After a strong rally, mutual funds pare holdings in Indian banks in June quarter

A section of analysts predict that the banking sector will experience a reduction in net profit margins in FY24.

among the 12 listed PSU banks, mutual funds reduced their holdings in nine lenders. The 12 private banks also saw a reduction by mutual funds

‘);

$(‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]);

//if(resData[stkKey][‘percentchange’] > 0){

// $(‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”);

// $(‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”);

//}else if(resData[stkKey][‘percentchange’] < 0){

// $(‘#greentxt_’+articleId).removeClass(“greentxt”).addClass(“redtxt”);

// $(‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”);

//}

if(resData[stkKey][‘percentchange’] >= 0){

$(‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”);

//$(‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”);

$(‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”);

}else if(resData[stkKey][‘percentchange’] < 0){

$(‘#greentxt_’+articleId).removeClass(“greentxt”).addClass(“redtxt”);

//$(‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”);

$(‘#gainlosstxt_’+articleId).find(‘.arw_green’).removeClass(“arw_green”).addClass(“arw_red”);

}

$(‘#volumetxt_’+articleId).show();

$(‘#vlmtxt_’+articleId).show();

$(‘#stkvol_’+articleId).text(resData[stkKey][‘volume’]);

$(‘#td-low_’+articleId).text(resData[stkKey][‘daylow’]);

$(‘#td-high_’+articleId).text(resData[stkKey][‘dayhigh’]);

$(‘#rightcol_’+articleId).show();

}else{

$(‘#volumetxt_’+articleId).hide();

$(‘#vlmtxt_’+articleId).hide();

$(‘#stkvol_’+articleId).text(”);

$(‘#td-low_’+articleId).text(”);

$(‘#td-high_’+articleId).text(”);

$(‘#rightcol_’+articleId).hide();

}

$(‘#stk-graph_’+articleId).attr(‘src’,’//appfeeds.moneycontrol.com/jsonapi/stocks/graph&format=json&watch_app=true&range=1d&type=area&ex=’+stockType+’&sc_id=’+stockId+’&width=157&height=100&source=web’);

}

}

}

});

}

$(‘.bseliveselectbox’).click(function(){

$(‘.bselivelist’).show();

});

function bindClicksForDropdown(articleId){

$(‘ul#stockwidgettabs_’+articleId+’ li’).click(function(){

stkId = jQuery.trim($(this).find(‘a’).attr(‘stkid’));

$(‘ul#stockwidgettabs_’+articleId+’ li’).find(‘a’).removeClass(‘active’);

$(this).find(‘a’).addClass(‘active’);

stockWidget(‘N’,stkId,articleId);

});

$(‘#stk-b-‘+articleId).click(function(){

stkId = jQuery.trim($(this).attr(‘stkId’));

stockWidget(‘B’,stkId,articleId);

$(‘.bselivelist’).hide();

});

$(‘#stk-n-‘+articleId).click(function(){

stkId = jQuery.trim($(this).attr(‘stkId’));

stockWidget(‘N’,stkId,articleId);

$(‘.bselivelist’).hide();

});

}

$(“.bselivelist”).focusout(function(){

$(“.bselivelist”).hide(); //hide the results

});

function bindMenuClicks(articleId){

$(‘#watchlist-‘+articleId).click(function(){

var stkId = $(this).attr(‘stkId’);

overlayPopupWatchlist(0,2,1,stkId);

});

$(‘#portfolio-‘+articleId).click(function(){

var dispId = $(this).attr(‘dispId’);

pcSavePort(0,1,dispId);

});

}

$(‘.mc-modal-close’).on(‘click’,function(){

$(‘.mc-modal-wrap’).css(‘display’,’none’);

$(‘.mc-modal’).removeClass(‘success’);

$(‘.mc-modal’).removeClass(‘error’);

});

function overlayPopupWatchlist(e, t, n,stkId) {

$(‘.srch_bx’).css(‘z-index’,’999′);

typparam1 = n;

if(readCookie(‘nnmc’))

{

var lastRsrs =new Array();

lastRsrs[e]= stkId;

if(lastRsrs.length > 0)

{

var resStr=”;

let secglbVar = 1;

var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’;

$.get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) {

$(‘#backInner1_rhsPop’).html(data);

