from the stock” until stability returns.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.