Bank of England hikes rates by quarter percentage point in split vote

People walk outside the Bank of England in the City of London financial district, in London, Britain, January 26, 2023.

Henry Nicholls | Reuters

LONDON — The Bank of England on Thursday raised its main interest rate by 25 basis points to at 15-year high of 5.25%, a 14th consecutive hike as policymakers strive to rein in inflation.

The Monetary Policy Committee (MPC) voted 6-3 in favor of the quarter-point hike, with two members preferring a second straight 50 basis point increase and one voting to keep rates unchanged.

related investing news

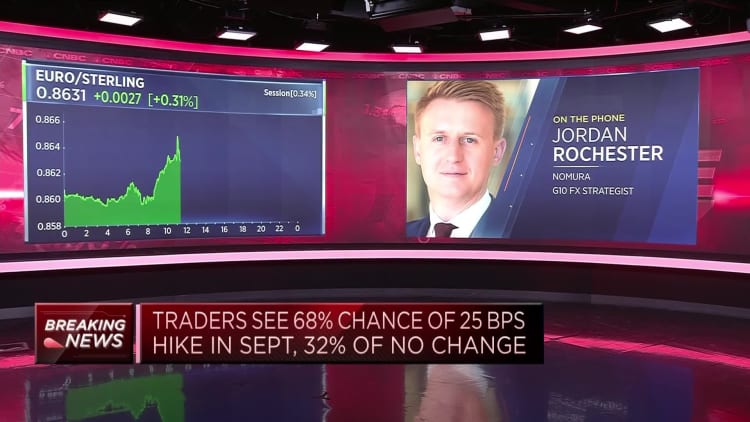

Market pricing was split roughly 60/40 in favor of a quarter-point hike as of Thursday morning, according to Refinitiv data.

The MPC gave little indication that its tightening of monetary policy was likely to end imminently, vowing to “ensure that Bank Rate is sufficiently restrictive for sufficiently long to return inflation to the 2% target.”

The Bank also updated its inflation forecast and now expects inflation to fall to 4.9% by the end of this year, in a quicker decline than it had anticipated in May. Inflation is expected to dip below 2% during the second quarter of 2025, the Bank said in its accompanying Monetary Policy Report, finishing 2024 at 2.5% and 2025 at 1.6%.

The projections will be a relief for Prime Minister Rishi Sunak, who promised the halve inflation by the end of the year, back when the rate had hit 10.1% in January.

Finance Minister Jeremy Hunt welcomed the news, noting that under the Bank’s newest forecast, headline inflation will be below 3% in a year’s time without the economy slipping into recession.

“But that doesn’t mean it’s easy for families facing higher mortgage bills so we will continue to do what we can to help households,” Hunt added in a Thursday statement.

Mixed data

During its last meeting in June, the Bank’s Monetary Policy Committee surprised markets with a 50 basis point hike, as inflation in the U.K. was running significantly hotter than across other advanced economies and well above the British central bank’s 2% target.

Prices have since shown signs of cooling, but the MPC is navigating a more complicated picture in the labor market.

Headline consumer price inflation slid to 7.9% in June from a hotter-than-expected 8.7% in May, while core inflation — which excludes volatile energy, food, alcohol and tobacco prices — stayed sticky at an annualized 6.9%, but retreated from the 31-year high of 7.1% of May.

The central bank has been keeping a close eye on the country’s exceptionally tight labor market, but the latest data showed jobs activity softened considerably in May. Wage growth nevertheless remained uncomfortably strong for the Bank, with private sector regular pay growth rising to 7.7% in May.

“Recent data outturns have been mixed. However, some key indicators, notably wage growth, suggest that some of the risks from more persistent inflationary pressures may have begun to crystallise,” the MPC noted in its report.

“The MPC will continue to monitor closely indications of persistent inflationary pressures and resilience in the economy as a whole, including the tightness of labour market conditions and the behaviour of wage growth and services price inflation.”

Thinking about peak rates

Neil Birrell, chief investment officer at Premier Miton Investors, said that the more cautious hike was not surprising, given that “inflation may be falling, but the core rate is still clipping along at a level that needs addressing.”

“We are probably now at a stage where we can be thinking about the peak in rates, but the Bank is retaining flexibility to go higher if necessary. Nonetheless, the length of time that rates stay at their peak is more important than the actual level itself,” Birrell said.

Samuel Zief, head of FX strategy at JPMorgan Private Bank, said the 25 basis point increased bore the appearance of a “central bank that wants to stop hiking,” while the three-way vote split shows why the market is having difficulty reading the MPC’s thinking.

“We continue to think the BoE has a couple more hikes left in them to a terminal rate around 5.75%, but it is difficult to have conviction over that landing point,” Zief added.

Although the Bank stopped short of another bumper 50-basis-point increase, some analysts are voicing concerns about potential overtightening given, that the existing rises in rates — from 0.1% in December 2021 to 5.25% at present — have yet to feed through into the real economy.

“Targeting the lagging indicators of inflation and unemployment with blunt monetary policy tools that work with long and variable lags is a job fraught with challenges,” said Harry Richards, fixed income investment manager at Jupiter Asset Management.

“It is no surprise that Central Bankers often tighten too far at the end of a cycle until something ‘breaks’ and unfortunately, we have been more convinced in recent months that these mistakes of the past are in the process of being repeated.”