F&O Manual |Indian indices steady on positive global cues; Nifty struggles at 19,800 levels

Among individual stocks, HindCopper, NTPC, and IPCALAB saw a long buildup, while PowerGrid and Apollo Hospital saw a short buildup.

Indian indices opened with little change on August 1 despite positive global cues. The market has slipped into the red in mid-morning trade with information technology and metal up 0.5 percent each, while realty index down nearly 2 percent. BSE midcap index trading flat, while smallcap index up 0.5 percent.

At 11:00 am, the Sensex was down 28.81 points or 0.04 percent at 66,498.86, and the Nifty was down 13.80 points or 0.07 percent at 19,740. About 1,908 shares advanced, 1,124 shares declined, and 128 shares unchanged.

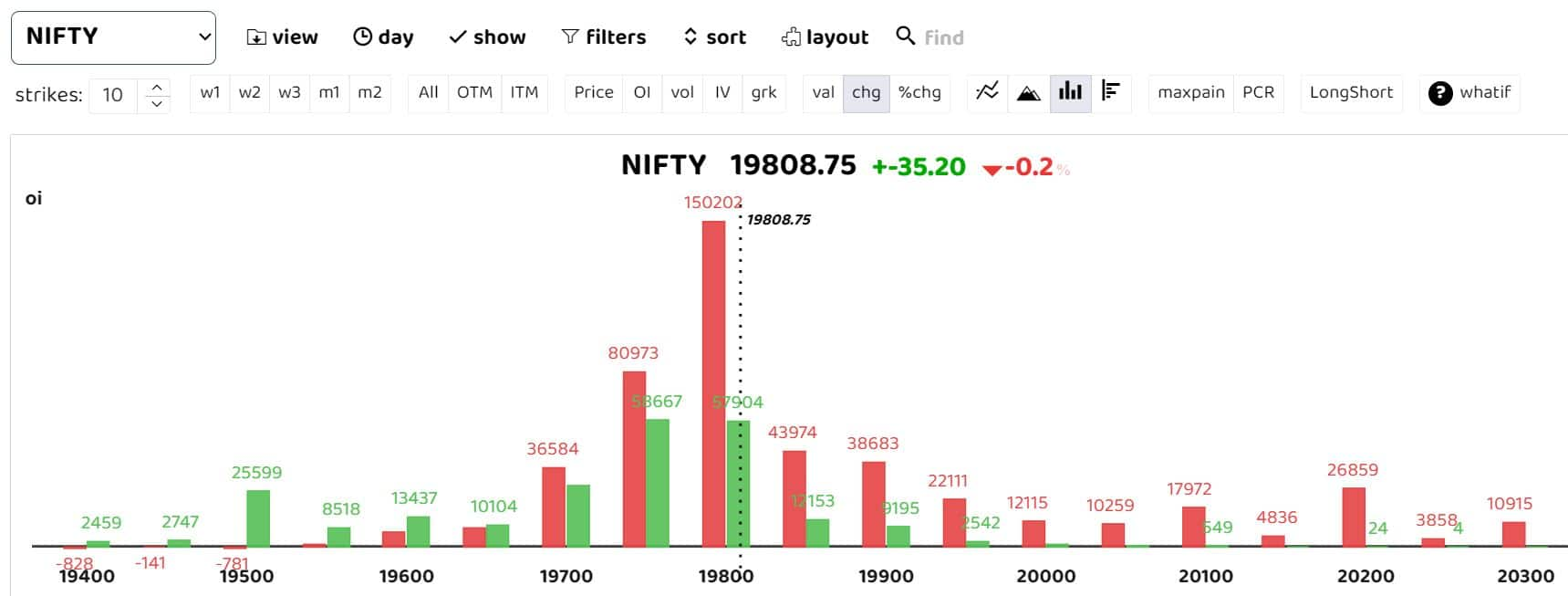

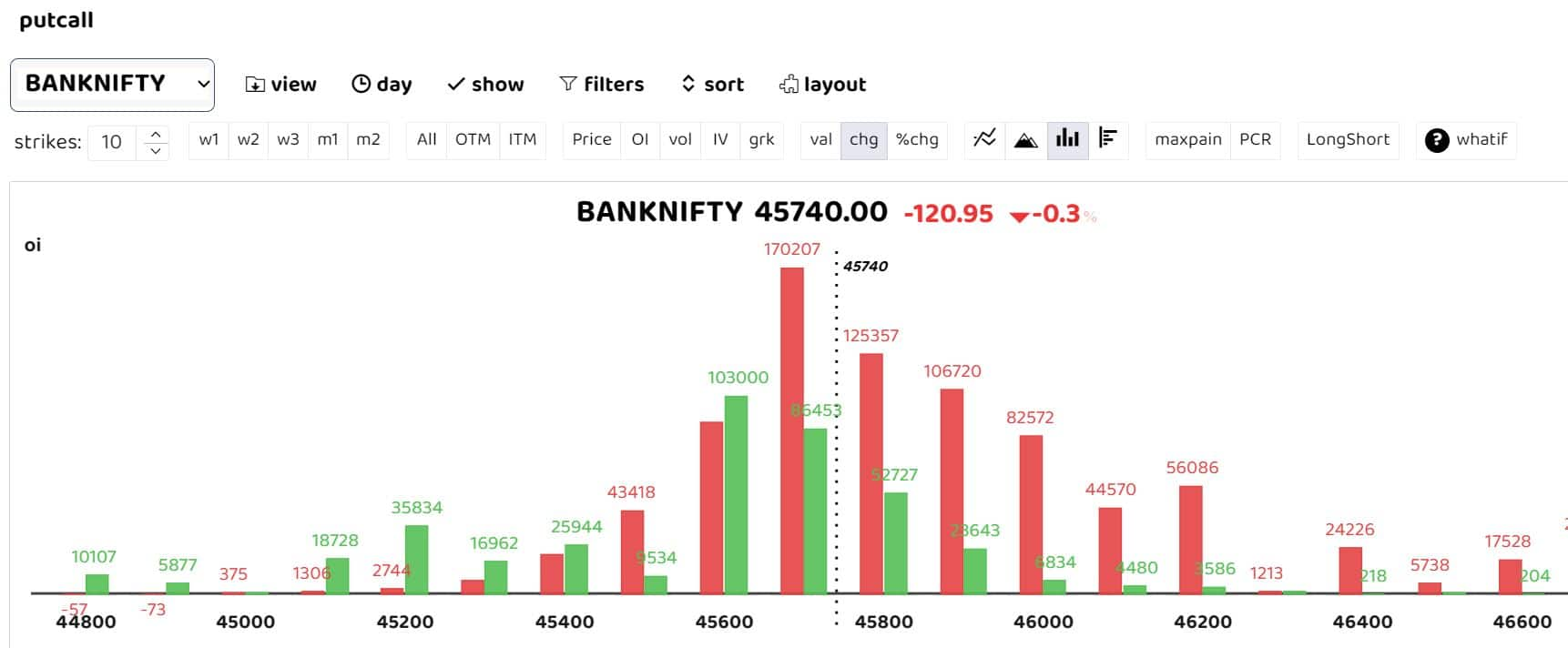

Bars reflect the change in OI during the day. Red bars show call option OI, and green bars show put option OI

As per options data, put writers are dominant for the day. Nifty weekly contract has highest open interest at 19,800 for Puts and 19,750 for Calls. Monthly contracts have highest open interest at 20,500 for Calls and 19,000 for Puts. Being back in the 19,770-840 region, potential for regrouping of bears is high. As per analysts, 19,600 is likely to act as a cushion, while the pivotal zone of 19,500, coinciding with 20 DEMA, is expected to act as sacrosanct support. On the higher end, a cluster of resistances can be seen around 19,800 – 20,000 in the comparable period.

Vinay Rajani, CMT, Senior Technical & Derivative Analyst at HDFC Securities, states that “the primary trend of the Nifty is bullish, as it has been holding above the 20, 50, and 100 DMAs (Daily Moving Averages). Higher tops and higher bottom formation are also intact on Nifty daily and weekly charts. At present, Nifty is forming a ‘Flag’ pattern on the daily chart. A bullish breakout from this pattern would be confirmed above the 19868 hurdle.” A level above 19,868 would push Nifty towards a new all-time high, with a target of 20,400 expected. Rajani added that existing long positions should be held with a stop loss of 19,500 in Nifty, where the change of polarity level comes into play.

As per options data, Bank Nifty has also maintained support near the 45,300 zone and witnessed a gradual pullback to close near 45,650 levels, with consolidation seen in the major banking stocks. The levels near 45,200 are the crucial support zone, and an upside decisive breach above the 46,300 zone would trigger a fresh breakout for further higher targets visible. As per Prabhudhas Lilladher Bank Nifty would have a daily range of 45,400-46,000 levels.

Among individual stocks, HindCopper, NTPC, and IPCALAB saw a long buildup, while PowerGrid and Apollo Hospital saw a short buildup.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.