F&O Manual |Nifty Stages Rebound After Recent Slide, Sectoral Indices Rally in Green

Among individual stocks, Idea, Dabur, and Naukri displayed a bullish setup. On the other hand, CumminsInd, MGL, and RBL Bank witnessed short buildup.

In the aftermath of a sharp decline over the last two trading sessions, benchmark indices started the day on a positive note by opening higher. However, as trading progressed, the market sentiment turned wobbly, influenced by weakness in several Asian gauges following a marginal fall in the overnight US markets. At 11 am, the Sensex was up 318.00 points or 0.49 percent at 65,558.68, and the Nifty was up 95.50 points or 0.49 percent at 19,477.20. About 2028 shares advanced, 949 shares declined, and 115 shares unchanged.

The overall sectoral outlook appeared bullish, with all sectoral indices trading in the green. The Information Technology index recorded an 1 percent rise, and the pharma index showed a modest increase of 0.5 percent.

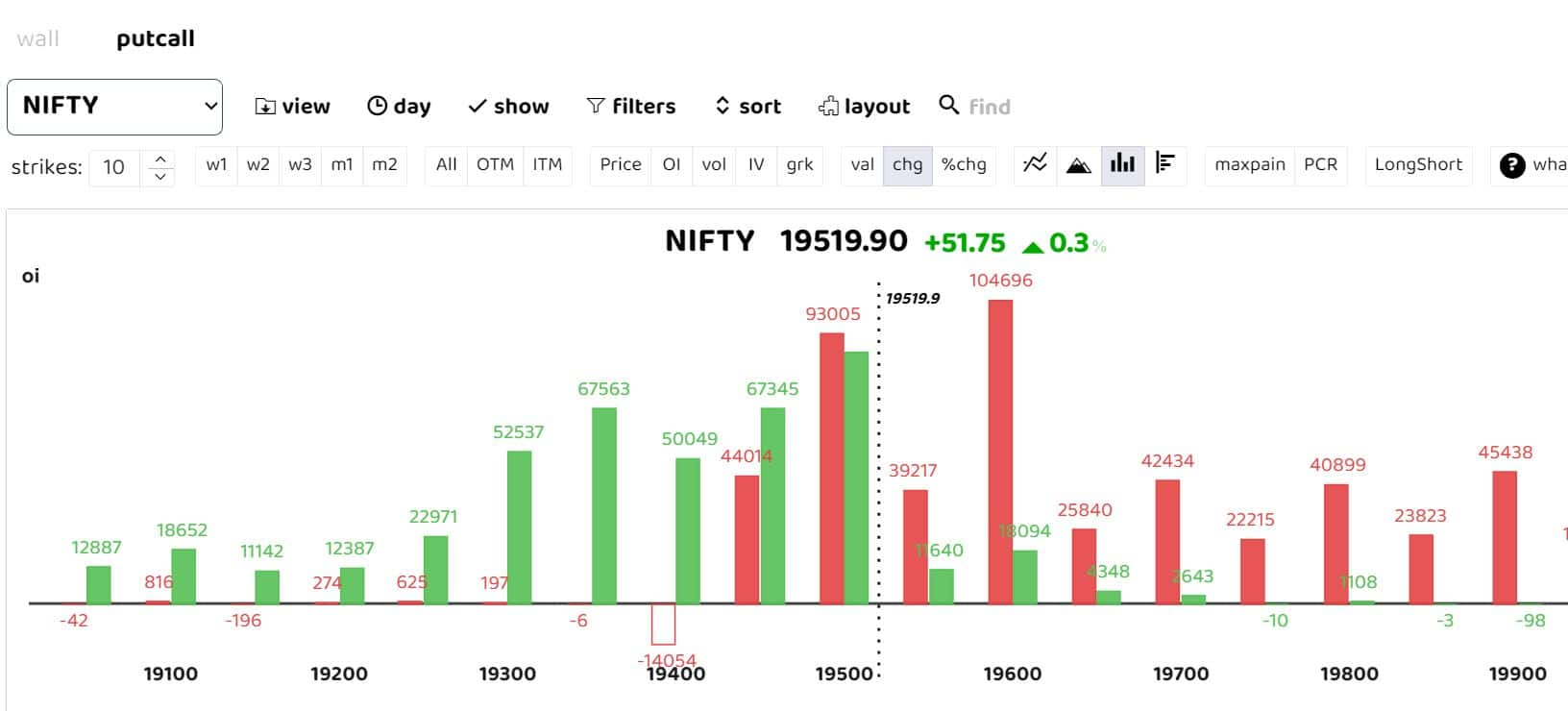

Bars reflect the change in OI during the day. Red bars show call option OI, and green bars show put option OI.

Bars reflect the change in OI during the day. Red bars show call option OI, and green bars show put option OI.

The overall sectoral outlook appeared bullish, with all sectoral indices trading in the green. The Information Technology index recorded an 1 percent increase, and the pharma index showed a modest rise of 0.5 percent.

Options data highlighted an intriguing battle between call and put writers around the 19500 levels. Sameet Chavan, Head Research, Technical and Derivatives at Angel One Ltd, expressed optimism, suggesting that the recent market fall was mainly due to external macro factors, and there’s no immediate need for apprehension. The comfortable PCR, particularly in BANKNIFTY, indicated that markets were slightly oversold. The ‘Long Short Ratio’ also saw a substantial cooling off to 40 percent compared to 59 percent at the beginning of the week. These factors contributed to a decent rebound, initially led by the IT sector and later by the BFSI sector.

However, he also cautioned that the market has not completely recovered yet, and a sustainable close beyond 19550-19600 levels is required to confirm the completion of the price retracement and resume the recent upward trend.

Among individual stocks, Idea, Dabur, and Naukri displayed a bullish setup. On the other hand, CumminsInd, MGL, and RBL Bank witnessed short buildup.

Meanwhile, some stocks, such as Indusind Bank, Axis Bank, and Hindustan Copper, saw short-covering as the tide seemed to be changing for them.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.