F&O Manual | Markets trade negative amid global weakness; Nifty struggles at 19,800 level

Among individual stocks INFY, TechM and Persistent were those that saw short buildup while IndiaMart and MPhasis saw long buildup.

Indian markets opened negatively, following the largely lower Asian markets and lower US markets. US stocks finished mostly lower on Thursday, with the Nasdaq and S&P 500 dragged down by lagging earnings from technology stocks Tesla and Netflix.

As of 12:09 pm, the Nifty index was down 1.01 percent or 201.10 points at 19,778.05. The Nifty Bank was down 0.34 percent or 155.65 points at 46,031.25.

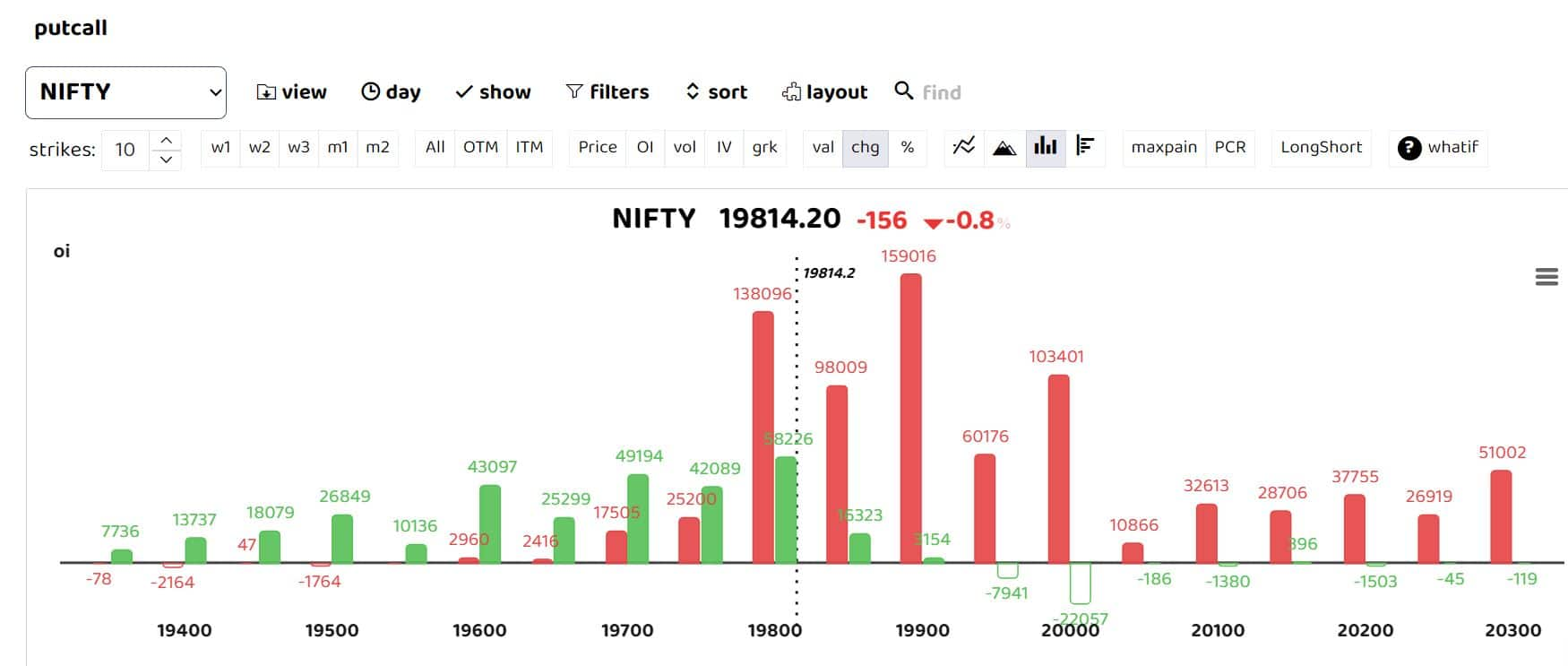

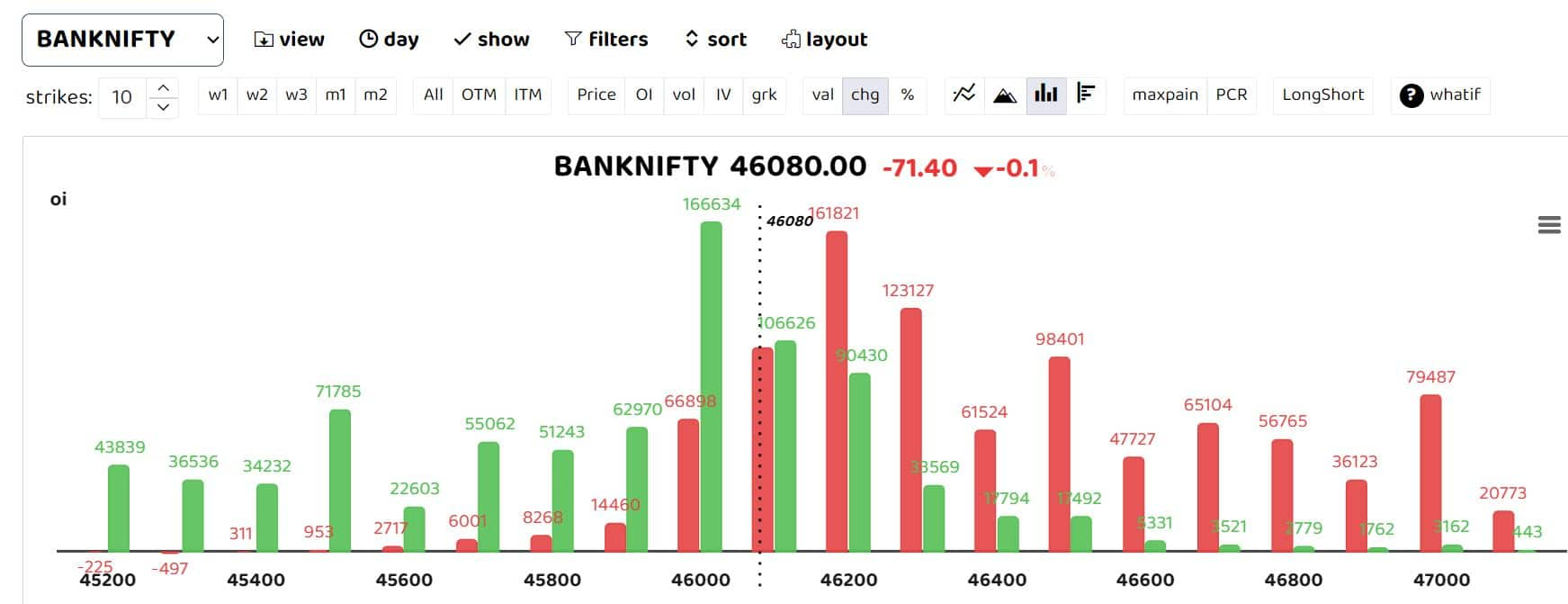

Bars reflect the change in OI during the day. Red bars show call option OI, and green bars show put option OI.

Nifty produced a strong positive candle almost touching the psychological zone of 20,000 level continuing with the upward journey to gain almost 1,300 points in the last one month. Chances of some breather with profit booking after the long bull run cannot be ruled out with near term support being placed near 19,600-19,650 zone. The Nifty closed shy of 20,000 levels amid continued FII buying support. ICICI securities believes that for the day, Nifty opened with a gap down on back of weak Infosys results. However they believe buying is likely to emerge from lower levels.

The support for the day is seen at 19,700 levels while the resistance is seen at 19,900 followed by 20,000 levels.

Bank Nifty continues to outperform the Nifty with. Bank nifty will have strong support at 45,500. Both the PSU as well as the private bank index saw gains of more than 0.70 percent. For the next week analysts believe bank Nifty will lead the rally with 46,500-46,700 as possible targets.

Prabhudas Lilladher has stated that BankNifty has indicated a strong close breaching above the crucial resistance zone of 46,900 levels to strengthen the bias further confirming a positive trend and can expect for next targets of 47,000-47,500 in the coming days. The major frontline banking stocks like Kotak Bank, ICICI Bank, Axis Bank, SBI and HDFC Bank are well placed with positive bias to pull the index to new heights. BankNifty would have the daily range of 45,900-46,700 levels, added the brokerage house.

Among individual stocks INFY, TechM and Persistent were those that saw short buildup while IndiaMart and MPhasis saw long buildup.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.