F&O Manual | Market rebounds, Nifty trades higher with dominant Put writers

Among individual stocks HindCopper, IDFC and ACC saw a long buildup, while PEL and RBL Bank saw a short buildup.

The Indian equity market took a breather after a four-week rally as bulls chose to take some money off the table. Indices opened in the red but traded marginally higher by the afternoon. The BSE midcap index was up 0.6 percent and the smallcap index 1 percent. Among sectors, IT, metal, oil and gas, and power was up 1 percent each, while the FMCG index was down 0.5 percent. HDFC Bank, Piramal Enterprises, Bandhan Bank, NTPC and Infosys are among the most active shares on the NSE.

Around midday, the Sensex was up 190.26 points or 0.29 percent at 66,350.46, and the Nifty was up 54.90 points or 0.28 percent at 19,700.90. About 2,072 shares advanced, 1,104 shares declined, and 153 shares traded unchanged.

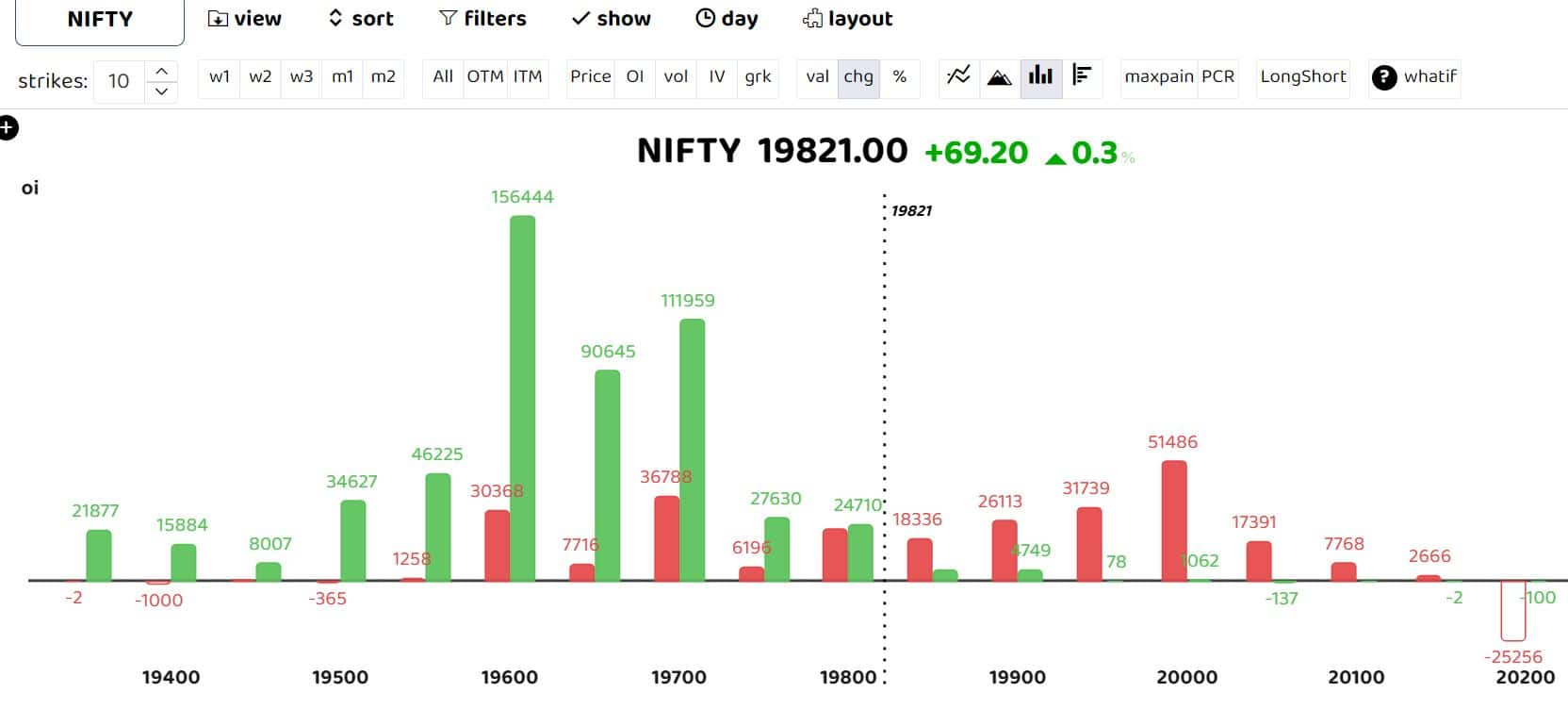

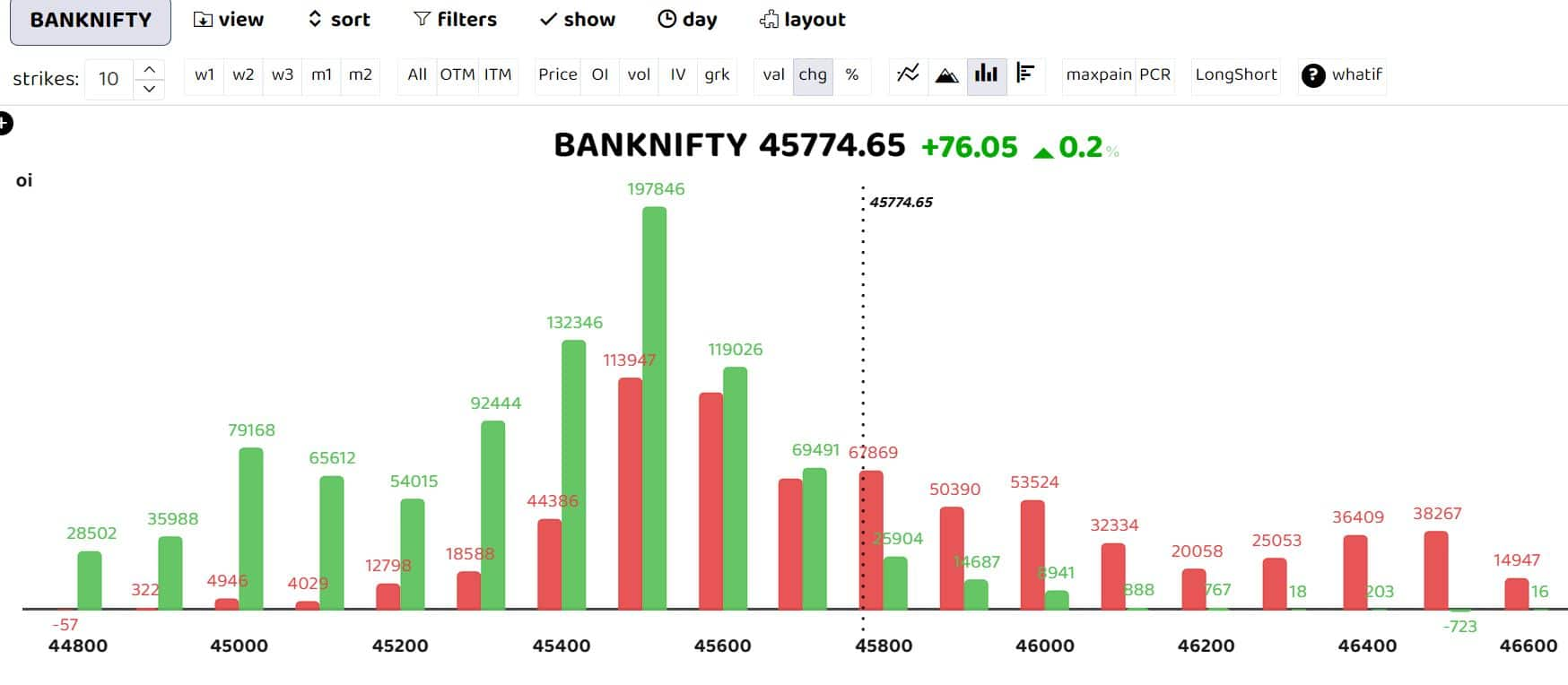

Bars reflect the change in OI during the day. Red bars show call option OI, and green bars show put option OI.

After resisting near the psychological barrier of 20,000 zone, the Nifty has slipped down with support near 19,600 levels on two occasions, indicating a strong base and climbed further to 19,800. As per options data, the support for the day is seen at 19,550-19,600 levels, while the resistance is seen at 19,850, followed by the 20,000 levels.

As the month ends, in the August series rollover note, brokerage firm Motilal Ostwal stated, “The Nifty formed a bullish candle and has been making higher highs, higher lows from the last four series with addition in open interest by 33.84 peries in the series with a rise