Over 60 small-caps make it big with double-digit returns as market hits fresh highs

Over the near term, the ongoing earnings season and FII flows would continue to hold away over equity markets.

The market continued its record run this week with the Nifty inching near the 20,000 mark and Sensex shooting past 67,000 points for the first time, led by better progress of monsoon, decent earnings from India Inc and steady foreign capital inflow despite mixed global cues.

There was some selling pressure on Friday, though, amid weakness in IT stocks after Infosys slashed its guidance for the rest of this fiscal.

The BSE Sensex ended the week with a gain of 0.94 percent or 623.36 points to finish at 66,684.26, and Nifty50 added 0.92 percent or 180.5 points to end at 19,745.

During the week, the Sensex and Nifty touched fresh record highs of 67,619.17 and 19,991.85. The BSE Large-cap and Mid-cap indices added 0.5 percent each, and Small-cap index 1.3 percent.

“The domestic market witnessed a broad-based rally during the week, strengthened by encouraging domestic macroeconomic data and sustained inflows from FIIs. The unlocking of value by heavyweights (like RIL and ITC) also helped in apprising the main indices. Mixed cues from global peers did not cause any serious disturbance in the mood of the domestic market as FII inflows stayed put with the prospects of the Indian economy,” said Vinod Nair, Head of Research at Geojit Financial Services.

“The bull run was, however, interrupted lately by weak guidance from Infosys, which cast a shadow over the outlook for the Indian IT sector. The banking sector led the sectoral rally in anticipation of a good Q1 result. The picture of global markets was mixed as the US market struggled with weak earnings. In the upcoming week, investors will be closely focused on the FOMC meeting. While a 25-basis point rate hike is widely expected, investors will be more interested in the committee’s commentary on future rate actions, seeking clues for the anticipated future rate pause,” he said.

On the sectoral front, the Nifty PSU Bank index climbed 4 percent, Nifty Media index 3 percent, Nifty Bank index 2.8 percent, and Nifty Pharma and Energy indices added 2 percent each. On the other hand, Nifty IT index shed 3.5 percent.

“The equity markets trended higher during the week and made a series of fresh closing all-time highs. The continued inflow of FII money and improved sentiments led to buoyancy in domestic equity markets. Healthy results in the ongoing earnings season, value unlocking through HDFC-HDFC Bank merger and Reliance demerger, expectations of inflation peaking out globally and indications of a soft landing in the US helped boost the positive sentiment,” said Joseph Thomas, Head of Research at Emkay Wealth Management.

“Over the near term, the ongoing earnings season and FII flows would continue to hold away over equity markets; some profit booking though cannot be ruled out,” he added.

