The crystal ball for the US economy: How do things look now?

Devina Mehra, First Global (File pic)

Over the last few days, there has been a flood of data and announcements coming out from the US: Inflation, the Fed rates change and GDP numbers.

First, the big picture: The US economy appears to be gliding to a soft landing; inflation is now coming down without a bad recession or disruption.

This scenario is frankly better than what most observers, including myself, had expected.

Last year, the three-month yield (interest rate) had gone up above the 10-year one. This, as an indicator for over 50 years, had always predicted a recession but this time that expected recession did not materialise.

This teaches us an important lesson that I often repeat: For any kind of macroeconomic forecasting, you usually simply don’t have enough data points to make any categorical statement that will stand scrutiny on a statistical basis. For any macroeconomic scenario, you do not have 30 or 40 instances of a similar kind where only one variable changes, so any projections made based on past experience are conjectures at best.

Hence, in this case, an indicator that over the last 50 years had always predicted a recession failed…which, of course, can be considered a good outcome.

Let’s come back to the data and statements.

Inflation IS finally slowing down

The inflation numbers that came out were better than estimated, meaning inflation fell to levels lower than expected.

In June 2023, US Consumer Price Index (CPI) rose 3 percent over June 2022 versus a forecast of 3.1 percent and previous reading of 4 percent.

In terms of details:

-Food inflation seems to have subsided to a comfortable 2 percent annual pace based on the 3- and 6-month annualised numbers.

-Shelter (housing) inflation finally shows signs of disinflation (i.e. lower inflation), with the 3-month annualised rate dropping to 5.7 percent from 9.5 percent in February.

-The Fed’s preferred inflation gauge, core services ex-housing, within CPI, eased in June to 4 percent YoY, the slowest since December 2021 after peaking close to 6.5 percent.

-On the flip side, the year-on-year measure of inflation will lose its benefit from favorable base effects going forward in the second half of 2023.

While the report shows inflation below estimates, the Fed won’t emphasize a single month’s data and will continue to watch the trends to decide on future action.

What did the Fed do?

The Fed (US Central Bank) meeting last Wednesday went as per our expectations:

-25 basis points (0.25 percent point) hike in Fed rates

-Mildly dovish statements from the Fed Chair

Let me first explain why the Fed has been raising interest rates very rapidly over the last year and a half from a bottom of 0-0.25 percent to 5.25-5.5 percent presently.

The Fed has increased rates because inflation rose very rapidly in the US – even touching 9 percent in 2022, as against a target of 2 percent.

The Fed tightened or raised interest rates because higher interest rates put a brake on demand in the economy, both slowing down the economy and bringing down inflation.

However, raising interest rates too much can also cause a recession. Therefore, the Fed, like any other central bank, has to find a balance between inflation control and the growth of the economy.

Some highlights of the press conference by the Fed Chair, Powell:

-Inflation has declined whereas rates have increased, making real rates higher…it’s possible that policy may overcorrect, meaning that interest rates may be pushed higher than they strictly need to be.

-The Fed is walking a tightrope between being too restrictive and not doing enough to bring down inflation.

-On the other hand, the Fed also said that they may raise rates again in September if data warrants it.

-Their future course of action depends on data and they will be careful about reading too much into a single reading on inflation.

-Unemployment rate at the same level as lift-off is a real blessing.

-Need to take both the level of inflation and speed of decline in judging when to cut rates.

-Several on the Federal Open Market Committee (FOMC) say they expect rate cuts next year.

-The staff are no longer forecasting a recession.

All in all, the Fed is not likely to raise rates at the next meeting but is also unlikely to cut rates this year and may also raise again, if the inflation does not come down further.

Also to be noted: I had never forecast a rate cut in 2023 because it was clear from the beginning that when inflation had gone so high in 2022, it was unlikely to be at a level that warranted rate cuts this year.

US GDP also beats expectations

US Q2 (second quarter i.e. April-June 2023) GDP advance estimates beat yet again with a 2.4 percent growth versus 1.8 percent expected and 2 percent in Q1.

The increase in real GDP reflected increases in consumer spending, nonresidential fixed investment, state and local government spending, private inventory investment, and federal government spending that were partly by decreases in exports and residential fixed investment.

The labour market also appeared fine with weekly initial jobless claims down to a 5-month low of 221,000.

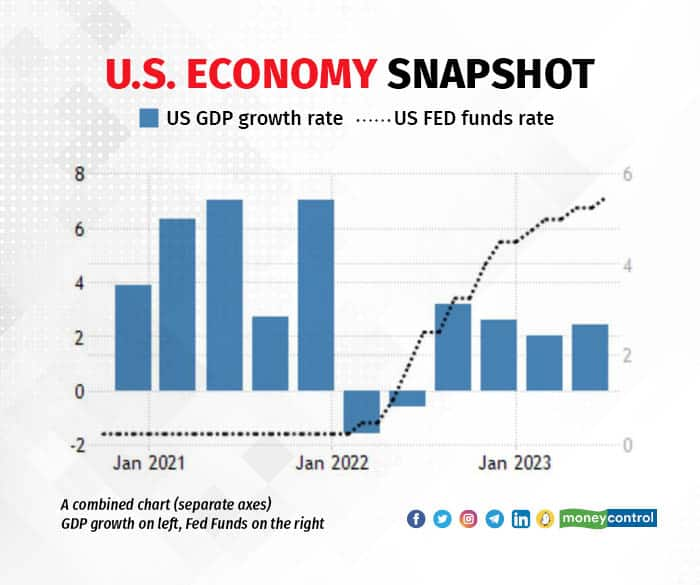

Here is how the US quarterly GDP numbers have come in even as the Fed has raised rates over the last one and a half years.

As is clear the slowdown in GDP into negative territory happened only in the first two quarters of 2022, where it was not led by the interest rate tightening.

In spite of an unprecedented pace of hikes in interest rates, the US economy proved to be very resilient and did not fall into recession.

For now, it appears that the danger of a recession is past and the economy has managed what is called a soft landing…of managing to control inflation without a huge damage to the growth.

(Devina Mehra is the Founder and Chairperson of First Global, a leading Indian and Global investment Management firm. She is a gold medalist from IIMA and has been in the Investment business for over 30 years. She tweets @devinamehra and can be contacted at info@firstglobalsec.com or www.firstglobalsec.com)

(Harsh Shivlani also contributed to this article)