$.ajax({url:url,

type:”POST”,

dataType:”json”,

data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs},

success:function(d)

{

if(typparam1==’1′) // rhs

{

var appndStr=”;

//var newappndStr = makeMiddleRDivNew(d);

//appndStr = newappndStr[0];

var titStr=”;var editw=”;

var typevar=”;

var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’);

var phead =’Why add to Portfolio?’;

if(secglbVar ==1)

{

var stkdtxt=’this stock’;

var fltxt=’ it ‘;

typevar =’Stock ‘;

if(lastRsrs.length>1){

stkdtxt=’these stocks’;

typevar =’Stocks ‘;fltxt=’ them ‘;

}

}

//var popretStr =lvPOPRHS(phead,pparr);

//$(‘#poprhsAdd’).html(popretStr);

//$(‘.btmbgnwr’).show();

var tickTxt =’‘;

if(typparam1==1)

{

var modalContent = ‘Watchlist has been updated successfully.’;

var modalStatus = ‘success’; //if error, use ‘error’

$(‘.mc-modal-content’).text(modalContent);

$(‘.mc-modal-wrap’).css(‘display’,’flex’);

$(‘.mc-modal’).addClass(modalStatus);

//var existsFlag=$.inArray(‘added’,newappndStr[1]);

//$(‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’);

//if(existsFlag == -1)

//{

// if(lastRsrs.length > 1)

// $(‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’);

// else

// $(‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’);

//

//}

}

//$(‘.accdiv’).html(”);

//$(‘.accdiv’).html(appndStr);

}

},

//complete:function(d){

// if(typparam1==1)

// {

// watchlist_popup(‘open’);

// }

//}

});

});

}

else

{

var disNam =’stock’;

if($(‘#impact_option’).html()==’STOCKS’)

disNam =’stock’;

if($(‘#impact_option’).html()==’MUTUAL FUNDS’)

disNam =’mutual fund’;

if($(‘#impact_option’).html()==’COMMODITIES’)

disNam =’commodity’;

alert(‘Please select at least one ‘+disNam);

}

}

else

{

AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’;

commonPopRHS();

/*work_div = 1;

typparam = t;

typparam1 = n;

check_login_pop(1)*/

}

}

function pcSavePort(param,call_pg,dispId)

{

var adtxt=”;

if(readCookie(‘nnmc’)){

if(call_pg == “2”)

{

pass_sec = 2;

}

else

{

pass_sec = 1;

}

var postfolio_url = ‘https://www.moneycontrol.com/portfolio_new/add_stocks_multi.php?id=’+dispId;

window.open(postfolio_url, ‘_blank’);

} else

{

AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’;

commonPopRHS();

/*work_div = 1;

typparam = t;

typparam1 = n;

check_login_pop(1)*/

}

}

function commonPopRHS(e) {

/*var t = ($(window).height() – $(“#” + e).height()) / 2 + $(window).scrollTop();

var n = ($(window).width() – $(“#” + e).width()) / 2 + $(window).scrollLeft();

$(“#” + e).css({

position: “absolute”,

top: t,

left: n

});

$(“#lightbox_cb,#” + e).fadeIn(300);

$(“#lightbox_cb”).remove();

$(“body”).append(”);

$(“#lightbox_cb”).css({

filter: “alpha(opacity=80)”

}).fadeIn()*/

$(“.linkSignUp”).click();

}

function overlay(n)

{

document.getElementById(‘back’).style.width = document.body.clientWidth + “px”;

document.getElementById(‘back’).style.height = document.body.clientHeight +”px”;

document.getElementById(‘back’).style.display = ‘block’;

jQuery.fn.center = function () {

this.css(“position”,”absolute”);

var topPos = ($(window).height() – this.height() ) / 2;

this.css(“top”, -topPos).show().animate({‘top’:topPos},300);

this.css(“left”, ( $(window).width() – this.width() ) / 2);

return this;

}

setTimeout(function(){$(‘#backInner’+n).center()},100);

}

function closeoverlay(n){

document.getElementById(‘back’).style.display = ‘none’;

document.getElementById(‘backInner’+n).style.display = ‘none’;

}

stk_str=”;

stk.forEach(function (stkData,index){

if(index==0){

stk_str+=stkData.stockId.trim();

}else{

stk_str+=’,’+stkData.stockId.trim();

