F&O Manual | Nifty faces resistance near 20,000 mark amid rush to book profits

Stocks like RIL, PVR, Inox, and Biocon see short buildup; ICICI Prudential and REC Ltd witness long buildup.

Markets opened gap-down tracking negative global cues. The BSE Midcap and Smallcap indices were up 0.5 percent each. Among sectors, auto, realty, IT, power and capital goods indices were up 0.5-1 percent each, while the metal index shed 0.5 percent.

As of 12:05pm, the Nifty index was down 0.26 percent or 50.65 points at 19,694.35, while Nifty Bank was down 0.30 percent or 136.25 points at 45,938.95.

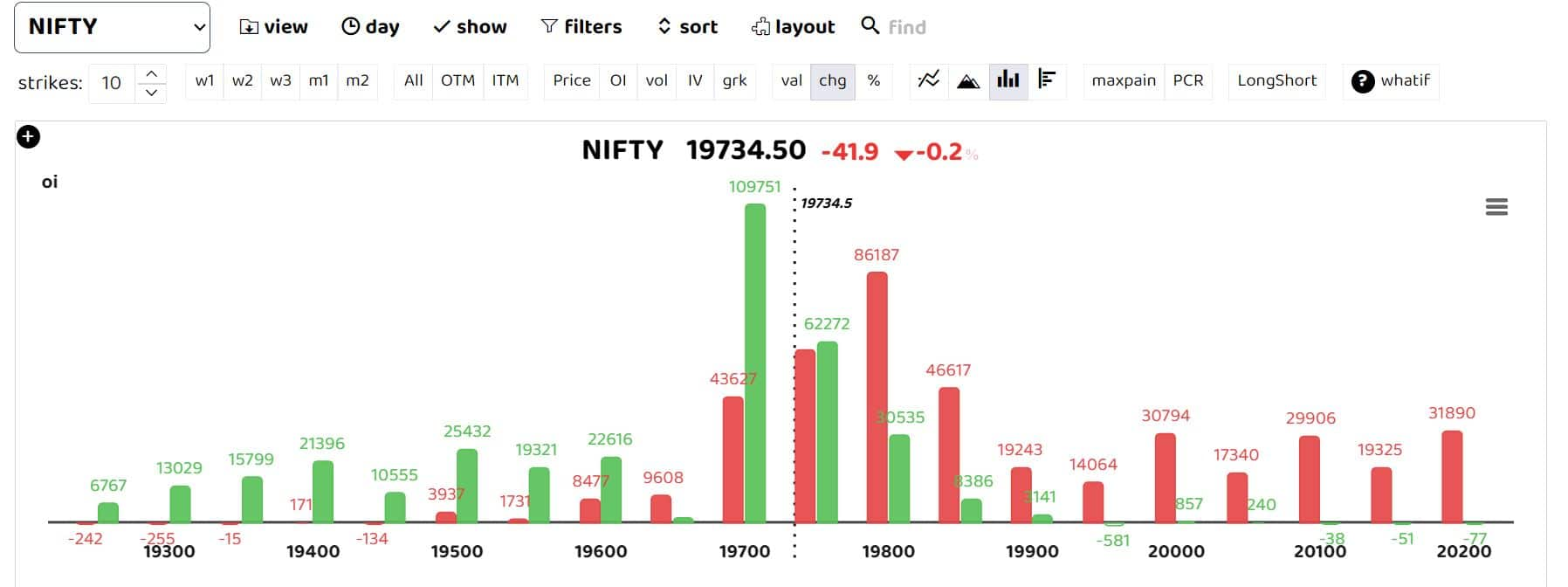

Bars reflect the change in OI during the day. Red bars show call option OI, and green bars show put option OI

The Nifty had started the week on a positive note and inched towards the 20,000 mark. However, profit-booking in the index heavyweights on Friday led the index to pare some of its weekly gains. As a result, the weekly price action formed a bull candle with an upper shadow, highlighting profit-booking near the psychological 20,000 mark.

As per ICICI securities, follow-through strength above last week’s high of 19,991 would lead to an extension of the rally towards 20,200 and a failure to do so would lead index into a healthy consolidation in the 20,000-19,500 range ahead of FOMC meet and monthly expiry week amid progression of earning season.

Key point to highlight is that, over the past 15 sessions, the Nifty has rallied over 1,100 points, which hauled daily and weekly stochastic oscillators in overbought conditions, indicating the possibility of extended profit-booking in recently run-up stocks cannot be ruled out. Further, ICICI securities advises traders that dips should be utilised to accumulate quality stocks as strong support for the Nifty is placed at 19,500.