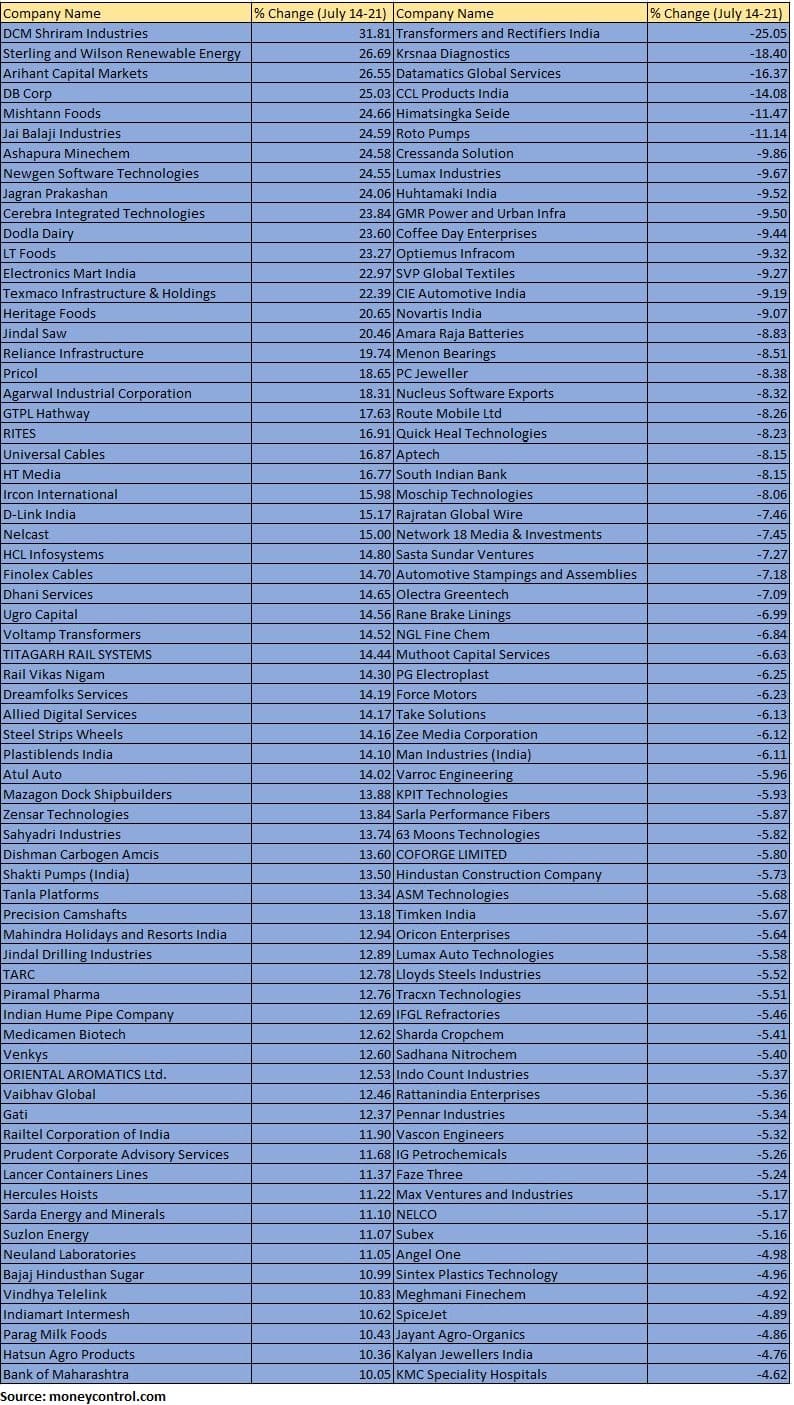

The BSE Small-cap index ended the week with 1.3 percent gain with DCM Shriram Industries, Sterling and Wilson Renewable Energy, Arihant Capital Markets, DB Corp, Mishtann Foods, Jai Balaji Industries, Ashapura Minechem, Newgen Software Technologies, Jagran Prakashan, Cerebra Integrated Technologies, Dodla Dairy, LT Foods, Electronics Mart India, Texmaco Infrastructure & Holdings, Heritage Foods and Jindal Saw rising 20-32 percent.

On the other hand, Transformers and Rectifiers India, Krsnaa Diagnostics, Datamatics Global Services, CCL Products India, Himatsingka Seide and Roto Pumps lost 11-25 percent.

In this week, Foreign institutional investors (FIIs) purchased equities worth Rs 3,115.26 crore, while domestic institutional investors (DIIs) offload equities worth Rs 776.69 crore.

In this month so far, FIIs bought equities worth Rs 17,697.89 crore and DII sold equities worth Rs 8,906.19 crore.

Road ahead for Nifty50

Let’s hear out what experts have to say on the bull run and the dynamics of the Nifty 50 index.

Amol Athawale, Vice President – Technical Research, Kotak Securities

Overnight fall in tech-heavy Nasdaq triggered a wave of massive correction in local software stocks led by Infosys, which slashed the revenue growth guidance for the rest of the year due to sharp deterioration in discretionary spending by the clients. The record upsurge in the markets in such a quick time was already raising concerns of expensive valuations, and hence investors took this opportunity of weak US cues to prune their holdings, although India’s fundamentals remain on strong footing.

Technically, on intraday charts, the Nifty has breached the crucial support of 19825 and post breakdown it is comfortably trading below the same, which is largely negative. In addition, a sharp intraday correction and reversal formation on daily charts is also indicating temporary weakness. Below 19825, the weak sentiment is likely to continue below the same and could slip till 19600-19550.

On the flip side, a fresh uptrend rally is possible only after the dismissal of 19825 and above the same, the index could retest the level of 19900-19950. Contra traders can take a long bet near 19550 with a strict stop loss of 30 points.

For Bank Nifty, 45800-45500 would be the key levels to watch out for and above the same, the index could move up till 46500-46900. On the flip side, below 45500 would be vulnerable.”

Siddhartha Khemka, Head – Retail Research, Motilal Oswal Financial Services

All eyes will be on the US Fed and ECB policy meeting next week. Investors would also take cues from various macro data that would be released. With the result season picking up pace, we expect a lot of stock-specific action and provide direction to domestic equities in the coming week. Apart from Index heavyweight Reliance, banking sector is also likely to be in focus as ICICI Bank and Kotak Bank would announce results over the weekend.

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas

On the daily charts, we can observe that the Nifty has held on to the zone of 19680 – 19700 where support in the form of the 50% Fibonacci retracement level (19677) of the rise from 19361 – 19992 and the 40-hour moving average is placed. During the current up-move, the 40-hour average has always absorbed the selling pressure and held on to start a fresh leg of up-move.

We believe that there can be some consolidation considering the sharp rise it has witnessed in the last few trading sessions. Overall, the uptrend is still intact, and we believe that this dip is a pullback and not a trend reversal. In terms of levels, 19677 – 19700 shall act as a crucial support zone, and on the upside 19880 – 19900 shall act as an immediate hurdle zone.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.