}

});

$.get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?classic=true&sc_id=’+stk_str, function(data) {

stk.forEach(function (stkData,index){

$(‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]);

});

});

function redirectToTradeOpenDematAccountOnline(){

if (stock_isinid && stock_tradeType) {

window.open(`https://www.moneycontrol.com/open-demat-account-online?classic=true&script_id=${stock_isinid}&ex=${stock_tradeType}&site=web&asset_class=stock&utm_source=moneycontrol&utm_medium=articlepage&utm_campaign=tradenow&utm_content=webbutton`, ‘_blank’);

}

}

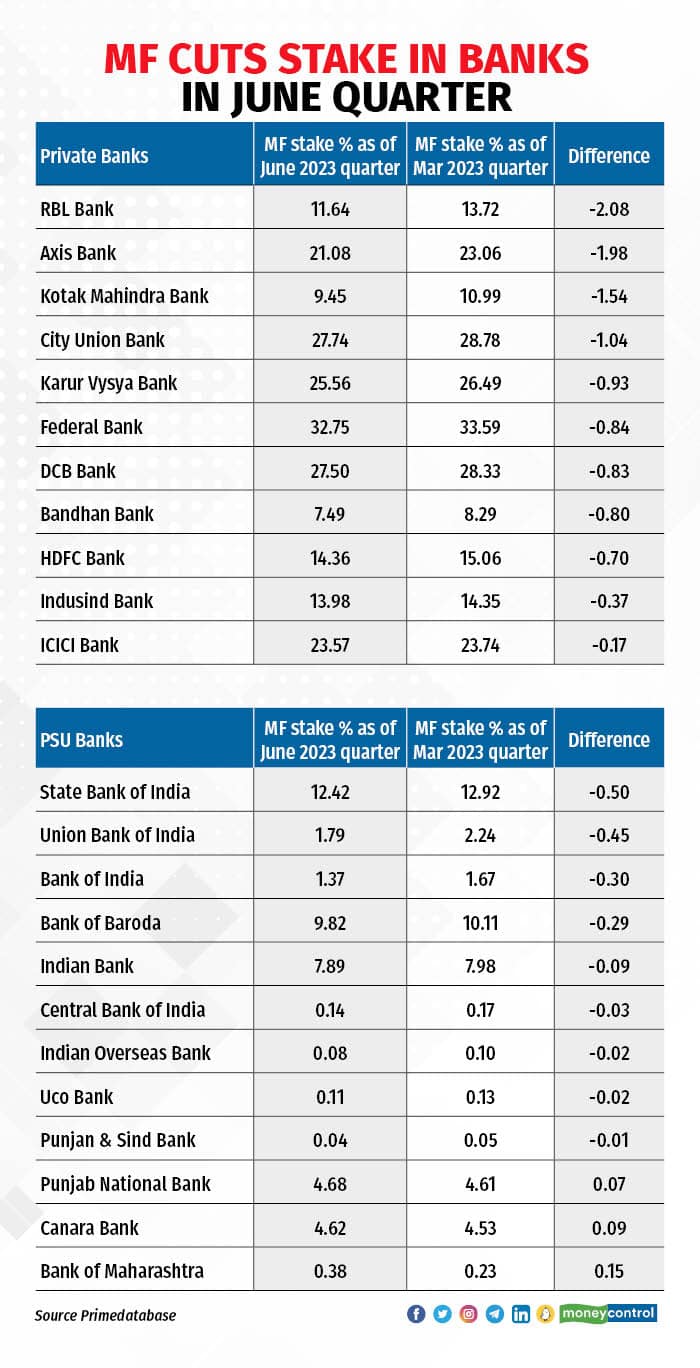

Mutual funds have cut stakes in Indian banks, including in state-run lenders, during the June quarter compared to a previous quarter after a strong rally seen in the last one year, according to the shareholding pattern data on BSE. This is the first time after four quarters that mutual funds are reducing stakes in banks.

To give a perspective, among the 12 listed PSU banks, mutual funds reduced their holdings in nine lenders. The 12 private banks also saw a reduction by mutual funds.

“In the June quarter, mutual funds have sold stakes in several banks – public and private – and added stakes in a few bank stocks. This may reflect their view on the valuations these stocks have reached post the rally seen over the past few months,” said Deepak Jasani, Head of Retail Research, HDFC Securities.