Follow our live blog for all market action

As per Sameet Chavan, Head Research, Technical and Derivatives, Angel One, the psychological mark of 20,000 that was missed by a whisker last week remains an immediate hurdle, followed by the golden retracement target of 20,100 – 20,200. On the downside, the recent congestion breakout level of 19,600 – 19,500 is considered immediate support, and a more significant correction may occur only if this level is breached, added Chavan. He has advised traders to closely monitor these levels and consider playing within this range.

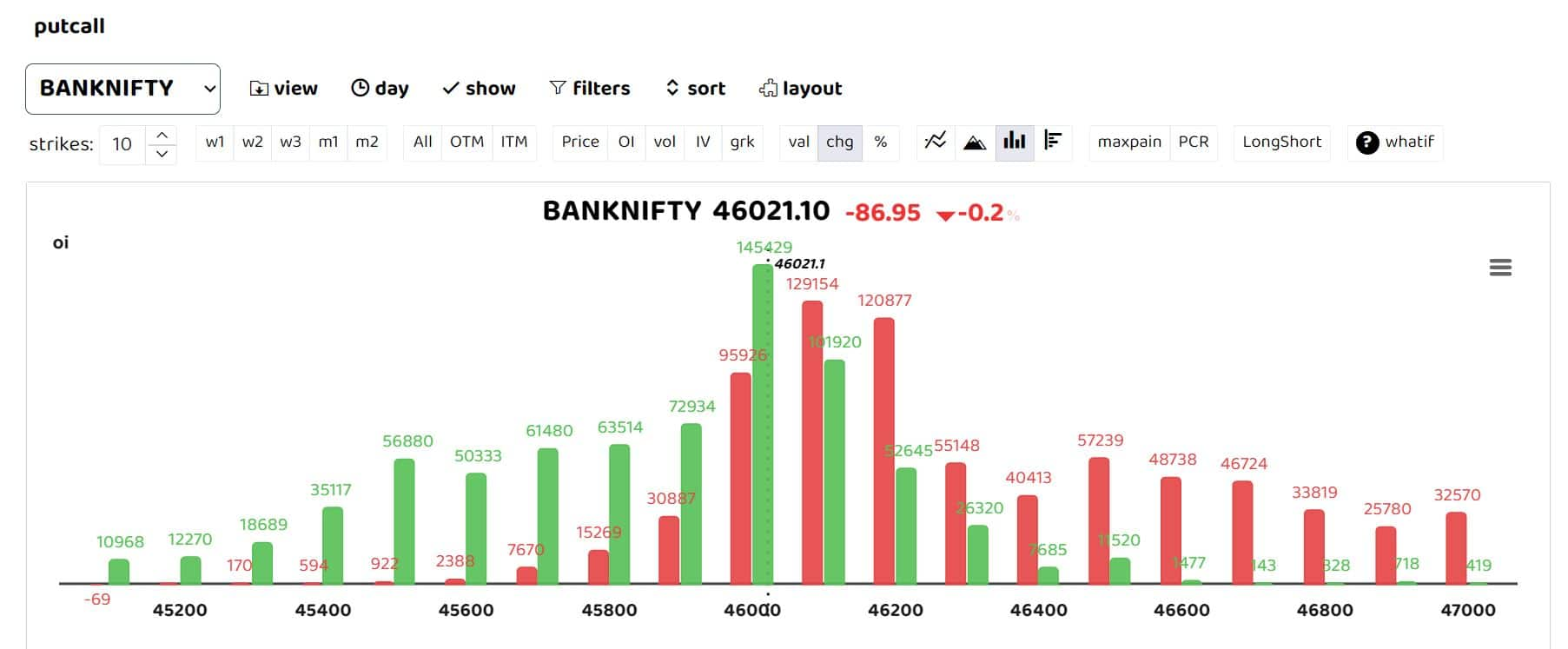

Bars reflect the change in OI during the day. Red bars show call option OI, and green bars show put option OI

Bank Nifty sees some volatility in today’s session. A tussle of call and put writers can be seen around 46,000 levels. Strong support can be seen at 45,600 while key resistance is at 46,400.

Among individual stocks, RIL, PVR Inox and Biocon saw short buildup, while ICICI Prudential and REC Ltd saw long buildup.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.