F&O Manual: Positive market trends persist despite volatility on expiry; metal and realty sectors support sectoral indices

Nifty crucial support zone stands at 19400– 19500 while the resistance zone is placed at 19650-19700.

Despite volatility on expiry, all the sectoral indices are trading positively, supported by the metal, realty, and information technology sectors.

As of 11:08 am, the Nifty traded 155 points or 0.80 percent higher at 19,540.20, while the Bank Nifty also traded 322.10 points or 0.72 percent higher at 44,961.55.

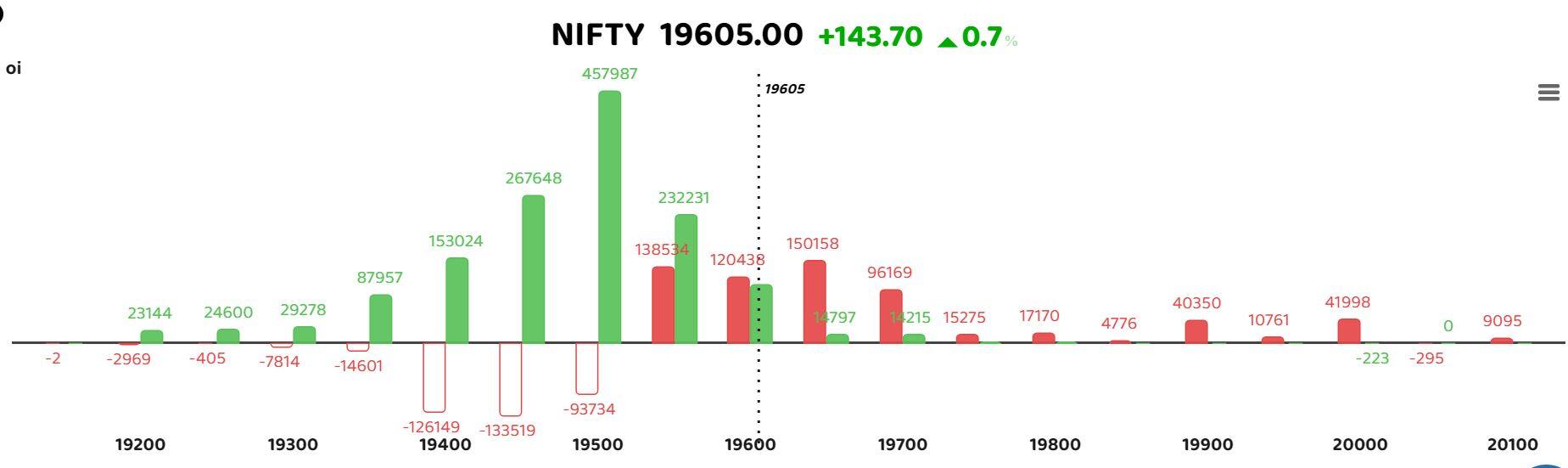

The bar graph reflects the change in OI (Open Interest) during the day. Red bars represent call option OI, while green bars represent put option OI.

The bar graph reflects the change in OI (Open Interest) during the day. Red bars represent call option OI, while green bars represent put option OI.

According to options data, put writers were dominant in the Nifty. Overall, the trend is positive, and the Nifty is undergoing a time-wise correction. The crucial support zone is between 19,400 and 19,500, while the resistance zone is between 19,650 and 19,700.

“Until we get a decisive close beyond the extremes of the range (19,300 – 19,550), we expect the consolidation to continue. The strategy to trade during such a consolidation would be to take a contrarian view around the extremes of the range,” stated Jatin Gedia, Technical Research Analyst at Sharekhan by BNP Paribas.

ICICI Securities believes that 19,500 is likely to act as an immediate hurdle zone, and sustaining above it would result in a fresh upward move.

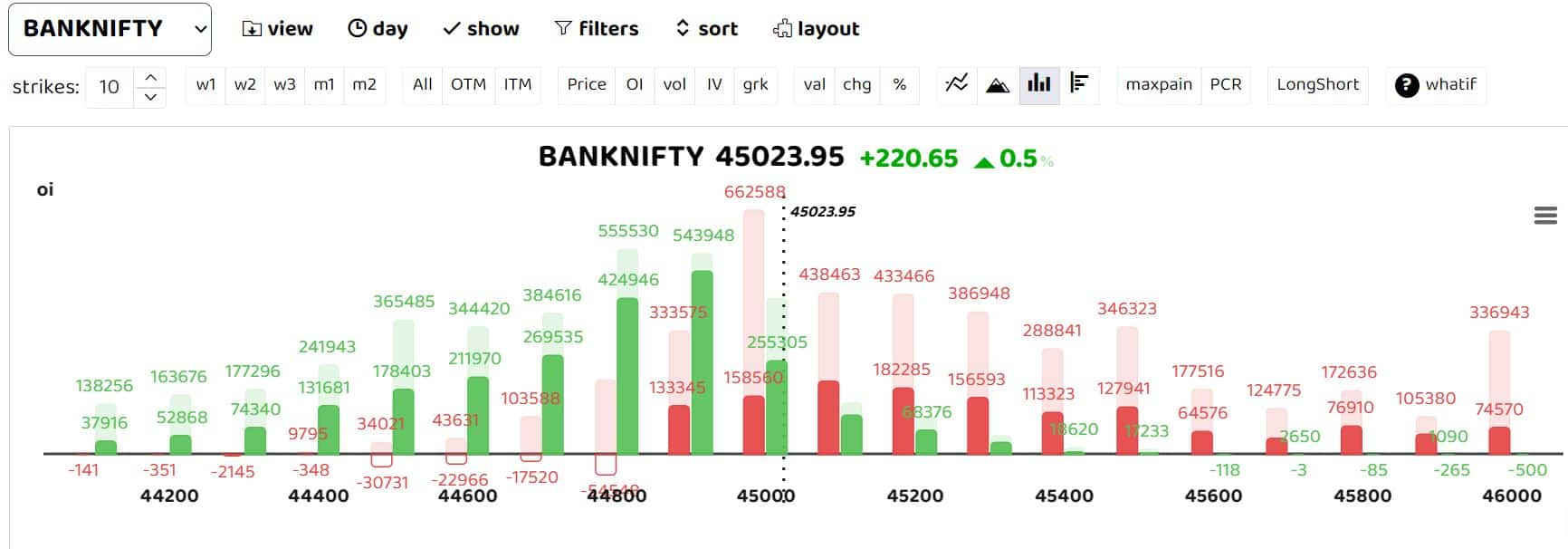

The bar graph reflects the change in OI (Open Interest) during the day. Red bars represent call option OI, while green bars represent put option OI.

The bar graph reflects the change in OI (Open Interest) during the day. Red bars represent call option OI, while green bars represent put option OI.

The option activity in BankNifty at the 45,000 levels shows a strong struggle with straddles at 44,950-45,000 levels. Buying is emerging from the lower levels based on the daily charts, while 45,000 is acting as a key hurdle area on the higher side.

Rajesh Shrivastava, a derivatives trader, has a bearish view on Bank Nifty but not a significant decline, expecting Bank Nifty to close around 44,800 levels. “The option activity at the 45,000 Strike provides cues about Bank Nifty’s future direction, with the bears currently having the upper hand,” stated Ashwin Ramani, Derivatives & Technical Analyst at SAMCO Securities.

Among individual stocks, there was a long buildup seen in Intellect, BSoft, ICICIPruLi, and RBL Bank. Meanwhile, a short buildup was seen in Federal Bank, Deltacorp, and Powergrid.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.