F&O manual | Market continues downward journey amid global weakness, Nifty faces strong resistance at 19,600

Among individual stocks, JK Cement, PVR Inox, Dr Reddy and Petronet displayed a bullish set-up. On the other hand, Divislab, MFSL and BataIndia saw a short build-up.

The Indian equity market continued its decline, slipping further into red. Brokers said weakness in global markets was a key cause of the trend. US shares fell last evening after rating agency Moody’s downgraded several regional US banks.

Selling was seen in the bank, FMCG, IT, power and realty names, while pharma index is up 0.4 percent.

At 11 am, the Sensex was down 310.74 points or 0.47 percent at 65,535.76, and the Nifty was down 80.70 points or 0.41 percent at 19,490.10. About 1,657 shares advanced, 1,324 shares declined and 111 shares were unchanged.

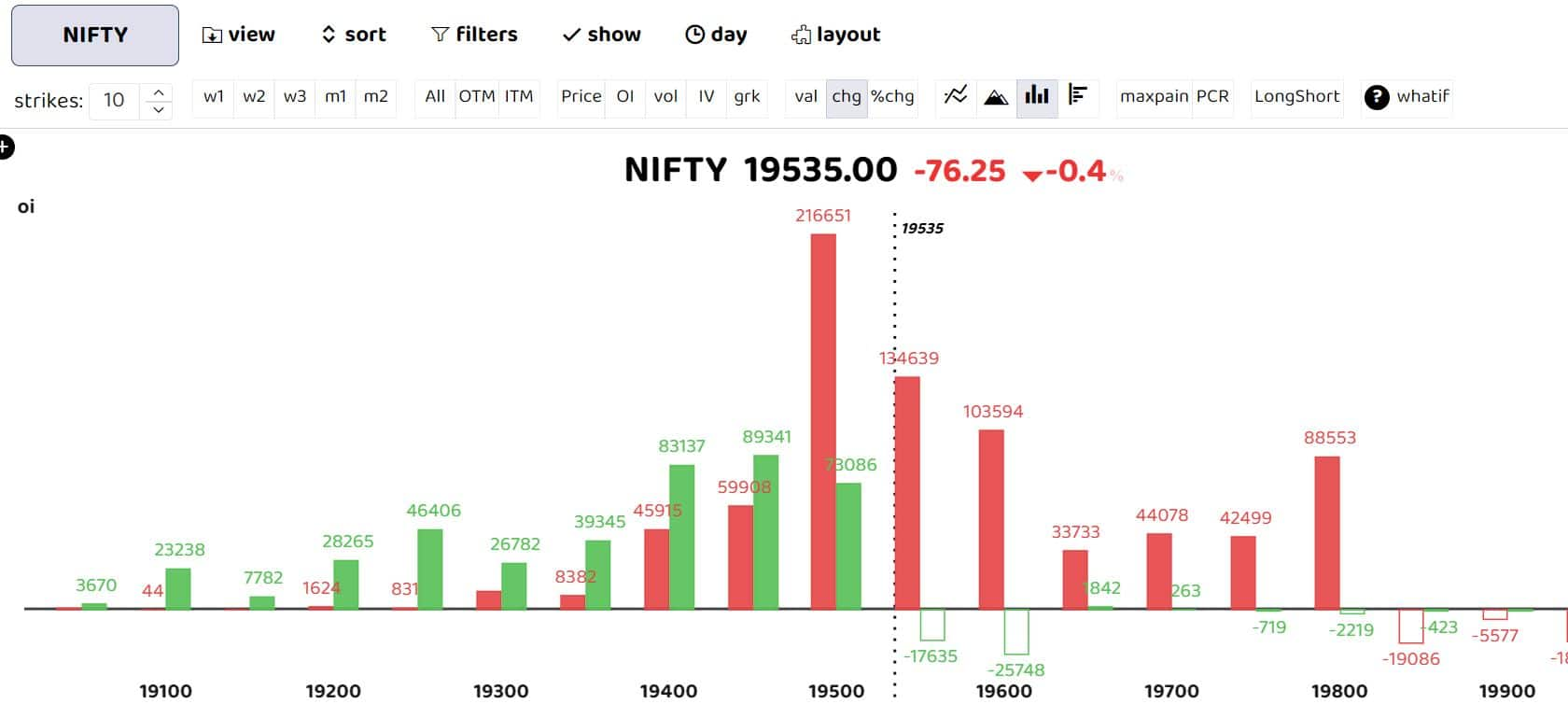

Heavy activity was seen in call option contracts today. Nifty weekly contract has the highest open interest at 19,500 for Calls and 19,400 for Puts while monthly contracts have the highest open interest at 19,800 for Calls and 19,600 for Puts. As per HDFC securities, Nifty has formed a bearish engulfing pattern, a fall below 19,524 could result in a faster down move. The brokerage firm expects 19,634-19,678 levels to be the resistance band for the Nifty in the near term.

As per options data, the support for the day is seen at 19,350 levels while the resistance is seen at 19,550 followed by 19,600 and 19,800 level.

As per analysts, Nifty has taken resistance around the 50 percent Fibonacci retracement of 19,646 drawn from the high of 19,992 made on July 20 to the low of 19,296 made on August 3. Aggressive call writing is observed at 19,600 and 19,650 strikes, due to which Nifty continues to fall.

Nifty is unlikely to gain momentum unless call writers exit from the 19,600 Strike. The option activity at the 19,600 Strike will play an important role in Nifty’s future movement.

Among individual stocks, JK Cement, PVR Inox, Dr Reddy and Petronet displayed a bullish set-up, while Divislab, MFSL and BataIndia saw a short build-up.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.