A section of analysts predict that the banking sector will experience a reduction in net profit margins in FY24. Additionally, they expect that systemic credit growth in the sector will be lower in FY24 compared to FY23. Consequently, there could be a noticeable slowdown in the overall pre-provision earnings growth of the banking system.

What do numbers say?

Among the PSU banks which saw a decline in mutual funds from last quarter are State Bank of India, Bank of Baroda, Central Bank of India, Indian Bank, Indian Overseas Bank, Punjab & Sind Bank, UCO Bank, and Union Bank of India.

Meanwhile, Bank of Maharashtra, Bank of India and Canara Bank saw mutual fund stakes going up.

Notably, both State Bank of India and Bank of Baroda have been facing a consistent decline in mutual fund holdings for the fourth consecutive quarter, with reductions of 100 basis points (bps) and 200 bps, respectively.

The trend was largely similar in private sector banks and non-banking finance companies as well. During the quarter, among private banks, RBL Bank, Axis Bank, Kotak Mahindra Bank, City Union Bank, Karur Vysya Bank, Federal Bank, DCB Bank, Bandhan Bank, HDFC Bank, Indusind Bank and ICICI Bank witnessed a reduction in stake by mutual funds.

For non-banking finance companies (NBFCs), L&T Finance Holdings, Manappuram Finance, Cholamandalam Investment and Finance, and Bajaj Finance witnessed a decrease in stakes by mutual funds.

Share prices rally

Since April 2022, the Nifty PSU Bank Index has climbed over 154 percent while so far this year it has risen 7.4 percent. The rally was due to the continuous robust profitability of public sector banks and improving non-performing assets with lower provisioning. The increase in credit growth among government-owned banks also helped to improve sentiments among investors.

Public sector banks collectively recorded a net profit of Rs 1.05 lakh crore in FY23, with SBI and others reporting their highest-ever earnings. All PSBs posted declines in gross and net bad loans, both as a percentage of loans and in absolute terms. For the June quarter, six PSU banks reported earnings and all of them have beaten expectations, analysts said.

For private sector banks, Bandhan Bank and City Union Bank gave negative returns while Kotak Mahindra Bank and HDFC Bank gained just 5 percent and 9 percent, respectively, since April 2022. IDFC First Bank is the biggest gainer surging over 100 percent followed by RBL Bank and IndusInd Bank, which jumped 71 percent and 45 percent, respectively. ICICI Bank advanced 35 percent while Axis Bank rose 22 percent during the period.

Sujan Hajra, Chief Economist and Executive Director, Anand Rathi, maintains an equal weight stance on the banking sector. Hajra believes that well-managed public sector banks have the potential for a valuation catch-up, which could lead to a modest outperformance by these banks continuing in the future.

FII trends

Apart from mutual funds, foreign institutional investors also cut their stakes in state-run banks except SBI, Bank of Baroda, Bank of Maharashtra and Punjab National Bank, from a quarter ago. FIIs have raised stakes in private banks and NBFCs during the quarter versus in the March 2023 quarter.

Meanwhile, mid-sized NBFC firms experienced interest from both FIIs and mutual funds, as they were seen buying shares of companies such as Indiabulls Housing Finance Ltd, Shriram Finance Ltd, PNB Housing Finance Ltd, Can Fin Homes, Max Financial Services Ltd, and Aditya Birla Capital.

Earnings

So far in the June quarter, 26 banks reported earnings, out of which 12 banks’ net profit has fallen from a quarter ago while one bank – Dhanlaxmi Bank – reported a net loss. The net interest income was marginally higher quarter on quarter for all banks. Operating profit declined for 13 banks while 10 banks reported single-digit growth. For the remaining three banks – Dhanlaxmi Bank, IDBI Bank and Jammu & Kashmir Bank – operating profit jumped in double digits.

Meanwhile, 16 banks reported fall in provisions QoQ while the other 10 reported a surge, which include South Indian Bank (jump of 400 percent QoQ), Axis Bank (up 238 percent QoQ), Kotak Mahindra Bank (up 146 percent QoQ), UCO Bank (up 89 percent QoQ), among others. Around 19 banks reported improvement in non-performing assets from a quarter ago.