in price by 3.63 percent on an expiry-to-expiry basis. Rollover of Nifty stood at 84 percent, which is higher than its quarterly average of 77 percent. Continuous longs have been added at support zones which has acted as a good base, which may keep the market afloat.”

Sameet Chavan, Head Research, Technical and Derivatives, Angel One Ltd said,” Technically speaking, amid the ongoing breather in the market, the chart structure construes optimism, and it is likely to continue the cheerful run in the comparable period. As far as levels are concerned, till the index firmly withholds the pivotal support of 19,500, there is no sign of caution in the market. While on the higher end, 19,800-20,000 holds stiff resistance and a decisive move beyond which could trigger the next leg of rally.”

He advocates traders to focus on stock-specific action. Also, to stay vigilant to global developments as they may act as a catalyst in setting up a near-term tone.

The BankNifty, after resisting near the 46,300 zone, has slipped down with near-term support maintained near the 45,000 levels and with 46,100 zone acting as the important hurdle. As per analysts, a decisive breach above the hurdle is needed to carry on the momentum still further ahead with the next targets of 48,000-48,200 anticipated.

At the same time, a decisive breach below the 45,000 levels would further weaken the bias and can extend the slide with next major support visible near 44,200-44,300 levels. As per options data key straddle positions are at 45,500 and 45,600 levels.

Among individual stocks HindCopper, IDFC and ACC saw a long buildup, while PEL and RBL Bank saw a short buildup.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.